The demand for gold and silver has risen sharply in 2022. Who are the largest producers and what is the demand for gold and silver in 2022?

Gold and Silver Demand in 2022

The demand for gold and silver has increased significantly in 2022. The main idea of the article is to review the largest producers and demand for gold and silver in 2022.

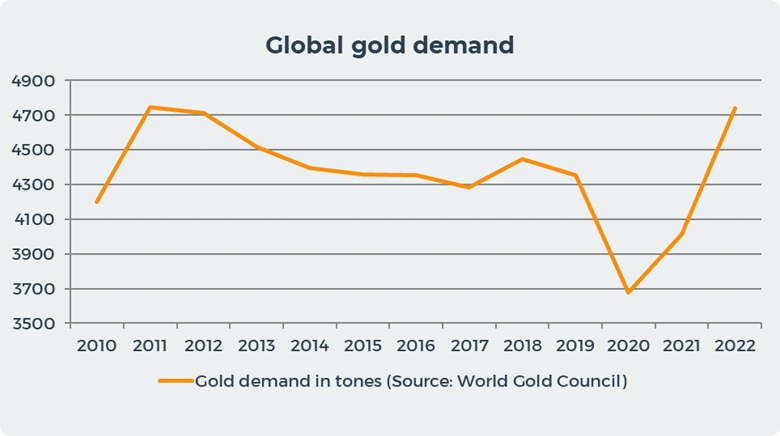

In the first chapter, we will show that the demand for gold is the highest in the last decade.

In the second section, we will show the largest producers of gold in 2022.

In the third section, we will show the largest producers and demand for silver in 2022.

1. Gold Demand is Growing

The graph below shows that the demand for gold in 2022 was the highest in the last decade. In 2022, the demand for gold amounted to 4741 tons (283.5 US$ Billions), which is 17% more than in 2021.

According to the World Gold Council report "It was boosted by a record fourth quarter, demand for gold was propelled by hefty central bank-buying and persistently strong retail investment." In the 4th quarter, the total demand for gold amounted to 1337 tons (80 US$ Billions).

Demand for gold in central banks amounted to 1136 tons (79.9 US$ Billions), which is the highest figure in the last 55 years. Although the report indicates that most of the purchases were "unreported."

Investment gold showed an increase in demand by 10% compared to 2021 and amounted to 1,107 tons of gold. This growth occurred due to increased demand for gold bars and coins.

Demand for gold bars and coins amounted to 340 tons (20.3 US$ Billions) for the first time since 2013. The main motive for buying bullion and coins was the need to protect wealth in a global inflationary environment.

Western investment demand for physical gold products hits annual record in 2022. Combined purchases of gold bars and coins in the US and Europe reached 427 tons (31.5 US$ Billions), the most since 2011. Retail investors in the US bought 113 tons (6.7 US$ Billions) of gold in 2022, the third largest annual total for this market after 2021 and 2009. Among the reasons for gold purchases by the Western world were high inflation, concerns about recession, the Russian-Ukrainian war and changes in local currency prices, the report said.

Among the countries, India and China traditionally had the highest demand, but there was a significant decrease in the demand for gold in 2022. While the countries of the Middle East, Asia and Europe showed an increase in the demand for gold, especially investment and physical gold.

Demand for physical gold is expected to continue to grow in 2023. The World Gold Council expects demand for jewelry to also increase compared to 2022 as China reopens after severe Covid-19 restrictions.

2. Gold Production in 2022

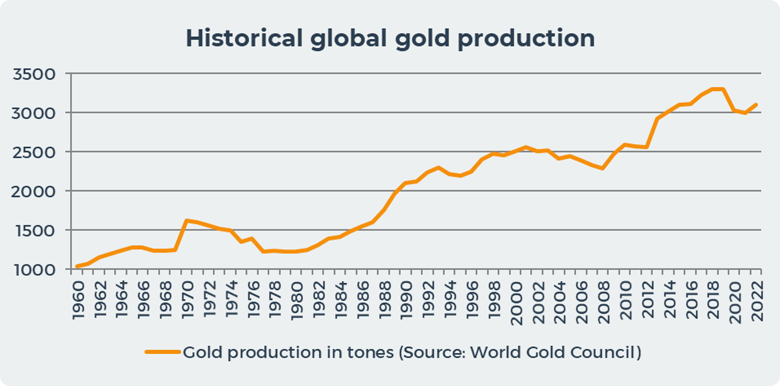

In 2022, 3100 tons (185 US$ Billions) of gold were produced, which is 3% more than in 2021. The increase in production was driven by growth in gold production in China, Colombia, Indonesia and Burkina Faso.

