Who were the main exporters and importers of gold in 2021?

Introduction: Gold Exporters & Importers

Gold has been known to mankind since ancient times and still plays an important role in the economic policy of states. The main idea of the article is to consider the main exporters and importers of gold in 2021.

In the first chapter, we will show the top ten main gold exporters in 2021.

In the second chapter, we will show the top 10 main importers of gold in 2021.

In the third chapter, we will show the countries with the biggest difference in gold exports and imports in 2021.

1. Main Gold Exporters in 2021

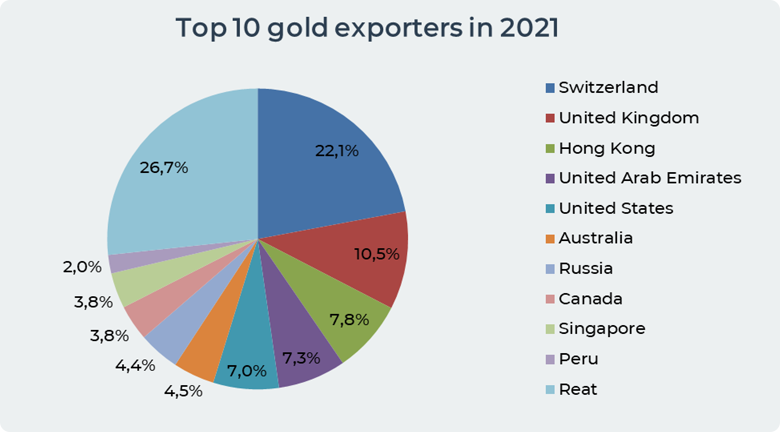

In 2021, countries exported gold for a total amount of 393.9US$ billion, which is 5.3% less compared to 2020, when gold exports amounted to 415.8US$ billion.

Among the continents, Europe surpassed Asia in terms of sales of the largest amount of gold in international gold markets and exported 164.9US$ billion of gold, or 41.9% of total gold exports. In second place are Asian countries that supplied 27.9% of world gold exports. Another 11.7% of gold exports came from North America, and 7% from Africa. South America accounted for 6.6% of global gold exports, while Oceania and Australia accounted for 5% of global gold exports in 2021.

The top 10 largest gold exporters exported 73.3% of the world's gold exports. Among the top 5 largest exporters of gold in 2021 are Switzerland, the United Kingdom, Hong Kong, the United Arab Emirates and the United States of America. Together, they account for 54.7% of world gold exports, which is more than half of world gold sales.

The most growing countries in the export of gold in 2021 compared to 2020 were Great Britain, which showed an increase in gold exports by 93.2%. The US increased gold exports by 35.1% compared to 2020. Switzerland showed a 21.1% increase in gold exports, and Peru increased its gold exports by 19.9%.

Among the countries that most reduced gold exports in 2021 were Italy, which reduced gold exports by 36.7%. The next country that decreased gold exports is Germany, which showed a decrease in exports by 30.2% compared to 2020. Other countries that showed a decrease in gold exports include Hong Kong with a decrease in exports by 25.3%, Japan decreased gold exports by 8.2% and Russia, which reduced gold exports by 6.3% in 2021.

Switzerland. In 2021, gold exports from Switzerland amounted to 86.7US$ billion. The increase in gold exports from Switzerland in 2021 is due to the recovery of gold demand in India and China after the collapse during the Covid pandemic. Switzerland is the world's largest transit hub and gold processing center in the world. In 2021, exports to India increased to 507 tons of gold (25US$ billion). Exports to China increased to 275 tons of gold (13.6US$ billion), and exports to Hong Kong increased to 79 tons of gold (3.9US$ billion). While exports to Asia increased, gold exports to the USA and the United Kingdom decreased.

United Kingdom. The London wholesale gold market is the largest in the world. The UK is one of the two dominant countries in the global gold price survey. The main destination of gold exports from Great Britain was Switzerland, which imported gold for 30.8 billion. Gold exports in 2021 from Great Britain amounted to 41.4US$ billion.

Hong Kong. In 2021, gold exports from Hong Kong amounted to 30.8US$ billion. Hong Kong is an important gold transit hub for China. In 2021, Hong Kong reduced its gold exports due to the rather strict restrictions of the covid pandemic in China. The top countries exporting gold from Hong Kong were China which exported 3.2US$ billion worth of gold and Switzerland which exported 2.5US$ billion gold in 2021.

