In this report we study the current condition of platinum as an investment.

We will first study if the current price of platinum can be considered cheap historically.

We will then assess the supply/demand of platinum and its current deficit. We will study the financial condition of the major miners of platinum.

We will finally compare the current platinum condition to the palladium condition, knowing that palladium prices recently surged to all time highs.

Historical price

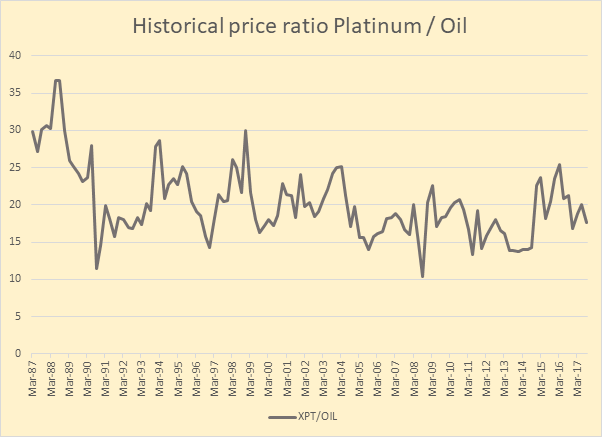

We don’t look at the price of platinum versus currency because the currency has been largely devaluated for decades. We look at the price of platinum in oil: how many oil barrels do we need to buy platinum over the last thirty years

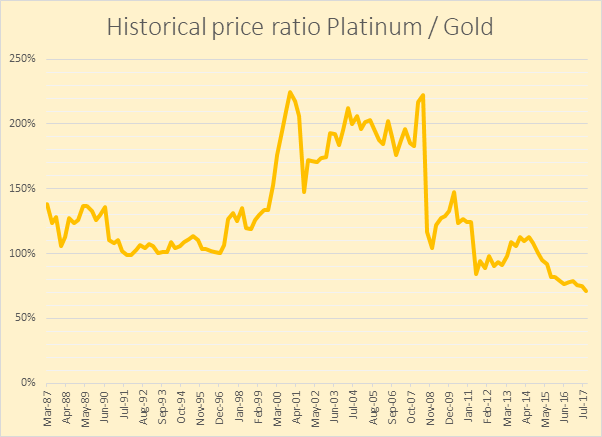

We then look at the ratio Platinum Price / Gold Price.

We can see in the charts below that the current platinum price (920 USD/Oz at the time of the writing) is average. This means that as a commodity platinum is following the general deflationary environment. It does not look like undervalued nor overvalued.

On the other hand, we can see that compared to gold, the current platinum price is at an all-time low. This means that platinum is ignored as a money metal.

Supply/Demand

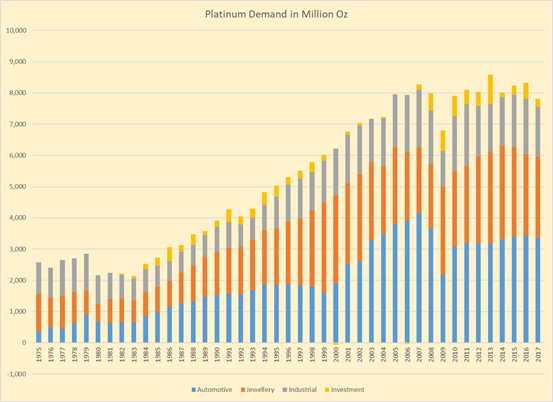

The demand

Platinum demand is used for 64% in industry, 33% in jewellery, and 3% in investment (source: World platinum council). As a comparison, 45% of the gold demand is for investment (source: World gold council)

Platinum is currently considered by the free market as an industrial metal, and is used as a commodity. The use of platinum as an investment product is neglectable. Hence the current divergence of the price of platinum and gold.

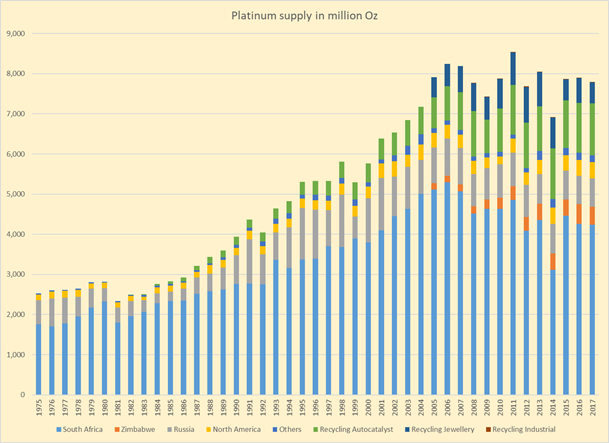

The supply

South Africa is the largest producer of platinum, counting for 71% of the world production, and 54% of the world supply if we add on the recycling. We can say that the production of platinum is largely driven by what is happening in South Africa. For instance, the drop of production of 2014 was due to large strikes in the mining sector in South Africa.

