Why is Japan one of the largest exporters of Gold in the world when it does not produce any?

Introduction: Japan is a big exporter of Gold

Japan is one of the largest exporters of gold in the world even though Japan does not produce gold. The main idea of the article is to understand why Japan is one of the largest exporters of gold in the world and to overview the gold market in Japan.

In the first chapter, we will show that the exports come from the internal sales of retails. Especially, the higher the price, the more retailers sell their jewelry and gold.

In the second chapter, we will show that TOCOM is one of the most important commodity exchanges in East Asia.

In the third chapter, we will show main gold refiners in Japan.

1. Net Gold Exports are 90% Correlated to Retail Gold Price.

Until 1973, the free export and import of gold from Japan was prohibited. However, in 1973, the Japanese authorities lifted the ban as part of an initiative aimed at encouraging private trade in gold. After that, in 1978, the Japanese government allowed the export of gold from Japan. This prompted Swiss and London gold dealers based in Hong Kong to start trading in gold, which they supplied to Japan from Hong Kong.

Japan is one of the largest exporters of gold in the world. The level of gold exports from Japan is the highest since 1985. According to Bruce Ikemizu, the manager of Standard Bank's Tokyo branch said "Japan is the only country that exports gold without being a major producer." In 2021 Japan exported 7.7 US$ billion of gold. The largest importer of Japanese gold is Singapore. Its share is 24% in Japanese exports.

The structure of Japan's gold exports is: 83% gold in unwrought forms; 16% gold (including gold plated with platinum) non-monetary, in semi-manufactured forms; and 0.099% gold (including gold plated with platinum), non-monetary, in powder form.

The graph below shows that the correlation between Net gold export and gold retail price in Japan is 90%. When Japan bought gold in the 1980s and 1990s, the price was low, but when gold prices started to rise, people started selling their gold, and the main gold trader in Japan, Tanaka Kikinzoku Kogyo, started buying gold from its citizens. Having bought gold, Tanaka sold it at an even higher price, which creates an imbalance in the export-import of gold in Japan.

Japan's largest gold retailer, Tanaka Kikinzoku Kogyo, says they have bought 40% of all jewelry and gold bars from individuals and are selling them now that the price of gold has risen. Tanaka's top manager said "More and more people who bought gold and jewelry in the 1980's and 1990's are selling back what they purchased."

Another gold retail gold trader in Japan, Sumitomo Metal Mining, says it spends several billion yen each day at the peak to buy processed gold for shipment to foreign smelters. This was said by Koichi Iwanaga, general manager of the company's commodity department.

1.1. The level of demand for gold in Japan is anti-correlated with the price of gold and gold reserves are correlated with the price of gold.

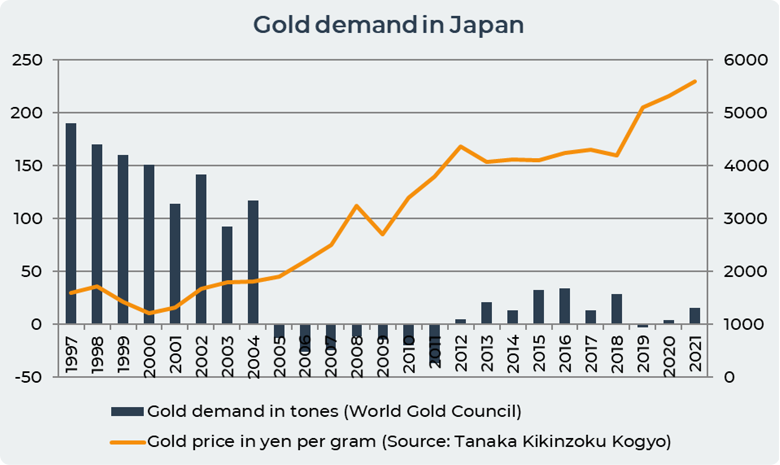

According to the data of the World Gold Council, the level of consumer demand for gold in Japan was high in the 1990s. At that time, the Japanese bought gold when the price of gold was low below 1500 yen per gram of gold in the retail market. However, when the price of gold exceeded 2000 yen per gram of gold, the Japanese began to sell their gold and the consumer demand for gold in Japan became negative from 2005 to 2011. Since 2012, the consumer demand for gold in Japan has increased slightly and amounted to 15.6 tons in 2021.

The graph above shows that the demand for gold and the price of gold in Japan are anti-correlated at the level of -64%. Which means that in the event of an increase in the price of gold, the Japanese begin to sell it and vice versa.

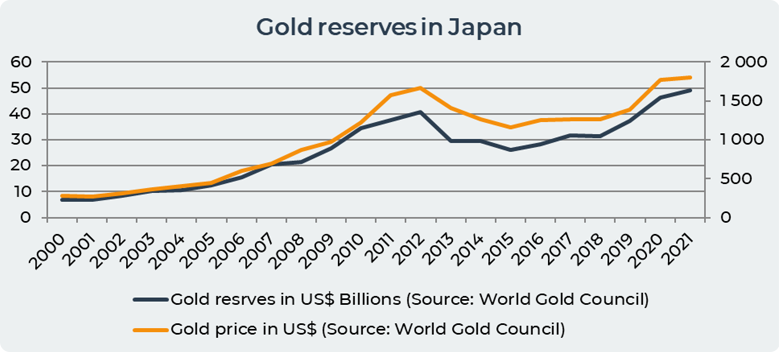

A similar situation exists with the Japanese central bank. Central bank gold reserves increased when gold prices rose and decreased when gold prices fell. The graph below shows that the correlation between the gold price and Japan's gold reserves is 98%.