The decline in gold production was in Papua New Guinea and the United States. Gold production continues to rise after a drop in output during the Covid-19 pandemic.

2a. Largest Gold Producing Countries in 2022

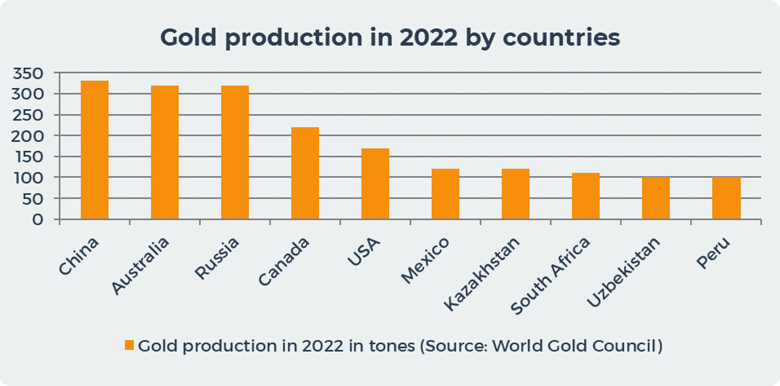

The chart below shows that the largest producers of gold in the world were China, Australia and Russia.

China continues to be the largest producer of gold in the world. They produced 330 tons (19.7 US$ Billions) of gold, which is 1 ton more than in 2021. The next largest gold producers are Australia and Russia, which produced 320 tons (19 US$ Billions) of gold each. However, Australia increased its gold production by 5 tons compared to 2021. Together, the top 3 countries produced 31% of the world's gold production.

Canada produced 220 tons (13 US$ Billions) of gold and the US 170 tons (10 US$ Billions) of gold and both countries produced less gold in 2022 than in 2021 when Canada produced 223 tons (13.3 US$ Billions) of gold and the US 187 tons of gold (11 US$ Billions).

The top 10 countries together produced more than 60% of all gold production, which continues to prove that gold production is concentrated in a small number of countries.

2b. Largest Gold Producing Companies

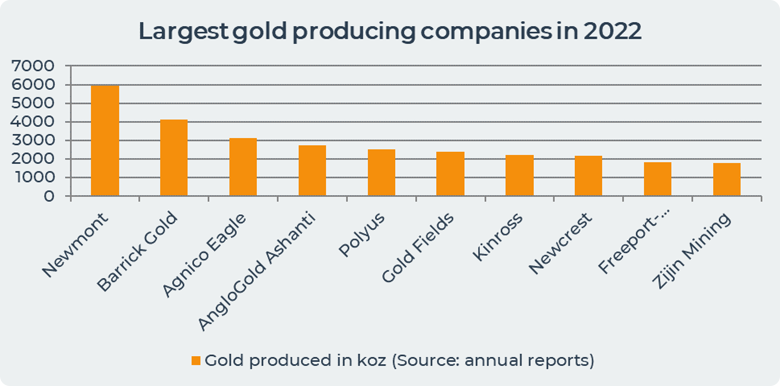

The largest producer of gold in the world was Newmont , which produced 5956 koz of gold and remained at the same level as in 2021.

Barrick gold production in 2022 was 6.7% lower than last year and amounted to 4141 koz. In its report, the company said the decline in gold production was due to infrastructure issues at Turquoise Ridge in Nevada and the replacement of a rock winder at Kibali in the Democratic Republic of Congo.

Agnico Eagle's gold production increased by 50% compared to 2021 and amounts to 3135 koz. This growth was possible due to the inclusion of production from the Detour Lake, Fosterville and Macassa mines, the company said in its annual report.

