Why is India so keen on physical gold?

Introduction: Gold Interest in India

India is one of the largest and oldest physical gold markets in the world. India also has a long history in the field of jewelry gold. The main goal of the article is to understand why Indians love gold so much.

In the first chapter, we will show that India has a special relationship with gold.

In the second section, we will show the main drivers of gold demand in India.

In the third chapter, we will show that the gold refining market is an important component of India.

1. India is Home to the Largest Physical Gold Market in the World.

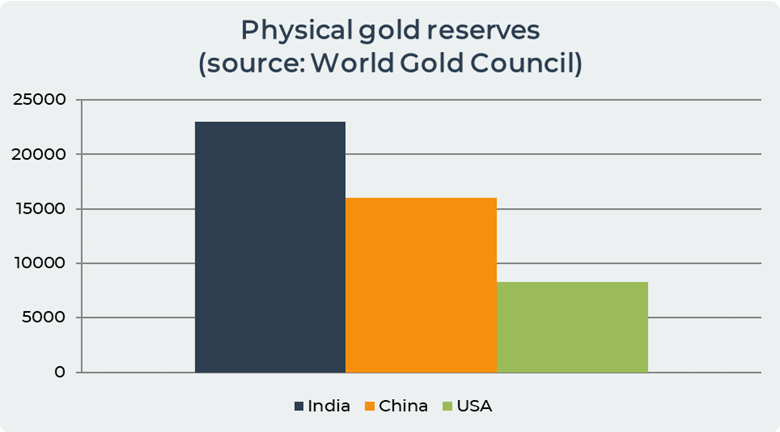

India has the largest physical gold market in the world. Annual consumption of physical gold is approaching 1000 tons per year. It is important that almost all the demand for gold is met at the expense of demand. This is why government gold policy is an important component driving the gold market. India has in its private reserves about 23000 tons of gold (3.1 US$ trillion), which is the largest reserve in the world.

There are numerous large gold trading centers in India. The main ones are located in Delhi, Mumbai, Ahmedabad, Bangalore, Chennai, Jaipur, Kolkata and Hyderabad. India has relatively limited gold production, so gold imports are an important component of meeting domestic market demand.

India has a special culture among the population that causes such a high demand for physical gold. In India, people don't trust their banking system, so they buy gold. Only about 30% of people have bank accounts. Gold is an important component of Indian religion, especially in religious rituals. Gold is considered an heirloom for many families in India. Many gold ornaments and jewelry are passed down from generation to generation to preserve the family heritage. Another element of Indian culture is gold gifts. In India, gold is auspicious for giving. Gold is considered not only a key source of money, but also a sign of happiness. Most often, gold is given at a wedding when the bride and groom can bring home a huge amount of gold after the wedding. A gift of gold is probably the highest form of gift in India. Gifts of gold are common for children's birthdays even in the smallest towns. Gold is a status symbol. Therefore, Indians do not hesitate to flaunt their gold to shine in the crowd. Also, gold is considered the safest investment according to Indians. It is this property of gold as a protector against bad times that led Indians to buy it as an investment.

1.1. Taxes on Gold in India.

The import of gold into India is quite tightly controlled by the government. The Directorate General of Foreign Trade allows two types of legal entities to import gold: banks nominated by the Reserve Bank of India and agencies notified by the Department of Commerce. In India, there are no restrictions on the amount of gold an individual can own. However, the tax authorities have certain restrictions during raids. For example, it is not possible to remove gold jewelry up to 500 grams for married women and 250 grams for unmarried women. For men, the lower limit is 100 grams. The level of taxation depends on the storage period. If gold is owned for more than three years, then it is taxed as Long Term Capital Gain at 20%. And Short Term Capital is taxed at the usual tax rate applicable to an ordinary investor. Gold ETFs and gold MFs are taxed like regular physical gold. Sovereign Gold Bond is taxed as income from other sources. If the bonds are held to maturity, the capital gains are tax-free. However, the capital gain is payable on transfer of SGB as on transfer of physical gold, ETF or Gold MF. The bonds are traded on stock exchanges in the form of demats and can be redeemed after the fifth year. In the case of a sale before maturity, the gain is a long-term capital gain and is taxed at 20%. The basic import tax in India is 12.5%.

