Why Central Banks are actively buying Gold?

Introduction: Who Buys Gold and Why?

Recently, central banks began actively buying gold. The main idea of the article is to understand who buys gold and why.

In the first chapter, we will show that central banks are net buyers of gold.

In the second chapter, we will show the largest net purchases of gold in 2022.

In the third chapter, we will show that the main reason for gold purchases is a sharp increase in demand.

1. Central Banks Are Net Buyers of Gold.

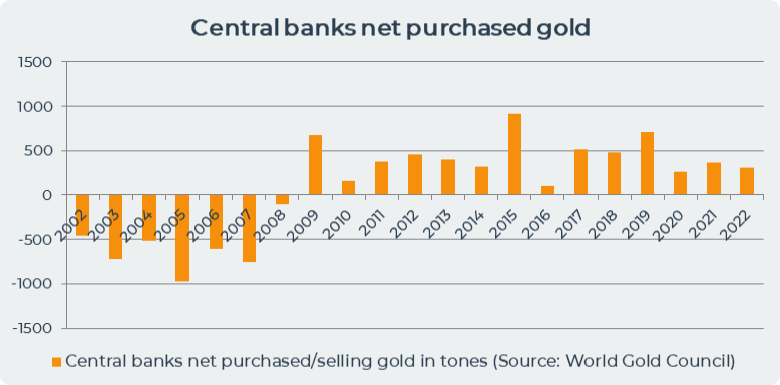

In the last decade, central banks have become net buyers of gold in the world . In 2022, central banks added 308 tons of gold (16$US Billions) to their reserves in 3 quarters. In the 3rd quarter of 2022, central banks added 119.8 tons of gold (6.1$US Billions) to their reserves, which is 49% more than in 2021.

Banks bought the largest amount of gold in 2015 - 913.4 tons of gold (47$US Billions) and in 2019 - 707.7 tons of gold (36$US Billions)

In 2022, gold reserves of central banks are the highest in the last 30 years.

2. Main Gold Buyers in 2022

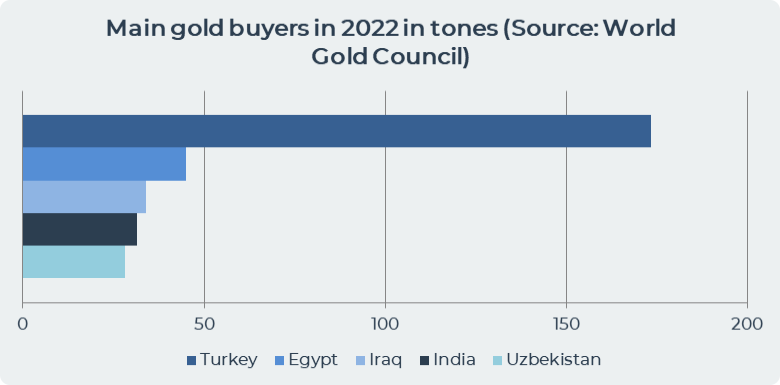

The biggest buyers of gold in 2022 are Turkey, Egypt, Iraq and Uzbekistan. Together, they purchased 90% of all declared gold purchases by central banks in 2022.

