Central Banks have been buying Gold for the last 10 years. Is this a buying indicator?

Introduction: Impact of central bank purchases on the gold price

Recently, Central Banks have become net buyers of gold. The goal of this article is to assess if this is a buying indicator, or if it is non relevant.

In section 1, we show that Central Banks have bought gold in the past 10 years.

In section 2, we quantify the market share of Central Banks in the gold market.

In section 3, we study the track record of Central Banks purchases and sales as an advanced indicator for gold prices.

1. Central Banks have been Net Buyers of Gold since 2009

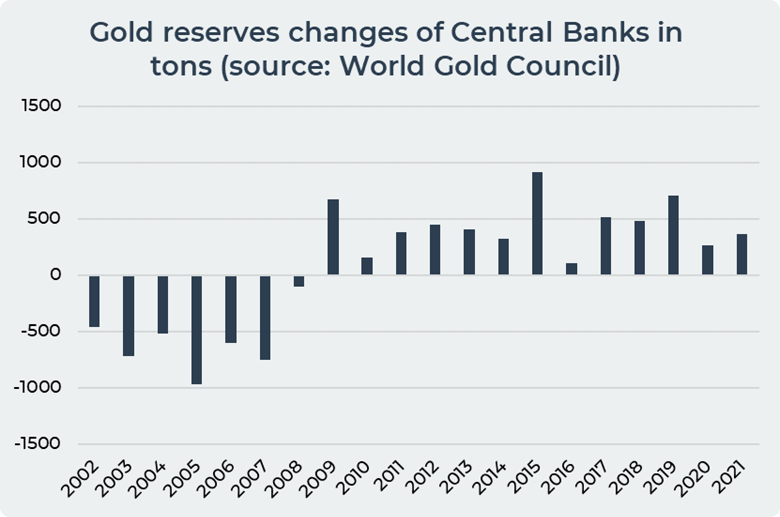

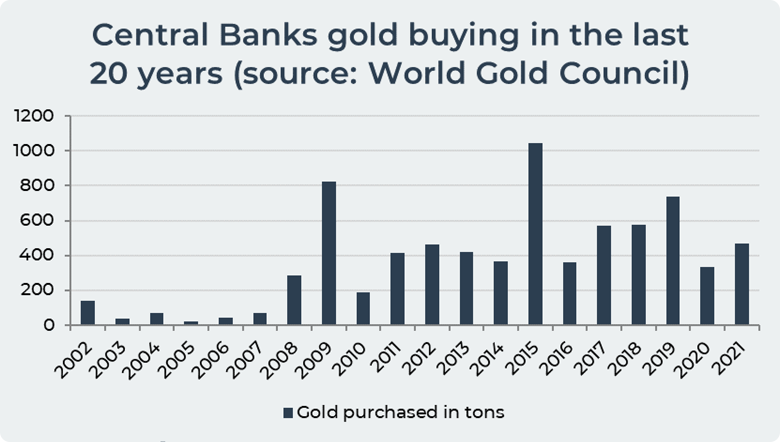

In the last 10 years, Central banks significantly increased their gold purchases. In 2021, they purchased 362.6 gold tones (16.8 US$ billions) altogether, which is an increase of 37.5% from 2020.

Global gold production in 2021 amounted to 3,000 metric tons. Central banks bought 12% of the world's gold production, which is quite a large part of the gold market. In 2020, the share of gold purchases by central banks in global gold production was 8%.

The highest amounts of gold purchase were in 2015 – 913.4 tons of gold (47$US billions) and in 2019 – 707.7 tons of gold (36$US billions).

In 2021, gold reserves at central banks stand at a 31-year high.

The first opportunity for central banks to purchase gold is the Over-the-Counter (OTC) market. Central banks have the opportunity to buy gold directly from a bullion bank or an internationally-recognized gold refinery. Most central banks buy Good Delivery (GD) bars.

A second option for central banks to add gold to their reserves is the Bank of International Settlements (BIS). Banks that are part of the Bank of International Settlements can buy gold through this bank. The Bank of International Settlements is located in Basel, Switzerland and serves as “a bank for central banks”.

Central banks can also buy locally produced gold. This mostly refers to gold-producing countries like China, Russia, Canada etc. And several central banks around the world have local gold purchase programs like in Mongolia, Philippines or in Russia.

