How the United Arab Emirates is becoming one of the main gold trading centers in the world?

Introduction: Gold export & trading in UAE

The United Arab Emirates is a relatively young regional center and is one of the largest exporters of gold in the world. The main idea of the article is to understand how the UAE is turning into one of the main centers of gold trade in the world.

In the first section, we will show that the export of gold from the UAE is related to the supply of gold and a gold price.

In the second chapter, we will show that the Dubai Gold and Commodities Exchange is an important component of the gold trade in the UAE.

In the third section, we will show the main gold refiners in the UAE.

1. Gold Exports from the UAE are on the Rise due to Gold Price and Questionable Sources of Supply.

Over the past 20 years, Dubai has become an important player in the world gold market. The Dubai Multi Commodities Center, which was founded in 2002 to expand gold trade, operates in Dubai. The main objective is to facilitate trade in physical commodities through a large free trade zone known as the Jumeirah Lakes Towers Free Zone. This zone offers a number of advantages for companies such as zero corporate tax, a large selection of real estate for activities within the free trade zone and assistance in logistics infrastructure. The Dubai Multi Commodities Center is creating a number of initiatives to support the growth of Dubai's gold sector. The essence of the initiatives is to support the development of the gold sector, support the growth of gold trade and include the Dubai Gold and Commodity Exchange, the Dubai Good Delivery Standard for gold refinement, the establishment of the DMCC Precious Metals Vault, as well as the establishment of precious metal assay benchmarks.

In 2021, the United Arab Emirates exported 28.7US$ billion gold, which is 7.3% of world gold exports. The main countries where gold is exported from the UAE are Switzerland, Turkey, Italy, Hong Kong and India. These countries account for 85% of all gold exports from the UAE.

The structure of gold exports from the UAE is 99% gold in unwrought forms, 0.341% gold non-monetary, in powder form and 0.051% gold non-monetary, in semi-manufactured forms.

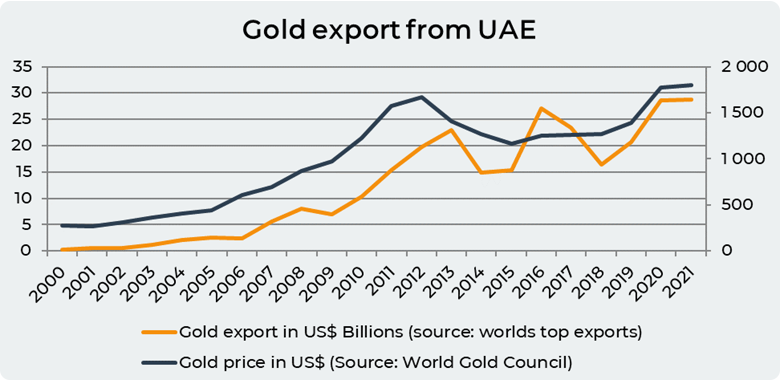

Gold exports from the UAE are also closely related to the price of gold. The graph below shows that the correlation between gold exports from the UAE and the price of gold is 91% over the past 20 years. Which means that when the price of gold increases then the export of gold increases to get the maximum profit. In the last two years, gold export amounts reached record levels of 28.6US$ billion in 2020 and 28.7US$ billion in 2021.

1.1. Doubtful Sources of Gold Supply to the UAE.

According to the report "Dubai's Problematic Gold Trade", the main problem lies in the sources of origin of the gold. The UAE imports gold from more than 100 countries, mainly located in Africa, South America and South Asia. These countries are characterized by frankly poor legislative regulation, lack of technology, low capital investments, exploitation of cheap labor and inadequate working conditions. These countries are also known for artisanal and small-scale gold mining (ASGM). However, Dubai does not follow proper due diligence standards. Since DMCC requires gold dealers to have only a written due diligence policy that aligns with standards of the Organization for Economic Co-operation and Development, this requirement is quite easy to ignore. About half of the gold arriving in Dubai comes from countries marked with a red flag. The UAE buys this gold at a low price or sometimes engages in gold laundering.