2a. Turkey is the Biggest Buyer of Gold Amid Soaring Inflation

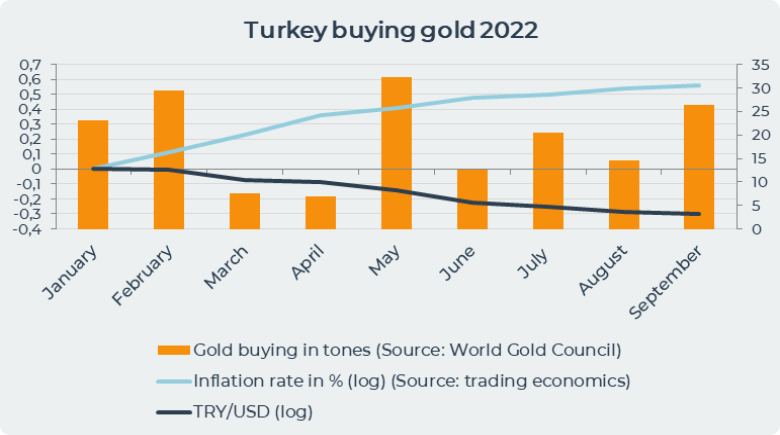

Central Bank of the Republic of Turkey is the biggest gold buyer in 2022. The Central Bank of the Republic of Türkiye added 173.5 tons (8.8$US Billions) of gold to its reserves on the back of the country's rapid growth in inflation and the diversification of its reserves. Since the beginning of the year, inflation has increased from 49% to 86%, reaching its historical maximum. Also, the collapse of the Turkish lira currency prompts the central bank to attract gold to its own reserves.

In December 2021, the Turkish central bank announced to support conversion of gold deposits to lira. The bank decided to provide incentives to those who convert their gold deposits into term deposit accounts in Turkish lira. In the end of December 2021, Erdogan announced a willingness for depositors to convert foreign currency deposits into liras, and the treasury and the Turkish central bank would reimburse losses incurred due to the fall of the lira during the deposit period.

February 8, 2022 Turkey's Treasury and Finance Minister Nureddin Nebati announced the creation of a new system for gold owners to convert gold into liras. "With this package, we will put under-the-mattress gold, which is estimated at around 5000 tons, into the banking system. It is equivalent to about $250-$350 billion. A certain part of that amount will support the Central Bank's foreign currency needs," he said. This program should encourage people to keep their savings in lira with guarantees against exchange rate fluctuations.

To date, Turkey has 488.9 tons of gold (24.9$US Billions) in its reserves, which is 30% of the total reserves of the Central Bank of the Republic of Türkiye.

2b. Egypt Sharply Sdded Gold to its Reserves

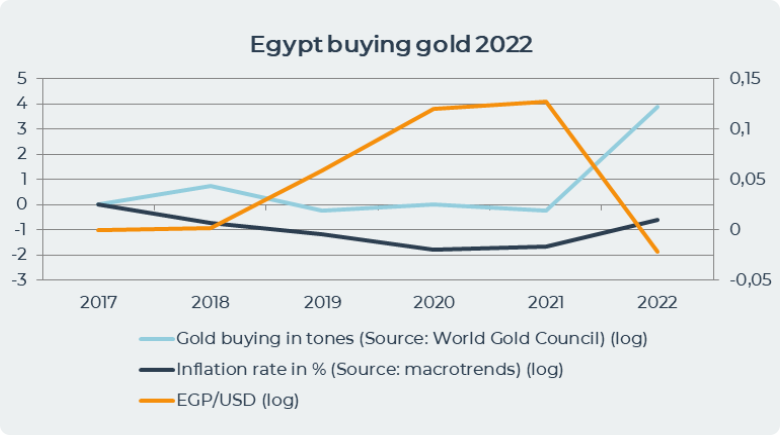

In 2022, the Central Bank of Egypt dramatically increased its gold reserves by 44.4 tons (2.3 US$ Billions), which is 35% of Egypt's total reserves to date.

Egypt was the largest buyer of gold in the first quarter of 2022. In 2022, the national currency Egyptian pound lost 15% of its value against the US dollar. Inflation also increased sharply in Egypt by 10%, reaching 16%, which prompted Egypt to buy gold for its reserves.

For the past 5 years, Egypt has been adding gold to its reserves from local mines, but in small quantities. In April 2022, an emergency resolution from El Sisi on Egypt's gold was published to increase domestic gold production in the long term.

At the moment, Egypt's gold reserves are 125.3 tons (6.4 US$ Billions), which is 21.6% of Egypt's total reserves. Egypt has the largest gold reserves in its region.

2c. Iraq Bought Gold for Stabilization its Currency

In June 2022, Iraq purchased 33.9 tons of gold (1.7 US$ Billions) in its reserves. In a statement from the central bank on March 22, 2022, it is said that Iraq purchased gold in order to stabilize the exchange rate of the Iraqi dinar against other currencies.