The biggest Central Banks buyers of gold in the last 20 years are by order of importance: the US, Germany, Italy, France and the Russian Federation. The biggest Central banks sells of gold in the last 20 years are: Norway, the Canada, the Uruguay and the Chile.

1a. USA is the Main Gold Buyer.

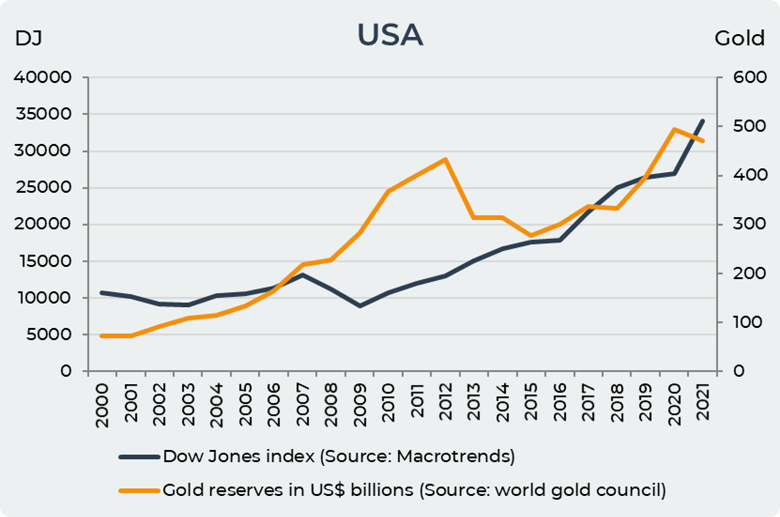

The biggest gold buyer in last 20 years is USA. They increased their gold reserves significantly from 72$US billions in 2000 to 472$US billions in 2021. The chart below shows that The Federal Reserve adds gold to its reserves when there is a downturn in the economy, rising inflation, geopolitical instability or a financial crisis.

The US began to increase its gold reserves in the period 2002-2005 against the background of acts of terrorism, the invasion of Afghanistan and Iraq, the decline in the value of the dollar and instability in the market.

During the global financial crisis, when the stock markets collapsed, the US added 215$US billion gold reserves to its reserves. During the global crisis, the Federal Reserve used gold as a safe haven during years of instability and for hedging.

As the economy began to recover from the financial crisis, the US sold $133 billion of its gold reserves, reducing its gold reserves to $300 billion in 2016. During a period when stock markets are rising, the Fed does not need to hold such gold reserves as it does during periods of volatility because gold is a dead asset.

After 2016, the US has increased its gold purchases to a 57% compared to 2016, reaching 472 billion gold reserves as of 2021.

1b. China Buys Gold for Increasing the Role of Yuan as a Reserve Currency in the World.

China bought $114 billion worth of gold over the past 20 years.

Officially, China does not comment on the reasons for the purchase of gold because, according to the China Gold Association (CGA), a "purchase or even intent to do so by China would trigger market speculation and volatility".

In 2015, the People's Bank of China said "On the basis of our assessment of the value of gold assets and our analysis of price changes, and on the premise of not creating disturbances in the market, we steadily accumulated gold reserves through a number of international and domestic channels.” Which means that China does not want to influence the volatility of the gold market.

In the official reserves of China, gold is only 3%, which is much lower than in the USA or European countries. Therefore, by purchasing gold, China is trying to gradually diversify its reserves and strengthen its national currency, which was confirmed in the report of the People's Bank of China in 2015 "Gold has a special risk-return characteristic, and at specific times is not a bad investment...But the capacity of the gold market is small compared with China's foreign exchange reserves; if foreign exchange reserves were used to buy large amounts of gold in a short amount of time, it will easily affect the market”.

About strong national currency China and its partners discussed during the last BRICS meeting too. They are preparing to trade in national currencies outside the dollar system and to create a bilateral settlement system.

In addition, China is the largest producer of gold in the world. China produced 370 metric tons of gold, which is 12% of all gold produced in the world. Therefore, their central bank has the ability to buy gold from their producers. Mainly, China keeps its gold production for itself.

The chart below shows that buying and selling gold in China is related to its currency performance. The correlation between gold and national currency performance is -82%. It means when China is buying gold its national currency became stronger in relation to US Dollar which is a target of Chinese government to make Yuan a reserve currency.

In 2021, China had 141$US billion gold in its reserves.