UAE. The UAE exported 28.7US$ billion gold in 2021. Due to its geographical location and extensive support from the authorities, the UAE has developed its gold market into one of the most important in the world. The main buyers of gold in the UAE in 2021 were Switzerland, which bought 7.4 billion, and India, which bought 7 billion. We wrote in more detail about the gold market in the UAE in the article Gold purchases and sales in UAE.

USA. In 2021, the US exported gold worth 27.7US$ billion. In addition, the United States was the world leader in gold re-exports in 2021. The US imported and then re-exported 4.9US$ billion worth of gold, up 62.4% from 2020 when gold re-exports totaled 2US$ billion in 2020.

2. Main Gold Importers in 2021

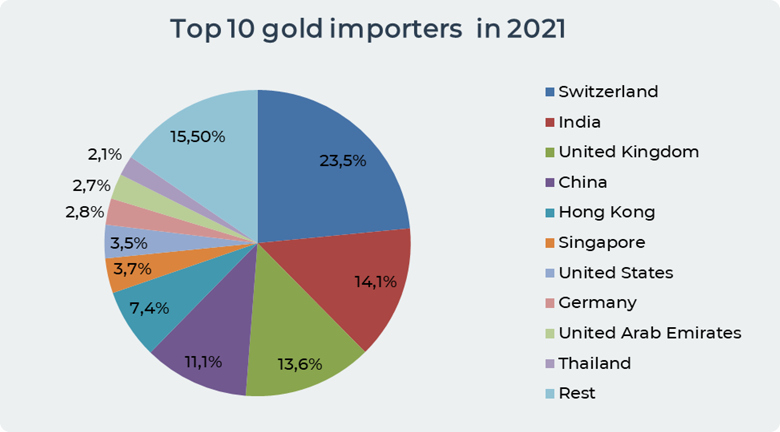

In 2021, global gold imports amounted to 395.1 billion, which is 2.1% lower than in 2020, when gold imports amounted to 403.6 billion.

Asian countries were the largest buyers of gold in 2021 and purchased 191.6 billion gold or 48.6% of all gold in the world. In second place, European countries imported 44.5% of gold in 2021. Another 5.2% of all gold was purchased by North America. Australia, Africa and South America together bought only 1.7% of gold.

The top 10 largest importers together purchased 84.5% of gold from all world imports. Among the main importers of gold in 2021 were Switzerland, India, Great Britain, China and Hong Kong. Together, the top 5 largest buyers of gold imported 69.7% of all global gold imports.

The largest increase in gold imports in 2021 compared to 2020 was shown by Cambodia, which increased gold imports by 468.5%, China showed an increase in gold imports by 282.7%. The list also includes India and Austria, which increased gold imports by 154.5% and 99.6%, respectively.

Among the countries that reduced gold purchases in 2021 were Turkey, which reduced its purchases by 78.2%, the UAE reduced gold imports by 71.6%, the United States reduced gold purchases by 59.9%, and Great Britain, which reduced gold imports by 39.2 % compared to 2020.

Switzerland. In 2021, Switzerland imported 92.4US$ billion gold. Switzerland bought the most gold from Great Britain, the United States, the UAE, South Africa and Burkina Faso. In general, gold imports to Switzerland increased in 2021 by 5% compared to 2020, when gold imports amounted to 87.9US$ billion.

India. After the Covid pandemic, the demand for gold in India started to recover again in 2021. To satisfy the voracious demand for gold, India imported gold worth 55.7 billion. The main places where India bought gold were Switzerland, UAE, South Africa, Guinea and Peru. India has great traditions in gold, which we described in the article Gold purchases and sales in India.

United Kingdom. AGold purchases by Great Britain in 2021 amounted to 53.7US$ billion, which is 39.2% less than in 2020, when Great Britain imported gold in the amount of 88.3US$ billion. Great Britain bought the most gold from Russia, Canada, the USA, Switzerland and Kazakhstan. However, at the moment, Great Britain has imposed sanctions on the import of gold from Russia.

China and Hong Kong. Against the backdrop of the easing of restrictions related to the Covid pandemic, the demand for gold in China and Hong Kong has started to grow. China imported gold worth 43.7US$ billion, and Hong Kong imported gold worth 29.1US$ billion in 2021. The sharp increase in gold imports is caused by gold purchases, primarily in Switzerland.