Deficit

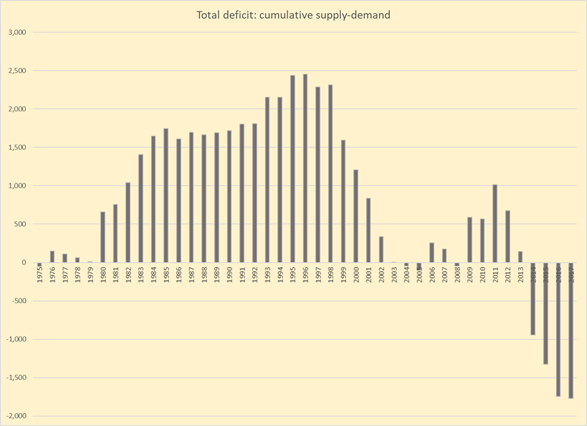

We consider the cumulative difference between the supply and the demand. This is the deficit of platinum. We can see on the chart below that platinum has been running a deficit for several years now. Only around 2011 there was a surplus of platinum due to the fact that platinum prices were much higher than production cost, which boosted the production. With platinum prices back to the production prices, and even lower, the miners are struggling to increase their production.

The cost of production

The average cost of production for platinum for 2015 was 932 USD/Oz (source: Statistica) versus an average price of 1000 USD/Oz for platinum. The data for 2016 have not been published yet at the time of the writing.

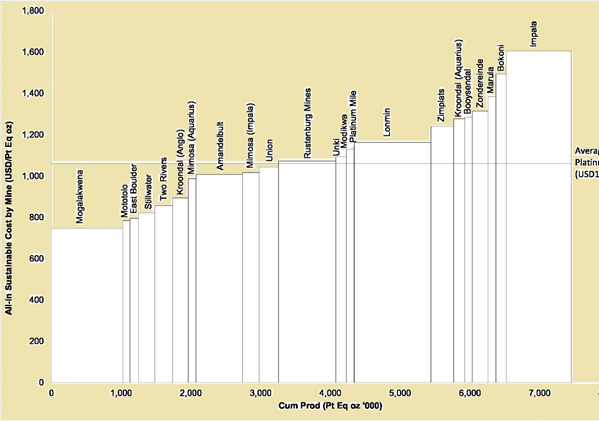

However, considering the average cost of production is deceiving, since only the marginal cost of production defines the final price in a free market: the producer the most likely to reduce its output is the one with the highest production cost, he is the one who is the most likely to impact the global supply.

In the below chart, we can see the cost of production per mine in South Africa which is the largest producer (source: Minxcon). The last producer is the famous mine of Impala with a production cost of 1600 USD/Oz. As long as the price of platinum remains at ~950 USD/Oz, the impala project is losing large amount of money. Producers do whatever they can not to stop an on-going project because it involves a lot of cash to start the project again. This is why the current situation with many non-profitable project is lasting.

Miners don’t develop new projects in such an environment. This lead to a production plateau, and eventually a decrease in production, unless the price of platinum is rising up again significantly

Are the miners bankrupt?

Here we try to assess the production cost of platinum in another way by looking at the profitability of the platinum miners

Who are the largest platinum miners?

Anglo American Platinum (AAP) produces 1.7 mn Oz of platinum, or 33% of the world production

Impala Platinum (IP) produces 1.5 mn Oz of platinum, or 29% of the world production

LonMin produces 0.68 mnOz of platinum, or 13% of the world production

What are their earnings history ?

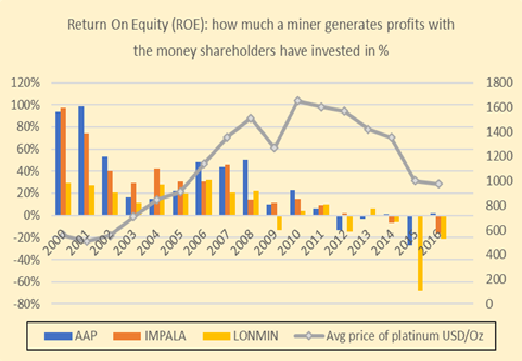

We can see in the chart below that since 2012 those producers have been having big financial difficulties. Even though in 2012 the price of platinum was relatively high, they began to have difficulties with negative return on equities.