1c. Russian Federation Bought Gold for Creating a Bilateral Settlement System.

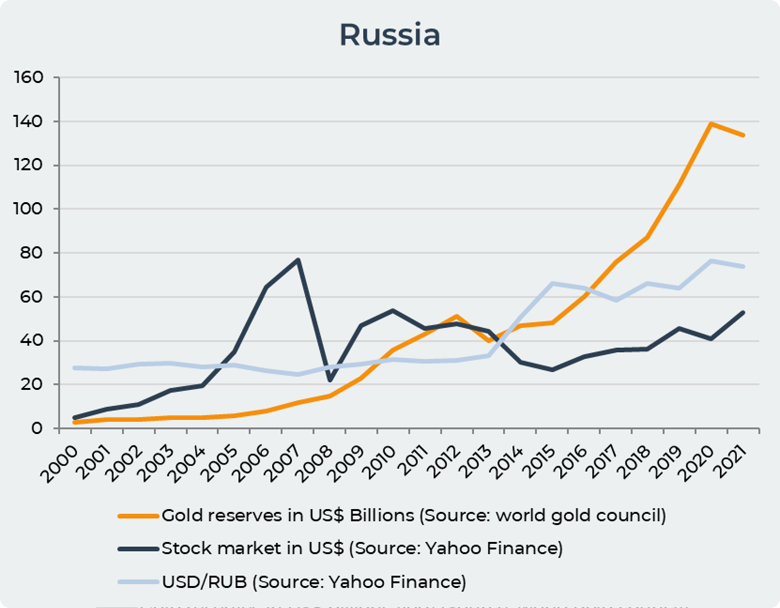

Russia has added 131 billion gold to its reserves in the last 20 years. The central bank of Russia has the opportunity to buy gold from local producers. Russia began to dramatically increase its gold reserves against the background of the 2008 financial crisis, the invasion of Georgia and the decline in the value of the ruble against the dollar.

In 2014, there was a significant collapse of the ruble. The ruble lost 54% of its value in relation to the US dollar as a result of the introduction of sanctions by the EU and the US for the illegal annexation of Crimea. Against the background of these events, the Russian Central Bank began to sharply buy gold. Elvira Nabiullina, head of the Central Bank, confirmed this on April 21, saying, “As a country with a non-reserve currency, we should be able to stabilize the domestic foreign exchange market in such a crisis. And our domestic foreign exchange market was mainly in dollars and euros. Therefore, the dollar-euro part of the reserves is needed for fending off such financial threats. But since 2014, our country has been subject to sanctions pressure, so we have diversified our reserves over the years, increasing the shares of gold and the yuan".

However, Russia continued to buy gold in unison with China in order to build a new monetary system and protect its currency and economy against sanctions after the start of a full-scale war against Ukraine. China and Russia happen to be the two nations which have by far concluded the most and largest bilateral trade agreements abandoning the U.S. dollar. At the last BRICS meeting in June 2022, Putin said that Russia and China are developing a new system together with the BRICS partners. Putin said "The matter of creating the international reserve currency based on the basket of currencies of our countries is under review. We are ready to openly work with all fair partners". Putin told the BRICS Business Forum.

As of 2021, Russia had 134$US billion gold reserves.

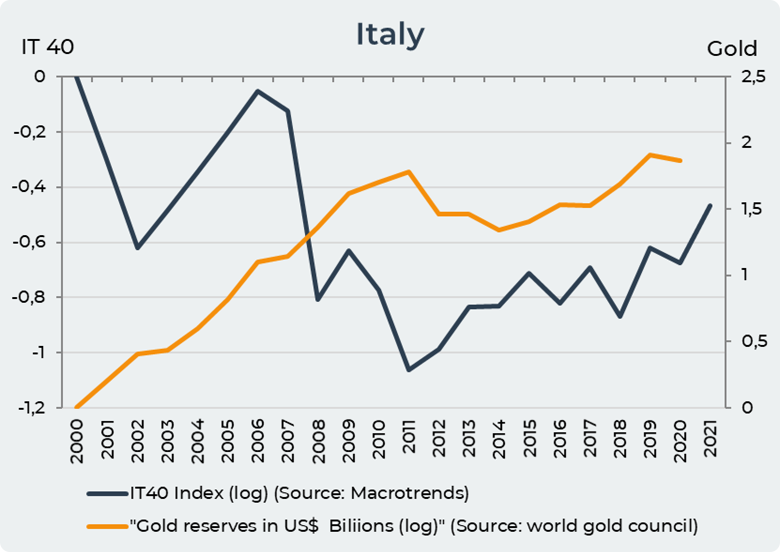

1d. France, Germany and Italy Buying Gold for Fears Eurozone Problems.