According to data from the International Monetary Fund, this purchase of gold is the first since September 2018, when Iraq purchased 6.5 tons of gold (0.3 US$ Billions).

The World Gold Council confirmed the purchase of gold by Iraq's central bank and now has 130.3 tons of gold reserves (6.6 US$ Billions), making Iraq the 30th largest holder of gold reserves in the world. Gold reserves make up 9.4% of all Iraqi reserves.

2d. India

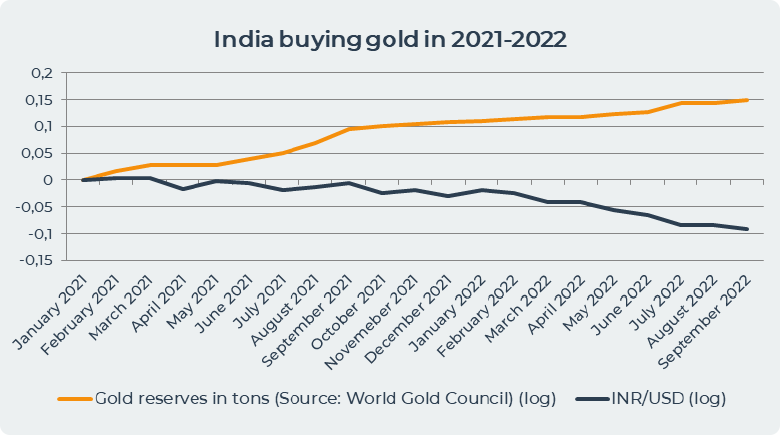

In 2022, India continues the trends of 2021 and continues to add gold to its reserves. The Reserve Bank of India added 31.3 tons of gold (1.5 US$ Billions) to its reserves, and in 2021 India purchased 77.5 tons of gold (3.9 US$ Billions).

Indian consumers usually buy gold jewelry ahead of the festive season every October. But apart from that, the Reserve Bank of India continues to add gold to its holdings.

One of the reasons why India started buying gold may be an attempt to diversify its assets in which its gold and foreign exchange reserves are stored. Also, in 2021 and 2022, the Indian rupee fell significantly by 10% against the US dollar, but the Reserve Bank of India used its foreign exchange reserves to cushion the fall in its currency.

Today, India's gold reserves amount to 785.3 tons of gold (40 US$ Billions), which is 7.9% of the total reserves. The share of gold in India's reserves increased by 0.6% compared to 2021.

2e. Uzbekistan

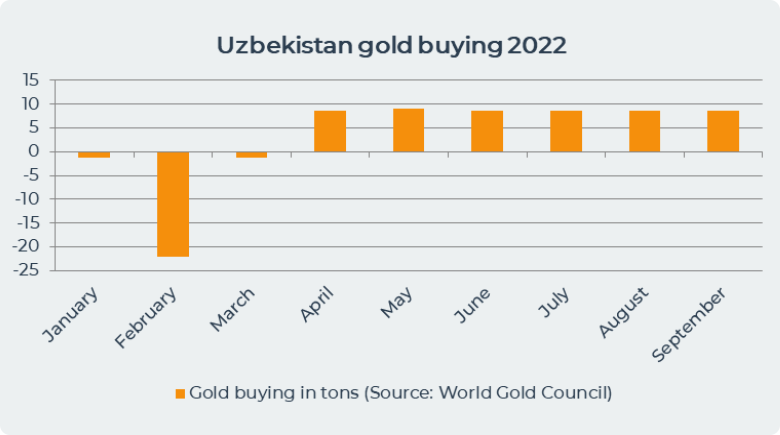

In 2022, Uzbekistan added 28 tons of gold (1.4 US$ Billions) to its reserves. After selling 24.6 tons of gold (1.2 US$ Billions) in the first quarter of 2022, Uzbekistan bought 26.4 tons of gold (1.3 US$ Billions) in the second quarter of 2022 and 26.1 (1.3 US$ Billions) tons of gold in the third quarter of 2022.