Gold demand in India

2. Income, Gold Prices and Government Taxes as Important Long-Term Drivers of Gold Demand.

In 2021, the demand for gold in India amounted to 797 tons of gold, which is 19% of the world demand for gold.

There are quantitative and qualitative long-term and short-term factors that cause such a high demand for gold:

- Income. India has a relatively young population, which creates a favorable environment for increasing the incomes of the population. According to forecasts, there will be 890 million working people in 2040. Increasing income of the population is a favorable factor for the growth of demand for gold in India. According to calculations by the World Gold Council, a 1% increase in population income increases the demand for gold by 0.9%.

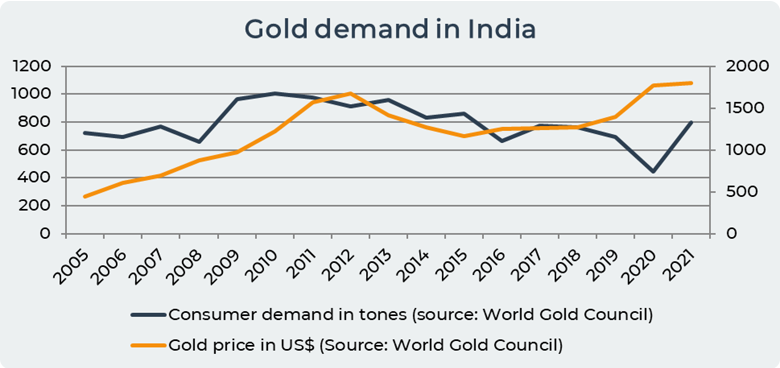

- Gold price. However, rising prices have a negative effect. Especially taking into account the fact that the incomes of rural regions have been decreasing since 2010. Also, urbanization continues to grow and the share of agriculture in India's GDP is decreasing. Therefore, according to the calculations of the World Gold Council, a 1% increase in the price of gold causes a decrease in the demand for gold by 0.4%.

- Government rules. And the third factor is the government's gold policy. Import duties and other taxes affect long-run demand, but the amount varies depending on whether gold is purchased as jewelry or bars and coins.

There are also short-term factors driving the demand for gold in India:

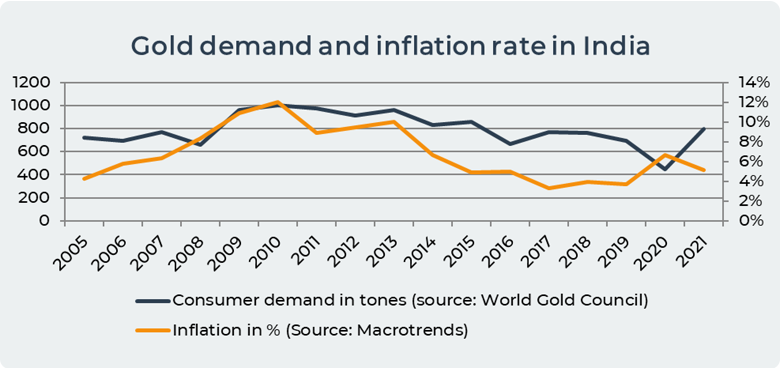

- Inflation. Like investors around the world, Indians are turning to gold as a hedge against inflation. The graph below shows that the demand for gold in India and the inflation rate are correlated by 60%. According to the data of the World Gold Council, a 1% increase in inflation in India causes an increase in the demand for gold in India, which increases by 2.6%.

- Change in the price of gold. The constant rise in the price of gold has an impact on long-term demand. While sharp fluctuations in the price of gold have an impact on the short-term demand for gold. For every 1% fall in the price of gold during the year, demand increases by 1.2%.

- Tax burden. In 2012, the increase in the import duty rate reduced the demand for gold by 1.2% per year.

Other reasons for the demand for gold in India include cultural affinity, ancient traditions and festive gifts still play an important role in Indian life. Among the rural population, ownership of jewelry is greater than in cities. Because in the cities, the residents consider gold bars and coins as a means of investment in the majority, while in the rural areas, gold is also considered as jewelry.