The next loophole in the international gold trade is the internal trade between gold refineries in Dubai. There are some factories that do not have accreditation for trading on LBMA. They buy gold from washing and sell it to plants accredited by LBMA. The mills claim that all their gold comes from jewelry, scrap, and sources within Dubai. However, this probably means that gold refineries buy gold through the souk, most of which is considered laundered. But for buyers of gold at these factories, the claim appears to be enough. The identity of the gold buyers remains a mystery.

Gold is delivered to Dubai from all regions of Africa where there is an airport. Most of the gold is transported directly by couriers who are usually able to transport 2-20 kg of gold, with 10 kg of gold being a typical package. Many African capitals have direct flights to the UAE and flights last less than 5 hours, which makes it easy to transport gold.

Dubai has an advantageous geographical location, is a financial center and has weak regulation of the gold trade and access to free trade, which contributes to the growing reputation of Dubai as a center of corruption. There is an increasing overlap between the smuggling of gold laundering and TBLM. Gold is often smuggled into the UAE and then used to purchase goods for import into Africa and then sold at a profit, creating a double opportunity for illicit funds. The gold free trade zone in Dubai is widely developed. Gold traders use the hawala system. The hawala system is a financial system that allows the transit of money without actually moving currency, usually through the connection of cash flows between exports and imports. All the above factors create favorable conditions for laundering gold and money for more profit.

In November 2020, the most influential gold regulator in the world, the LBMA, sent a letter to the UAE and other countries with threats to exclude the exit of gold bars from the UAE if they do not meet regulatory standards. In the letter, the LBMA outlined the standards that the gold bars must meet, especially with regard to money laundering and the source of supply, otherwise they will be blacklisted. This letter was sent against the background of investigations and reports from the Financial Action Task Force and the Carnegie report.

In response to the letter, the Gulf state's Ministry of Foreign Affairs and International Cooperation stated that "The UAE will certainly look into the questions and concerns raised by the London Bullion Market Association. The UAE recognizes the importance of its bullion industry and of developing increasingly robust mechanisms to address the challenges brought about by financial crime.” To confirm the words, the anti-money laundering law was introduced and also the Minister of Foreign Affairs of the UAE stated that strengthening the anti-money laundering regulatory framework is critical for the UAE.

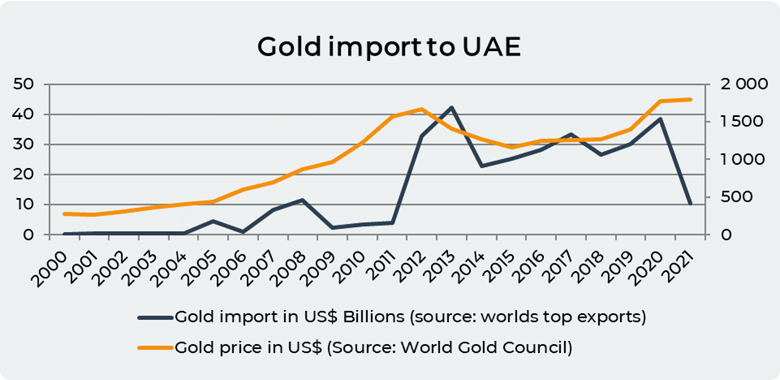

In 2021, gold imports amounted to 10.5 billion. Over the past 20 years, gold imports in the UAE and the value of gold have been correlated at the level of 71%.

2. Dubai Gold and Commodities Exchange as an Important Part of Gold Trading in UAE.

The Dubai Gold and Commodities Exchange was established in 2005 and is an electronic platform for commodity derivatives. The exchange is located in the Jumeirah Free Trade Zone. The exchange is also an affiliated member of the International Organization of Securities Commissions (IOSCO). According to UAE law, The Dubai Gold and Commodities Exchange is defined as a self-regulated organization by the Securities and Commodities Authority of the United Arab Emirates (UAE).

The Dubai Gold and Commodities Exchange offers several types of gold futures:

- Daily Gold Futures Contract is a physical delivery contract with a contract size of 400 troy ounces. Created in 2005. Maximum order size is 200 lots and minimum size is 5 lots. The currency of this futures is US Dollar.