3 years ago, Uzbekistan announced plans to diversify its reserves away from gold bullion, but the bank was forced to change its course, according to Deputy Governor of the Central Bank of Uzbekistan Behzod Khamrayev. In an interview, he said, "We thought about investing in Treasuries, but then the market itself didn't allow us to do it." He attributes the change in course to the sharp rise in gold prices in 2020 during the coronavirus pandemic. "Prices were really good and we continued to sell gold," he said. Khamrayev calls gold purchases the right moment. He says "For us, there are two factors: the current price and the future price." "Is the price rising or has it peaked and is going down? This is the moment we are looking for. If the price will rise, it is better to wait with sales," said Khamraev.

Today, Uzbekistan has 390 tons of gold (19.9 US$ Billions) in its reserves, which makes it the 15th largest owner of gold in the world.

3. Central Banks Play a Significant Role in Global Gold Demand

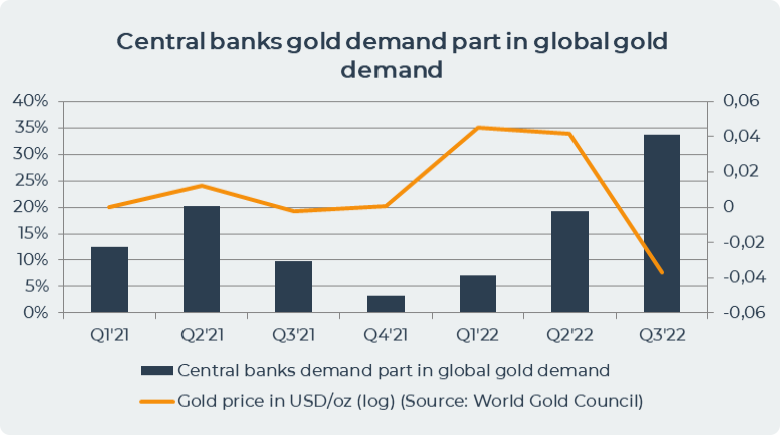

According to the report of the World Gold Council, in the third quarter of 2022, net purchases of gold by central banks and other institutions increased to 400 tons of gold, which is the largest indicator since 1967. Central bank gold demand has grown by more than 300% compared to 2021. However, the World Gold Council indicates that the data "includes substantial estimate for unreported purchases" due to the fact that many institutes do not publish their reports regularly, for example China or Russia.

If we consider purchases of gold, a clear trend can be seen that most purchases are made by developing countries. In the third quarter, the biggest buyers of gold were Turkey, Uzbekistan and Qatar, which bought 15 tons of gold, its largest purchase since 1967. Mozambique, the Philippines and Mongolia are also on the shopping list. Kazakhstan was the biggest seller of gold in the 3rd quarter. In its statement, the Central Bank of Kazakhstan said in August that sales may increase, but everything will depend on the market situation. The UAE was also among the sellers.

The data confirms previous surveys in the gold demand report, when a quarter of respondents said they were ready to add gold to their reserves.

The graph above shows that the share of central banks' gold demand has been steadily increasing since Q4 2021. Currently, the share of central banks has increased from 3% in the 4th quarter to 34% in the 3rd quarter of 2022. Banks and other financial institutions are actively buying gold against the backdrop of an unstable geopolitical situation, a sharp increase in inflation and unstable markets.

In 2022, the share of central banks in gold purchases is 20%, which is quite a high indicator and proves that central banks are an important player in the gold market.

Conclusion

In 2022, central banks continue the trend of remaining net buyers of gold and replenishing their gold reserves. However, in 2022, we see that the main buyers of gold are developing countries, which means that they are trying to diversify their assets against the background of an unstable situation. Banks are important players in the global gold market, although not all of them declare their purchases for certain reasons. According to forecasts of the World Gold Council, banks will continue to buy gold in the 4th quarter of 2022.

Date= 18th November 2022, Gold price – 1775.80$, Silver price – 21.43$, Platinum price – 999.10$, Oil price – 81.94$