3. Main Net Balance Exporters and Importers in 2021

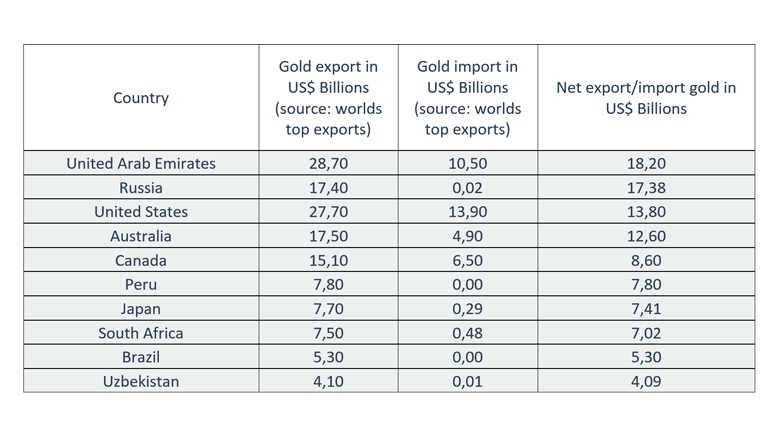

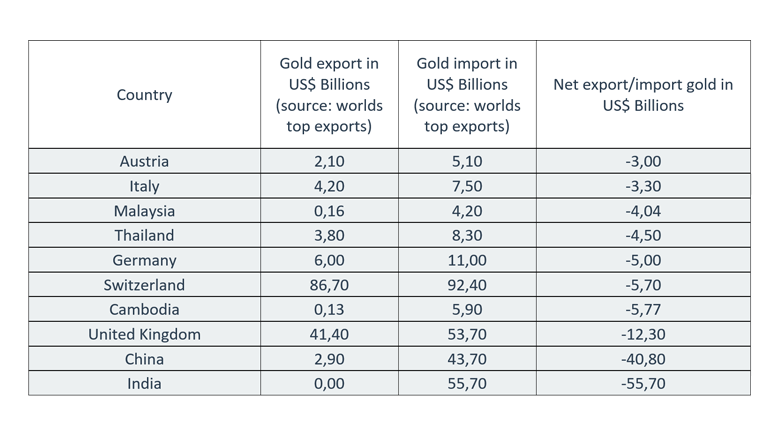

The table shows the countries that showed the largest net export of gold in 2021. Net export/import is defined as the value of the country's total gold export minus the country's total gold import.

The best net export performance was shown by the UAE, which has a net gold export of 18.2 billion due to its gold refining activities and free economic zone for gold trade. Another reason is gold laundering supplying. Russia is the second largest exporter of gold in the world, which is explained by the high production of gold. Russia was the second largest gold producer in the world in 2021 with an annual gold production of 331 tons. Gold is also an important component of income for Russia. The USA has the most famous exchange for gold trading in the world - COMEX, which allows it to be an influential player in gold trading. Australia is the world's third largest gold producer and net gold exports contributed 1% to Australia's total GDP in 2021. The top net exporters also include gold producers such as Canada, Peru, South Africa, Brazil and Uzbekistan. From this list, Japan stands out, which we described in more detail in the article Gold purchases and sales in Japan.

The largest net importers of gold in 2021 were India and China, which have the highest demand for gold in the world. India has net imports of 55.7US$ billion and China 40.8US$ billion. Great Britain, which is a transit hub for gold in the world, is among the top three largest net importers of gold with an amount of 12.3US$ billion. Next on the list is Cambodia. The strange data about the import of gold into Cambodia is that due to the increased control at the borders of Singapore and Vietnam due to Covid, the Cambodian authorities had to register official data. Before the Covid pandemic, Cambodia was a territory for smuggling gold to Vietnam, which the Cambodian authorities were unwilling or unable to pay attention to. Thailand turned out to be a net importer due to the fact that the central bank of Thailand added 90 tons of gold (4.6 billion) to its reserves. The list of net importers also includes Switzerland, Germany, Malaysia, Italy and Austria.

Conclusion

Gold is an important part of state policy, a luxury item, protection against inflation, etc. gold for states, investors and individuals. Based on its own interests, each country builds its own policy on the export and import of gold. It is affected by the level of demand for gold, the economic situation, etc. For some countries, gold is an important source of income. For some countries, gold is part of the culture, and for others it is a means of diversifying their assets and protection in times of inflation. No matter who does what, gold remains an attractive tool for achieving its own needs for each country based on the country's needs and policies regarding gold.

Date= 16th September 2022, Gold price – 1674.20$, Silver price – 19.37$, Platinum price – 904.90$, Oil price – 85.08$