Gold refining market in India

3. Gold Exchanges and Gold Refining Market in India.

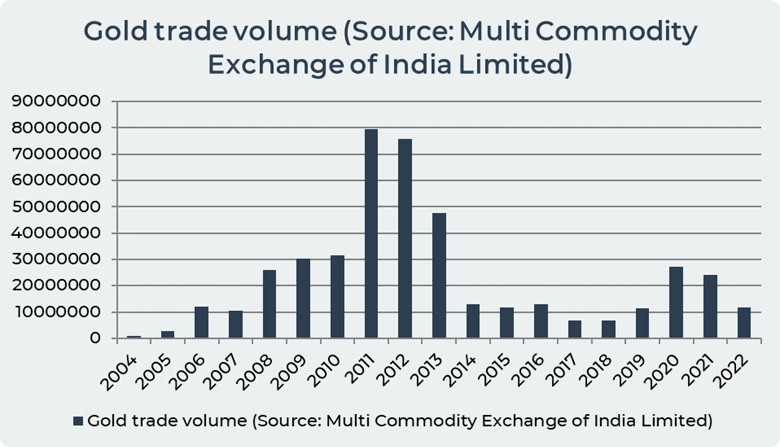

Multi Commodity Exchange of India Limited founded in 2003 located in Mumbai is an electronic futures exchange. Gold and silver were among the first contracts launched on the exchange. MCX is the largest Indian commodity futures exchange accounting for 85% of commodity derivatives in the Indian market.

The graph above shows that the volume of gold trading on the exchange steadily increased and reached its peak in 2011 and 2012. Then there was a sharp drop in the volume of gold trading on the exchange. Since 2017, the volume of trade has started to grow again.

The exchange offers 4 Indian rupee gold futures contracts:

- Gold (1 kg) – minimum 995 purity.

- Gold Mini (100 grams) – minimum 995 purity.

- Gold Guinea (8 grams) – delivered as an 8 gram coin.

- Gold Petal (1 gram) – trading unit 1 gram, minimum delivery as an 8 gram coin.

The prices quoted in Ahmedabad for the Gold and Gold Mini futures contracts are inclusive of import duty and customs taxes, but are exclusive of VAT and other additional charges or local taxes. While Gold Guinea and Gold Petal are listed as ex Mumbai.

For Gold and Gold Mini contracts, delivery takes place in Ahmedabad and Mumbai, as well as Chennai, New Delhi and Hyderabad. For petal and guinea contracts, delivery is possible only to Mumbai, New Delhi and Ahmedabad.

Gold Global is a Deliverable or cash settled contract. This contract differs from others in that its price is determined based on the international price of gold converted into rupees, but does not include import duties, customs taxes and other local taxes. This type of contract is offered as a hedging mechanism for Indian gold industry participants to insure against international price fluctuations and was established in 2015.

3.1 Gold Refining Market in India

Gold processing in India is extremely important because of the high demand for jewelry. The most famous gold refinery is the MMTC-PAMP Refinery. The plant is a joint venture between the Swiss company PAMP and the Indian MMTC. Located in Mewat district of Haryana state. This gold refinery is the only Indian one on the LBMA list. The annual processing capacity of gold is 100 tons per year, and silver is 600 tons per year. Gold bars are produced weighing up to 12.5 kilograms. MMTC-PAMP also manufactures gold sovereign coins in India and is licensed by the Royal Mint with the 'I' mark.

GRajesh Exports – Valcambi Refining is the largest gold refinery in the world with an annual production capacity of 2000 tones per annum. The gold refinery can produce 500 tones of kilobars per year, as well as 400 tones of smaller bars.

There are also smaller gold refineries operating in India. The Association of Gold Refineries and Mints also operates in India, which is a trade organization and represents 17 medium and large Indian gold refineries capable of producing up to 800 tons of gold per year.

Conclusion

India has the most developed gold market in the world. India is constantly competing with China for the lead in gold consumption in the world. Indians have a great love for gold because of the historical relationship with gold. Gold in India has a certain cult that shows the status of people in society. India accounts for up to 20% of global gold demand. Demand is influenced by income, the cost of gold, inflation and government regulation in the gold sector. India has a large exchange where gold is an important part and was the first contract introduced by the exchange. India also has a large gold processing market that is constantly developing. The Indian population continues to prefer physical gold.

Date= 13th September 2022, Gold price – 1741.30$, Silver price – 20.18$, Platinum price – 934.60$, Oil price – 88$

Source: Gold Purchases and Sales in UAE