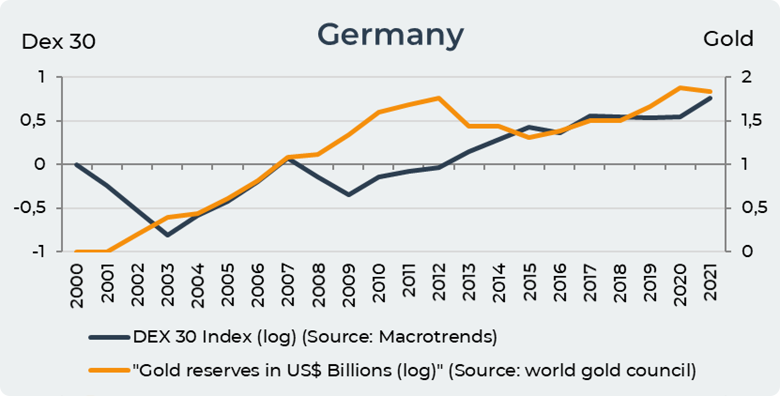

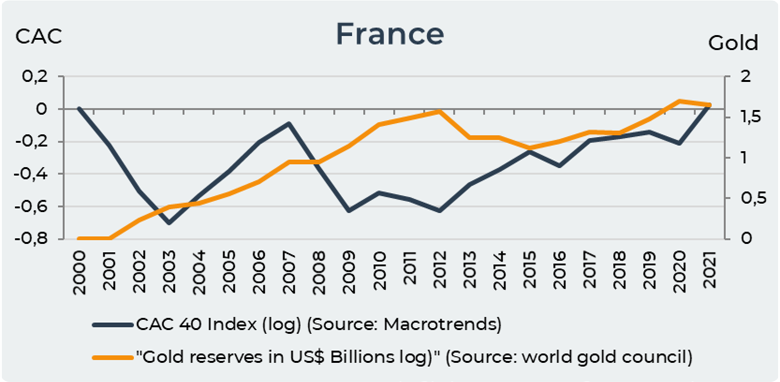

The three largest EU economies have behaved in a similar way to USA over the past 20 years in relation to gold.

Italy bought 120$US billion gold, Germany added 164$US billion gold to its reserves and France bought 117$US billion gold in the last 20 years. In the early 2000s, the role of the Euro changed significantly in the field of global monetary policy. The euro has strengthened its position. But the main reason for buying gold is following what USA is doing.

Between 2008 and 2012, Italy increased its gold reserves by 62$US billion, Germany added 89$US billion to its reserves, and France acquired gold worth 60$US billion.

In all three countries, as soon as the situation in the stock markets and economy was stable, their central banks started selling gold. As in the period from 2013-2015, when stock markets and the economy were growing.

Since 2016, Deutsche Bundesbank, Banque de France and Banca d'Italia have only been buying gold. In fact, European countries in gold trading are following what USA is doing.