- Physical Gold Futures & Spot Gold Contracts isa physical delivery contract. The size of contract is 25 kg. This contract was launched in 2015. Trading hours are 7 am – 8 pm hours Dubai time. A trading days are 10th, 20th and 30th Calendar Day contracts for one month and the purity of gold is 0.95 for this contract.

- India Gold Quanto Futures is a cash settled contract was launched in June 2015. The contract is denominated in US dollars but the underlying is specified in Indian Rupee.

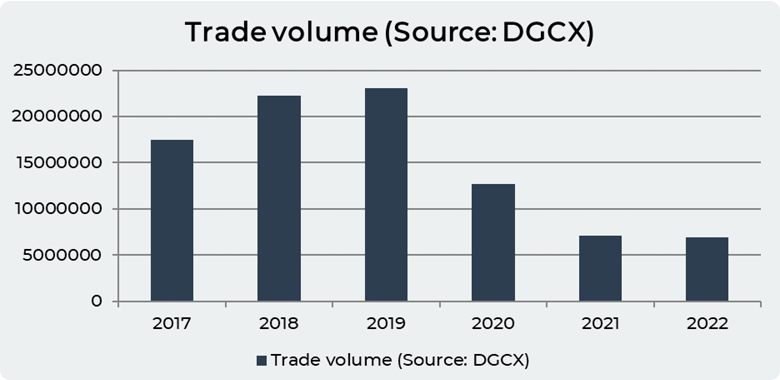

The graph above shows that the volume of trading on the exchange grew steadily, but sharply decreased in 2020 and 2021. However, in 2022, the volume of trading began to recover. The growth in the volume of gold trade was especially noticeable in February-March, when Russia started a war with Ukraine.

3. Gold Refining Market in UAE.

One of the first initiatives of the Dubai Commodities Clearing Corporation was to create a gold standard to be able to accredit gold processors who produce bullion. The standard is 0.995 gold purity for gold refiners trading on The Dubai Gold and Commodities Exchange. There are 13 gold refineries that are members of the Dubai Good Delivery Standard. The largest gold refineries in the UAE are Emirates Gold, which processes up to 200 tons of gold per year. Al Etihad Gold Refinery produces a range of gold bars from 400 ozs down to 100g. Dijllah Gold Refinery has a production capacity of 400 kilobars per day. Al Ghurair Giga Gold Refinery has an annual processing capacity of 100 tons of gold per year.

There are also vaults for storing gold in Dubai. Brinks, Transguard and G4S are three accredited repositories approved by the exchange. Brinks Global Services operates warehouses in the free zone of Dubai Airport and in the Jumeirah Lakes Towers complex. Transguard handles all valuable cargo entering and leaving Dubai International Airport and is specifically authorized to do so by Royal Decree.

A special place in the gold market in Dubai is occupied by Dubai Gold and Jewelery Group. They are an organization that represents the interests of more than 600 companies engaged in the production and sale of jewelry. Many gold trading outlets are located in the Gold Souk in Deira, one of the largest retail shopping centers in the world. The Dubai Gold and Jewelry Group also publishes a daily gold rate including 18, 21, 22, 24 carat gold prices and Ten Tola bullion prices.

Conclusion

Over the past two decades, the UAE, and especially Dubai, has become an influential player in the gold market. Undoubtedly, the government policy that promotes the development of the gold market in the UAE had a significant impact on the formation of gold trade. An important factor is also a favorable geographical location that allows access and relations with the markets of Africa, India and Europe. Despite the rapid growth and development of the UAE gold market, there is still a need to establish effective mechanisms to combat money laundering and to be more concerned about the ethical component of gold trading. Despite non-compliance with gold supply standards, Dubai remains an important regional hub for gold trade. And the love of gold on the part of the Emirates authorities will definitely keep the UAE an important player in the world gold market in the future.

Date= 9th September 2022, Gold price – 1737$, Silver price – 18.95$, Platinum price – 904.50$, Oil price – 82.75$