Over the past 20 years, Japan has purchased 42 US$ billion in gold. Japan bought the most gold in the period 2008-2012 when they added 20 billion gold to their reserves. And in the period 2015-2021, when they added 23 billion gold to their reserves. To date, the gold reserves of the Japanese central bank amount to 49 US$ billion of gold.

2. TOCOM is an Important Center of Gold Trade in East Asia.

In 1982, the Tokyo Gold Exchange was established. The exchange will later become part of The Tokyo Commodity Exchange, which is an electronic commodity derivatives exchange that was established in 1984. Today, various futures contracts for various precious metals, energy and agricultural products are traded on the exchange.

The Tokyo Commodity Exchange is the largest in Japan and accounts for 98% of the total commodity trade in Japan. The only other commodity exchange in Japan is the Osaka Dojima Commodity Exchange.

TOCOM's electronic trade schedule has been expanded. Trading takes place from 8:45-15:15 JST and there is an additional session from 16:30-6:00 JST which includes "night trading". Trading hours coincide with continuous trading on the Comex, and overnight trading hours cover the morning and late hours of PM auctions of the daily LBMA Gold Price. Tokyo is only one hour ahead of Shanghai, which means most trading hours on the Shanghai Gold Exchange and Shanghai Futures Exchange are aligned with TOCOM’s trading hours.

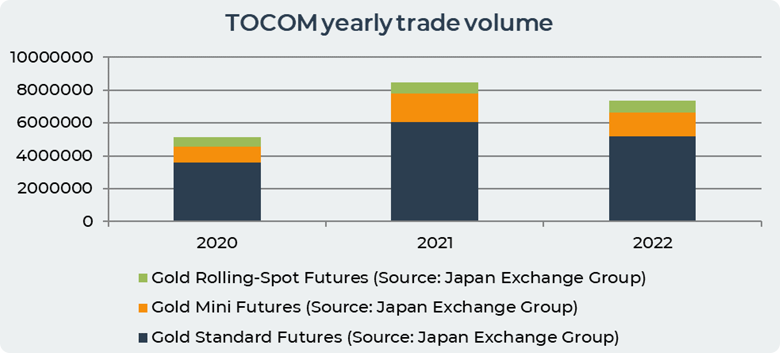

There are 2 types of TOCOM members: broker members and trade and affiliate members. And there are 14 Japanese good delivery list of bar brands that are part of TOCOM. Nine of these 14 refineries are on the LBMA Good Delivery List for gold. TOCOM offers 3 gold futures contracts: Gold Standard Futures, Gold Mini Futures and Gold Rolling-Spot Futures. All TOCOM gold futures contracts were transferred to Osaka Exchange in July 2020.

The gold rolling-spot future is a 100 gram Cash-settled Futures. The price increase is 1 yen. There are no limit positions. And contract was established in 2015.

The volume of trading on the exchange increased sharply in 2021 by 64% compared to 2020. And it already amounts to 7.38 million contracts in 2022. The largest share of the total trading volume is Gold Standard Futures with a share of 70%. The least traded Gold Rolling-Spot Futures are less than 10% of the total trading volume.

3. Japanese Gold Refining Market.

There are eleven gold refineries in Japan that are on the LBMA Good Delivery List for Gold. Such a number of gold processing plants shows the level of development of the Japanese market of the gold processing industry.

There are 4 other gold refineries that are not included in the LBMA Good Delivery List for Gold, but are part of TOCOM: Dowa Metals & Mining, Furukawa Metals & Resources, Chugai Mining Pan Pacific Copper and Nikko Smelting & Refining.

There is also an over-the-counter gold market in Japan, which is quite well developed. The over-the-counter market in Japan is represented by large trading houses Mitsui, Mitsubishi and Sumitomo.

A special example is Tanaka, which is deeply integrated into the Japanese gold market. The Tanaka Group operates the most famous gold refinery in Japan. Tanaka trades in bulk gold bars, kilo bars and gold grains, and can facilitate gold leasing and gold exchanges. Tanaka also operates its own high-end gold jewelry and investment bullion retail chain in Japan and is the largest bullion retailer in Japan. Current retail gold quotes from Tanaka are available on the company's website.

Conclusion

Japan is a prime example of a mature gold market that is well liberalized. The Japanese market supports an extensive OTC gold market. The main futures exchange conducts active and diverse gold trading. For a long time, Japan was one of the largest importers of gold, but having created sufficient reserves and developed its own market, Japan turned into one of the largest exporters of gold in the world, while not producing its own gold. Retail gold is available at many points and the Japanese buy and sell gold depending on the price of gold at a given time. Thanks to its liberal market, Japan has managed to become one of the largest traders of gold in the world. Although it is very easy to overlook the large gold market in Japan due to the close location of China.

Date= 9th September 2022, Gold price – 1737$, Silver price – 18.95$, Platinum price – 904.50$, Oil price – 82.75$