2. Market Share of Central banks in the Gold Market.

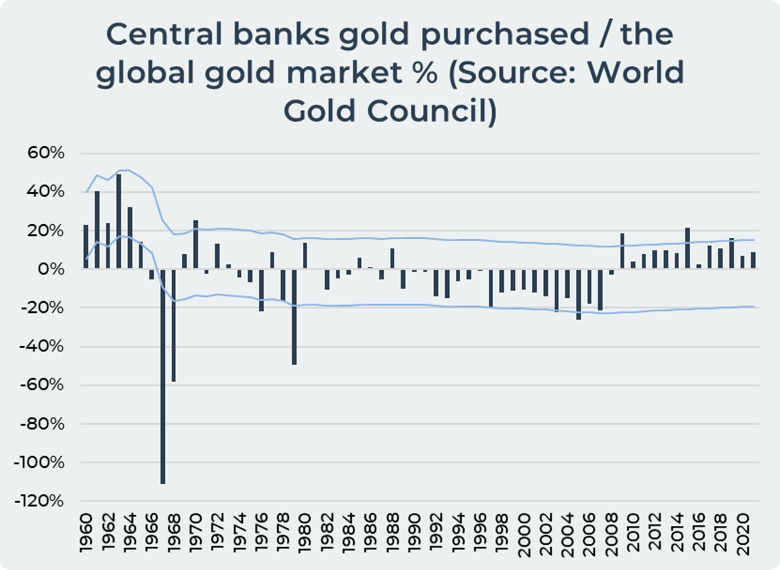

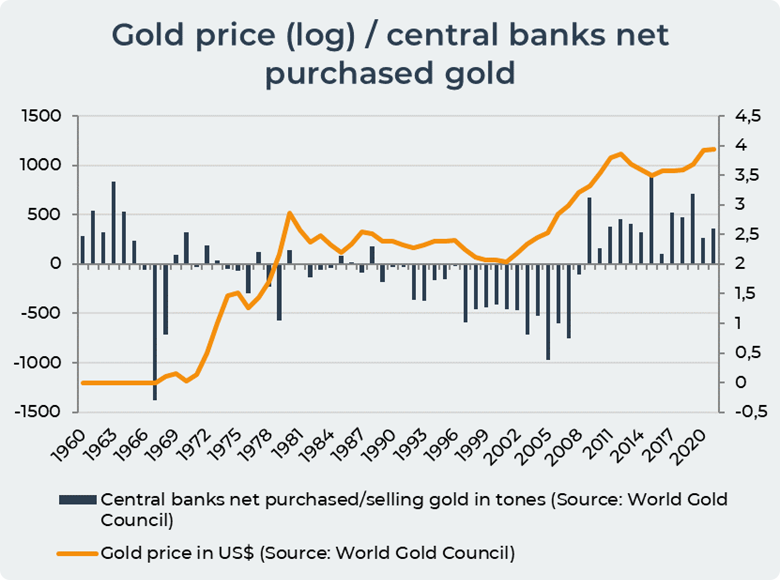

Central Banks have and average market share of 15% of the worldwide gold market. This is enough to have an influence on the price of gold, especially since they are alternatively net buyers and net sellers.

A gold market is a place where gold sellers and buyers trade gold products. The gold market is a subject of speculation and volatility. According to the World Gold Council “gold market” is “inherently global and gold is traded continuously throughout all time zones. The gold market comprises a broad range of participants that includes physical players such as producers, refiners, fabricators and end-users.”

There are important differences in the market, such as trade restrictions, gold taxes in different regions, so there is not one single gold market. “Financial intermediaries, such as banks, provide an important function in offering financing, providing trading liquidity and offering broader services in gold trading” according to World Gold Council.

In 2021, central banks purchased 9% of gold from the world's gold demand, which is 2% more than in 2020. The largest share compared to the world's gold demand in the last 20 years was purchased by banks in 2015, which is 22% of gold purchases from the global demand. In 2009, banks purchased 19% of the world's gold demand, and in 2019, banks added 16% of the world's gold demand to their reserves.

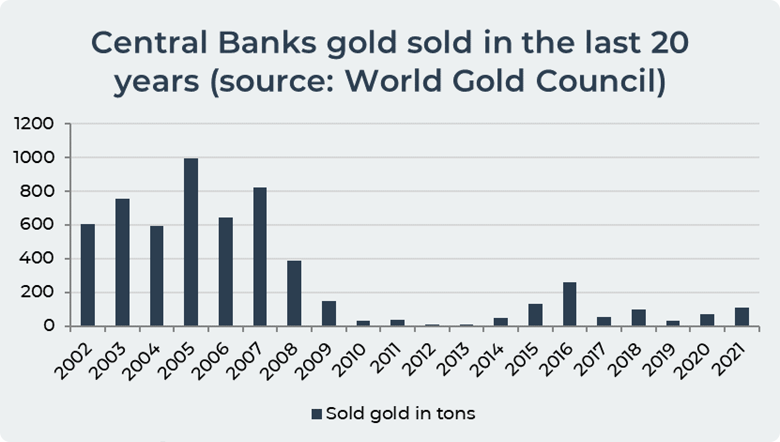

The chart below shows that central banks bought the most gold in 2009, 2015 and 2019. In 2009, banks purchased 823.2 tons of gold ($42 US Billion). In 2015, banks added the largest amount of gold in the last 20 years - 1044.7 tons (54$US Billions). In 2019, banks purchased 738 tons of gold (37 $US Billions).

