Which countries have banned the export of their gold?

Introduction: The Countries that have banned the export of their Gold

Gold trade is an important element of the policy of many states. However, there are countries that do not want to sell their gold. The main purpose of the article is to find out which countries have banned the sale of their own gold.

In the first chapter, we will show that China has completely banned the export of its gold.

In the second chapter, we will show that Kazakhstan banned the export of gold bars.

In the third section, we will show that India has banned the export of 22 carat gold and above.

1. China Fully Prohibit to Export its Gold.

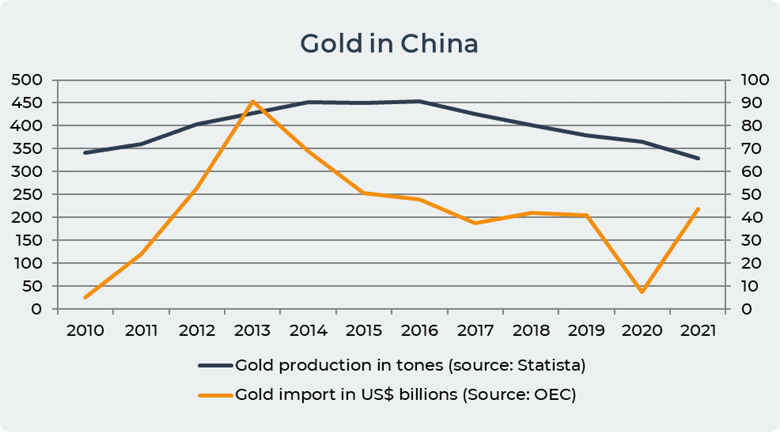

China has been the largest producer of gold in the world for the past decade. In the period from 2010 to 2021, China produced 4788 tons of gold (239US$ billions), which is 13% of the world's gold production.

Over the past 10 years, China has imported 511.8US$ billion worth of gold. The peak of gold exports to China was in 2013 when China imported gold worth 90.8 billion dollars. China imported the most in the period 2012-2015, when China imported 263 billion gold. A sharp collapse in the import of gold occurred in 2020 when there were restrictions of the Covid pandemic.

China's gold production has grown steadily since 2010 and reached its peak in 2016 when China produced 453 tons of gold. From that time, gold production began to decline. However, China still remains the largest producer of gold in the world. The decline in gold production is associated with a decrease in gold reserves in mines, which forces Chinese gold mining companies to look for mines in Latin America and Africa.

Since 2009, China has banned the export of its gold. Chinese gold mining companies have no incentive to export gold because gold trades at a premium on the domestic market. However, gold mining companies can export gold to Shanghai and Hong Kong. Gold export activities are regulated by the law of the People's Republic of China - Regulations of the PRC on the Control of Gold and Silver which clearly said in Chapter 2 that all gold and silver must be sold to the People's Bank of China and no individual can keep, exchange or sell gold outside. Failure to comply with this law can result in fines and criminal liability.

China's official reserves are 1948 tons (141US$ billion) as of 2021. The question arises, where is the other gold? Many analysts believe that the gold is in China's central bank, the People's Bank of China, but they do not say about their real gold reserves. In addition to the People's Bank of China, there are two more places where you can store gold in China.

First, Vice Chairman of the Guangdong Gold Association Zhu Zhigang says that an unknown amount of gold has accumulated in twelve commercial banks that have received licenses to import gold into China since 2012. Among them are two international banks, The Australia and New Zealand Banking Group Limited and HSBC. Their gold reserves are not disclosed.

Second, Chinese gold can be "loaned" to jewelry factories located mainly in and around Shenzhen. This practice was invented by Chinese gold mining companies in order not to sell gold at prices that, in their opinion, are too low. Most gold is traded on the Shanghai Gold Exchange. But instead of selling gold at low prices on the exchange, Chinese gold producers lend gold to jewelry factories with the hope of returning the gold to the market when the gold price is favorable.

The value and status of gold remains high in China, where it represents financial security.

2. Kazakhstan Prohibits the Export of Gold to Protect its Interests

On March 14, 2022, the President of Kazakhstan Kassym-Jomart Tokayev signed a decree "On measures to ensure the financial stability of the Republic of Kazakhstan".

This decree explains that for the purpose of financial stability and protection of the national interests of Kazakhstan, a ban is introduced on the export of currency in the amount of more than 10 000 dollars. Also, this decree prohibits the export of gold bars of refined gold 5, 10, 20, 50 and 100 grams and investment coins made of gold “ALTYN BARYS” and silver “KÚMIS BARYS” issued by the National Bank of the Republic of Kazakhstan, as well as refined gold over 100 grams.

During the briefing on the decree, the Minister of Finance of Kazakhstan said that customs officers will be replaced by representatives of border services who will check people crossing the border.

