The Central Bank of Russia announced that from March 28, it will buy temporary gold from Russian banks at a fixed price of 5000 rubles/gram. What did they propose exactly?

Introduction

As a result of the sanctions, Russia has introduced countermeasures to protect its economy. In the gold sector, the Russian government announced on March 23rd that it would buy gold at 5000 Rubles/gram.

The goal of this article is to understand the details of this measure, and its consequences.

Russia is Offering a Put Option on Gold to its Miners

The Central Bank of Russia announced that from March 28 to June 30, 2022, it will buy gold from Russian banks at a fixed price of 5000 rubles per gram.

This offer is only for local miners and for Russian banks which have been banned from the LBMA in London and COMEX in New York.

This measure means that Russia will offer a put option to its miners. Russia will be there to buy all the gold production at 5000 rubles per gram.

The official explanation is to support the Russian gold market through purchases by the Central Bank. It will allow Russian mining companies to continue production and ensure a stable sale of mined gold, despite sanctions.

Indeed, in the mining industry, stopping production is a non-return. When a miner stops production in a mine, he needs to sell his trucks, to fire his workers, and to give back all his infrastructure. If a miner is forced into closure, he cannot resume production right away when the times are good. He would need at least one or two years to set up the mine again into production.

This measure shows that the Russian government takes very highly the production of gold, and wants to prevent at all cost the closure of its mines. Russia is offering a free put option to its miners in order to be sure that gold will be produced in Russia.

What is the Value of this Put Option in US$?

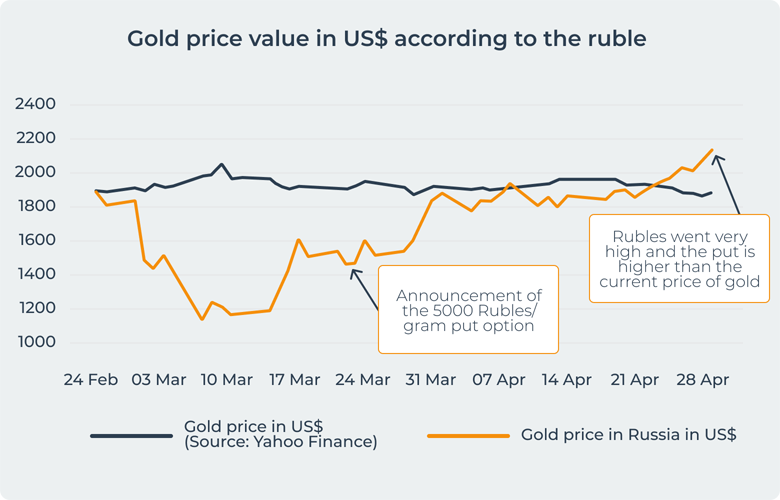

The costs of the miners are in rubles, but the price of gold is still in US$. Hence, the put option at 5000 rubles/gram is varying a lot in US$.

At the time of the announcement, the value of the put was 1,469 US$/Oz, compared to a price of 1936 US$/Oz at that date. It was a protection, but not that generous.

However, the ruble has been extremely volatile due to the war, and so has been the strike of this put option.

The ruble which was stable at 76 (1 US$ = 76 rubles) before the war, went first down to 150 after the sanctions (1 US$ = 150 rubles). After this peak, it came back gradually due to two major effects:

- The Russian Central Bank raised its interest rate to 20% (it was at 8% before the war, it is 15% now);

- The West continued to buy oil and gas from Russia, and the prices of those goods went ballistic.

As a consequence, the ruble went up a lot. It is currently at 67 (1 US$ = 67), higher by 13% to its pre-war level.

Hence, the price of the put option offered to the Russian miners went to the roof as shown in the chart below. It stands now at 2200 US$/Oz whereas the price of gold is at 1883 US$/Oz. This is 16% higher.

Conclusion

The Russian government identified its gold mining industry as a strategic sector, and chose to support it with a temporary free put option. This is not surprising since Russia had sold all its US$ and replaced it by gold before the war. What is interesting, is that Russia has identified the gold mining industry as a strategic sector at times of war.

Due to the incredible rise of the ruble versus the US$, this put option turns into a gift to the Russian gold mining industry. It is not sure that the Russian government will extend this support if the ruble continues to be that strong.