Central banks sold the most gold in the past 20 years in 2005. In 2005, banks sold 974 tons of gold or 26% of the world's gold demand. In 2005, banks bought 22.6 tones of gold (1.2 US$ Billions) and sold 996.2 tones of gold (51$US Billions) In 2003, central banks reduced their gold reserves by 22% of world gold demand, and in 2007 by 19%. In 2003, banks added to its reserves 37.3 tones of gold (2$US Billions) and sold 753.8 tones of gold (39US$ Billions). In 2007, banks sold 822.4 tons of gold (41$US Billions).

We also can see in the two charts above that Central Banks are acting in the same manner worldwide. They are all buying together (2009-2021) or they are all selling together (2002-2008).

3. Should we Follow what Central Banks are Doing?

In this section, we are trying to assess if we should follow the Central Banks actions regarding their purchase of gold. In other words, if Central Banks are buying gold, as it has been the case in the past 10 years, is it a buy indicator, a sale, or is it not relevant?

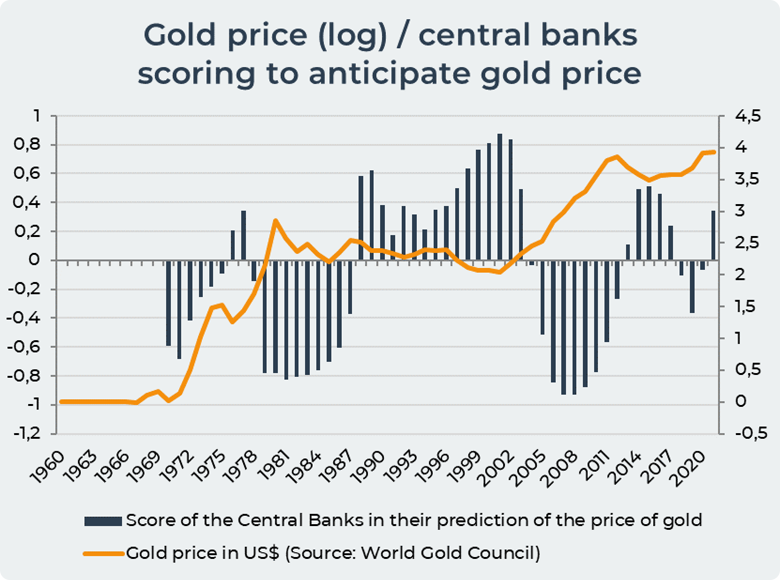

In the chart below, we assigned a score to the Central Banks. If they are net buyers and if the price went up, their score is positive (100% is a perfect score). On the opposite, if Central Banks buy but the price is going down, then the score is negative (-100% is a perfect fail).

We can see that in the period of sharp rise, like in the 1970’s or in the 2000’s, Central Banks’ score is very negative. Central Banks are very late to start their purchase of gold. They do it usually at the top.

Central Banks are good indicators only in period of low volatility of gold, such as the 1990’s and the 2010’s.

When gold is not moving a lot, Central Banks have the right behavior, and it is good to follow what they are doing. But as soon as gold begins a big rally or a big drop, Central Banks are doing the opposite of what should be done. They bought the big decline of 2000’s and they sold the big rally of 1970’s. It looks like Central Banks are mean reversal agents, or we could say in the financial jargon Central banks are gamma-neg.

Another remark is that Central Banks are terrible at their timing of selling gold, as we can see in the chart below. They sold from 1996 to 2007 large amounts of gold at the lowest price, and they became net buyers when the price of gold was at the highest in 2010. Similarly, Central Banks sold large amounts in 1967-1968 just before the huge rise in price. This is not a symmetric behavior: Central Banks are not that bad at buying gold.

Conclusion

The market share of Central Banks (15% in average) makes them an important player of the gold market.

Central Banks have a terrible track record at selling their gold at the lowest price. They don’t have such a terrible track record when buying their gold. However, they tend to be consistently late, and to start their buying program when the price of gold is already at the top. They have a mean-reversal behavior when it comes to trading gold.

The conclusion is that we should not follow Central Banks when they are selling. We could follow them when they are buying, but we should not count on Central Banks to help us catch the big moves in gold.

Date= 5th August 2022, Gold price – 1786$, Silver price – 20.14$, Platinum price – 956$, Oil price – 94.46$