In this updated report, we will study the current condition of physical platinum as an investment. Why the current platinum price is so low ?

In this updated report, we will study the current condition of platinum as an investment.We will first study why the current platinum price is historically low.

We will then assess the supply/demand of platinum and its current deficit. We will study the cost of production and finally the financial situation of the major miners of platinum.

Historical perspective

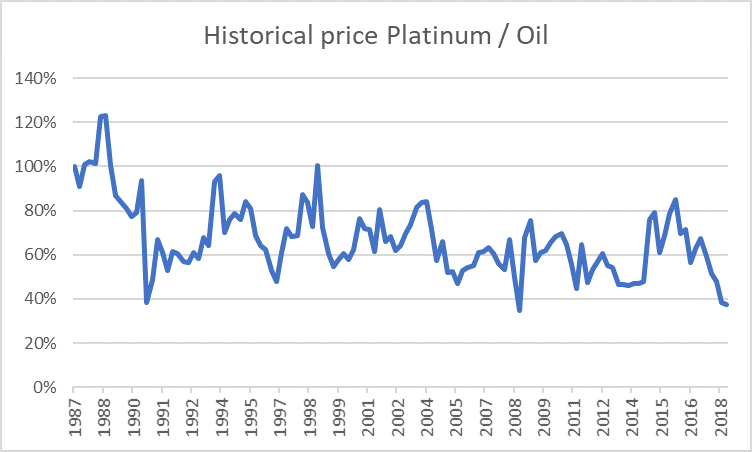

With a price of 850$/Oz and a Brent at 80$/barrel, platinum has reached its lowest price in 30 years.

The chart below shows the value of platinum divided by the value of oil. Since oil is the base of our economy, since mining platinum uses a lot of oil, and since the currencies have been highly inflated for thirty years, it makes more sense to express the price of platinum in terms of number of oil barrels it can buy.

We can see in the chart below that platinum has reached its low level of 2008, during the so-called Lehman crisis.

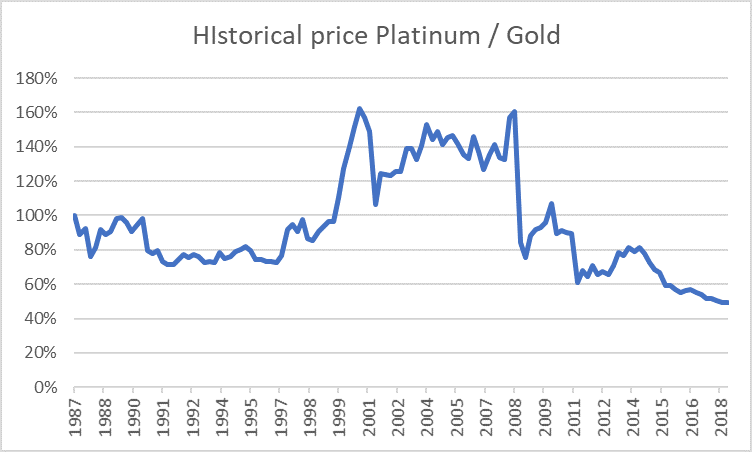

Now, comparing the price of platinum to the price of gold (see chart below), we find also that platinum is at its lowest levels for the past thirty years.

We will see later in this study the reasons for such a price depression. The main reason for the decorrelation between platinum and gold is that 50% of the purchase of gold is for investment, whereas it is only 2% for platinum.

Why is the price of platinum so much depressed?

Does the current situation justify a price of platinum to be at its lowest for the past 30 years?

To answer those questions will study the supply/demand situation. Then we will assess the sustainability of the mining company in such an environment.