The President instructed the Government of Kazakhstan together with the National Bank of the Republic of Kazakhstan to take the necessary measures for the implementation of this decree from the moment of signing.

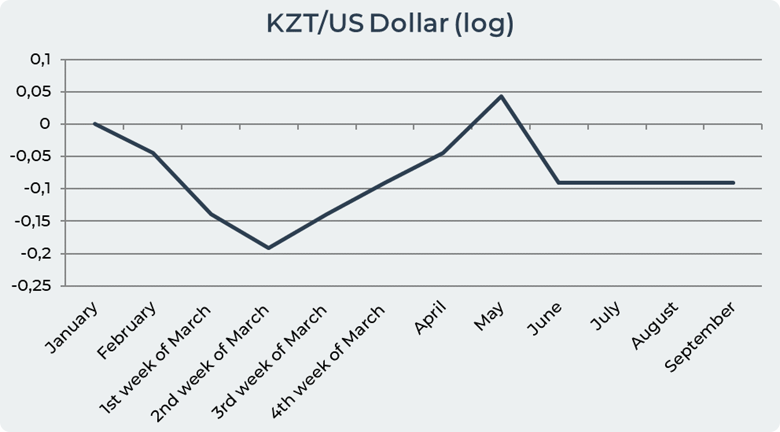

Experts call this decision a means of protecting the tenge currency, which collapsed in value to the dollar by 20% after Russia invaded Ukraine and found itself under sanctions.

The graph below shows that the value of the Kazakh tenge against the US dollar fell sharply in the first and second weeks of March 2022. In order to contain the fall of the national currency, the central bank of Kazakhstan used 815 US$ million of its reserves to keep the tenge at the level. In addition, by the end of March 2022, the central bank of Kazakhstan announced the transition from open market currency trading to the Frankfurt auction method, which accepts only limited bids to avoid excessive volatility.

3. India Prohibits to Export Gold Jewelry Above 22 Carats

On August 16, 2017 the Directorate General of Foreign Trade, said, "The Foreign Trade Policy 2015-20 has been amended to allow the export of gold jewelry (plain or studded) and articles containing gold of eight carats and above, up to a maximum limit of 22 carats only from domestic tariff area and export oriented units (EOU) or any such privileged facilities."

This decision means that the export of jewelry or medallions with a content of 22 carats or more is prohibited. This decision of the government caused a mixed reaction. One part of the jewelers took the government's decision as a serious blow, while the other part said that the impact will be insignificant because the demand for gold with such a high carat content in the world is insignificant. A senior official of Commerce Ministry's apex export promotion body, Gems and Jewelry Export Promotion Council (GJEPC) said, “The government's decision to ban the export of gold jewelry and lockets will not affect India's gold jewelry exports as there is demand for such jewelry in global markets low".

This step of the government is considered a way to curb trade violations. This decision is connected with the free economic zone with South Korea. Gold traders in India have also used free trade agreements with countries such as Thailand and Indonesia to avoid import duties. "The move may be to reduce round-tripping of jewelry and coins, wherein a trader can import the gold coins or jewelry at a lower import tax because of trade agreements with some countries and re-export the same stock without any value addition," said Ketan Shroff, joint secretary of the India Bullion and Jewelers Association. He said exporters would benefit from not paying the 10 percent import tax currently levied on most incoming gold shipments. Before the government's decision, traders only had to pay a lower tax on import — or not pay tax at all — on gold jewelry and gold coins if they re-exported the gold. This could also be an attempt by the authorities to prevent the current account deficit from widening again after a sharp rise in Indian gold imports in the final months of 2017.

The share of gold products of 22 carats and above in India is about 15% of the total gold imports into India.

Conclusion

Each country builds its own gold policy depending on its own interests. Among all the countries that produce gold, there are only three that limit the export of their gold. The strictest gold export ban policy exists in China, which is shrouded in mystery about gold storage and what exactly the Bank of China does with gold. Similarly, information about official reserves raises certain questions, especially against the background of the fact that China is the largest producer and the largest importer of gold in the last ten years. Only the Chinese Communist Party has data on real gold reserves and what exactly is happening with gold. Another country that completely banned the export of its gold to protect its market and its own financial stability. Another reason for banning the export of gold from Kazakhstan is the preservation of the stability of its own currency, which was under attack due to sanctions against Russia. India partially limited the export of its gold containing more than 22 carats to combat round-tripping of jewelry and coins, as well as high demand for gold in its own market and low demand for gold with 22 carats and more on the world market. One way or another, each country determines how to act in relation to its gold.

Date= 14th September 2022, Gold price – 1715.20$, Silver price – 19.89$, Platinum price – 921.90$, Oil price – 87.55$