In the recent years we saw negative ROE of -20% on all the miners. A negative ROE of 20% means that the company is destroying the shareholder’s capital by 20%. Lonmin had a record ROE of -60% in 2015, almost destroying the whole company. This means Lonmin is almost bankrupt.

All this is in line with the previous chapter about the production cost which is far too high compared to the market price of platinum.

What about the recent situation?

From 2016 to 2017, Anglo American Platinum stock price remained flat. Its last announced result was positive, but the return on equity is still very poor with a PER of 59.

From Sep 2016 to Sep 2017, Impala stock price lost 47%. The last semester Impala announced a loss. A Citigroup analyst commented on the result: “Looking at your situation, your cost base is way too high for the ounces you produce. You need to get your ounces up or your costs down and at this stage there doesn’t seem to be progress on any of these two” (Source: business live)

From Sep 2016 to Sep 2017, Lonmin stock price lost 65%! They announced a loss in the last semester. The company has 33,000 employees and is running at loss. A Bernstein analyst wrote “I don’t think Lonmin as a company will exist in a year’s time. It’s hard to see why the correct response to an oversupply in the platinum market is a desire to expand production” (source: the telegraph). Indeed the management announced that they were willing to increase the production even though their cost of production is above the selling price.

Lessons learnt from Palladium

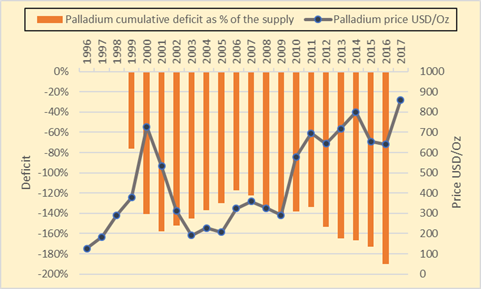

We will now compare the palladium situation to the platinum situation in order to try to forecast what will happen to platinum. The idea is that palladium is in an advance stage of production deficit compared to platinum, hence if things continue the way they currently are, platinum should end up like palladium

Palladium supply/demand deficit versus price

In the chart below, we see the historical cumulative deficit of palladium versus the price of palladium

After 2000 the market price of palladium dropped sharply anticipating the reduction of the deficit which happened between 2002 and 2006. The deficit contracted by 40% and the price declined by 60%.

Then the price of palladium jumped sharply again in 2010 anticipating the increase of deficit which happened from 2012 up to now. This deficit was increased by 50% of the yearly supply, and the price rose 300%.

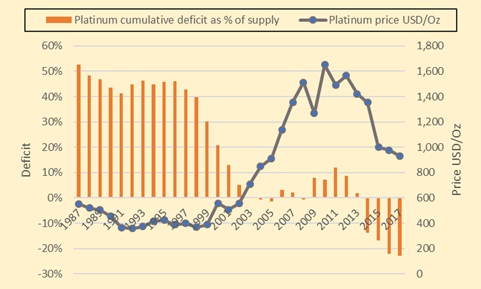

Platinum supply/demand deficit versus price

We see in the chart below that the increase of the price of platinum from 2000 to 2008 (300%) was in line with the increase of deficit (40%)

However, we see that the current deficit which started in 2014 up to now, and accounts for 20% of the yearly supply had no effect on the price. The price dropped sharply instead of rising. This shows there are very strong deflationary forces for platinum.

If this deficit was to continue and to reach 40% of the yearly supply, looking at what happened on palladium, and looking at what happened to platinum from 2000 to 2008, the price of platinum should rise drastically

Conclusion

Platinum has the cheapest price versus gold in 30 years. This is mainly because only 3% of platinum supply goes to investment, against 45% for gold.

The marginal production cost for platinum is around 1600 USD/Oz versus a current price at 920 USD/Oz. Miners have had big financial difficulties since 2012, some of them are almost bankrupt.

Platinum is in a deficit since 2014, the cumulative deficit accounts to 20% of the yearly supply. If it were to reach 40% of the yearly supply, the price should be affected as History shows it happened for platinum in 2002 and for palladium recently

Platinum is running on deficit; its marginal production cost is much above its current price. If the investment demand was to rise for platinum at the same level as gold, there would certainly be shortage of platinum, leading to much higher prices