It is worth noting that the Chinese company Zijin Mining entered the top 10 largest gold producers, which increased its production by 17% due to the successful start of production of key projects, primarily the Upper Zone of the Cukaru Peki copper-gold mine in Serbia. Freeport-McMoRan also increased its gold production by 31% through mining at the Grasberg minerals district in Indonesia, which is one of the world's largest copper and gold deposits.

3. Production and Demand for Silver is Increasing

According to the Silver Institute, all key silver categories showed growth in 2022. Total demand for silver in 2022 was 1242 Boz (287 US$ Billions), up 18% from 2021.

This significant growth is due to the application of the "green" economy, in particular a significant increase in photovoltaic (P.V.) production, which consumed 140.3 million ounces of silver (32 US$ Billions) in 2022. Industrial demand was also supported by electrification in the automotive segment and other investments in power generation and distribution.

Last year, silver jewelry production rose 29 percent to a record 234.1 million ounces (54 US$ Billions). An increase in demand for silver jewelry was observed in Europe and India. Silver demand surpassed jewelry in percentage terms in 2022, rising 80% to a record 73.5 million ounces (1.7 US$ Billions).

Net physical investment in silver rose for the fifth consecutive year to a new high of 332.9 million ounces (7 US$ Billions). India was the biggest investor in physical silver last year and saw growth of 188% compared to 2021 thanks to lower prices and bargain hunting. There was modest growth in the U.S., where the market contended with prolonged product shortages and exceptionally high premiums, the report said. Australian physical investment rose 15%, while European demand was flat last year as Germany, its biggest market, faced an unexpected and sudden VAT change.

3b. Silver Production

In 2022, 26000 tons (19.5 US$ Billions) of silver were produced. U.S. Geological Survey explained that the increase in global mine silver output in 2022 was primarily due to the higher production from mines in Chile and other countries as silver mines were still recovering from shutdowns in 2020 in response to the global COVID-19 pandemic.

The largest producer of silver in 2022 was Mexico 6300 tons (4.7 US$ Billions), China 3600 tons (2.7 US$ Billions) and Peru 3100 tons (2.3 US$ Billions). In total, the 3 largest silver-producing countries produced 50% of all world silver.

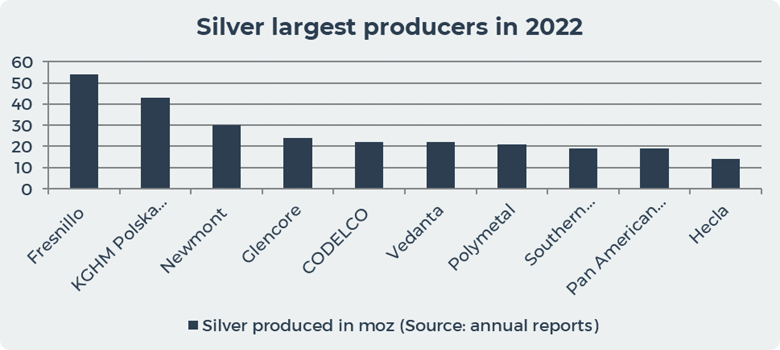

The largest silver producer in 2022 was Mexican silver producer Fresnillo. They produced 54 million ounces in 2022. The increase in production was driven by production at Juanicipio and increased ore processed at Fresnillo, offset by lower ore grades at San. Julian said in the annual report. The second largest producer of silver is the Polish company KGHM Polska Miedz, which produced 43 Moz of silver. Newmont is the third largest silver company. They produced silver of 30 Moz in 2022.

A noticeable trend among all the major silver producers is to reduce production, with the exception of Fresnillo. For example, Glencore, which is the fourth largest producer of silver, produced 25% less silver than in 2021. In its report, the company indicated that the drop in production was due to a decrease in the production of secondary silver at the company's zinc plants.

5. Conclusion

Gold and silver showed a powerful 2022 in their indicators. We saw record demand for silver and gold. It is noticeable that the demand for physical gold and silver grew strongly against the background of high inflation, since the two assets have excellent indicators in times of geopolitical instability and high inflation. According to forecasts, the demand for physical gold and silver will grow in 2023, making it an attractive asset in your portfolio.

Date= 05th May 2023, Gold price – 2029.40$, Silver price – 25.93$, Platinum price – 1074.50$, Oil price – 71.37$