Supply and Demand

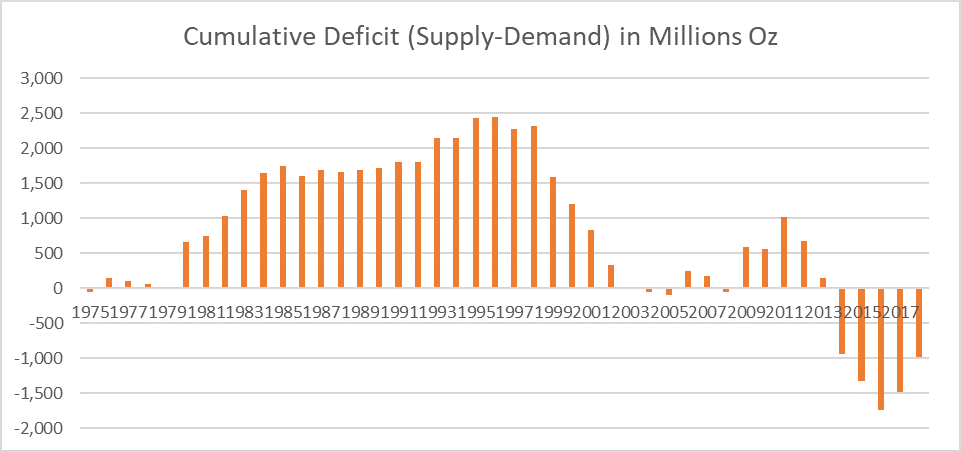

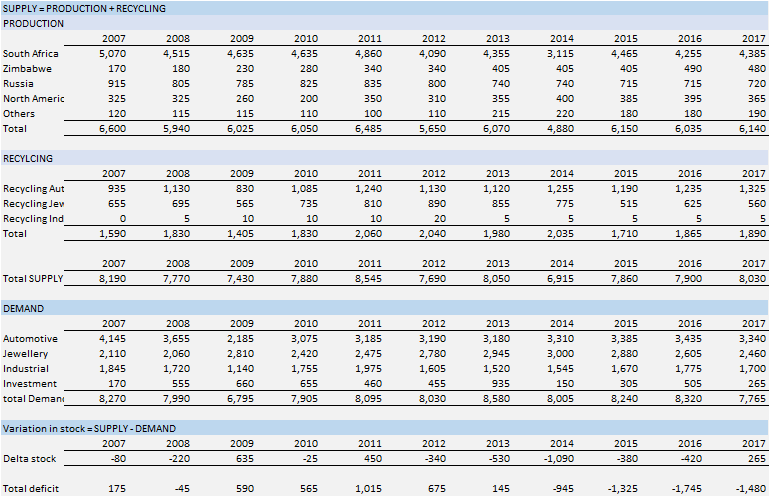

The first striking thing about supply and demand of platinum is the cumulative deficit in which the metal entered in 2014, mainly due to big strikes in South Africa around that year. Since then, the deficit has widened slowly.

Deficit is the difference between the Supply (mining production + recycling) minus the demand (Industrial + jewellery + investment). A widening deficit means that the production has decreased or the demand has increased.

In 2017, the deficit has lowered significantly. It is interesting to note that it is not due to a decrease of automobile demand, but to a collapse of the investment demand.

One may hear in the media and from analysts that due to environmental regulations, the production of vehicles using diesel engines will decrease, and thus the demand for platinum. Indeed, platinum use for automotive is mainly on the catalysts of diesel engines. If the automotive market moves towards only gasoline engines, the demand for platinum would collapse. Yet this is not what we are seeing. China has still an increase in its production of diesel cars and trucks.

The investment demand for platinum has for its part largely collapse. The value of the deficit for the year 2017 can be explain only by the reduction of the investment demand.

In 2018, the forecast is to have another big decrease of the investment demand, to reach almost zero.

This lack of interest for platinum is due to the fact that the metal is still subject to VAT (or GST) in many countries where gold is not taxed at all. We can quote for instance most of European countries where VAT for gold is 0% and VAT for platinum goes from 7% to more than 20% in certain countries. Hence platinum has always been largely disregarded as a precious metal for investment. But, if there is a rally into precious metal, if the fiat currency system were to tremble, investors would certainly rush into platinum since there will not be enough gold for everybody. And the market of platinum is so thin (the amount of available platinum is 10 times less than gold) that if you add a big investment demand to the fragile balance of supply/demand, you would enter a huge deficit.

What about the cost of production?

The cost of production of platinum has increased by 15% in 2017. This is not just in South Africa. This is all over the world, due to higher prices of oil and water, due to inflation of labour cost.

The cost in South Africa is around 1100 $ / Oz. At that level, miners don’t make money on platinum. This is an average. the marginal cost of platinum is more around 1,650 $/ Oz.

At the current level of 850 $ / Oz, more than half of the mining production is not profitable. The current price of platinum is 25% under the average cost of production and 50% under the marginal cost of production. Miners would make more money buying platinum bars than producing them.

So why the production does not drop drastically, would you ask? Because it is a huge investment to re-start a mine. If a miner had to stop a mine, he would have to let go a lot of employees, stop paying licences, etc. He would have to pay penalties over the equipment he is renting, or worse, he would have to pass as a loss the equipment he has bought. Resuming the mine would be a huge financial investment again. Therefore, all miners do all what they can not to stop the production.

You can add the social issue as well, where governments don’t want to see thousands of employees going unemployed, and you understand why miners continue to produce even at loss.

Even if the miners continue to produce, they decreased drastically the investments in new projects. Sooner or later, it will have an impact on the production of platinum. Moreover, if the demand were to increase, the supply would take years to catch up and restart again.

What about the miners?

As you can see in the table below, South Africa and Zimbabwe count for 78% of the world production. Three big miners share this production:

| Company | Production 2016 of platinum in Oz | Production 2017 of platinum in Oz |

| Anglo American Platinum | 1,688,400 | 2,511,900 |

| Impala Platinum | 1,524,500 | 1,468,100 |

| Lonmin Plc | 668,704 | 649,100 |

Impala has a joint venture with the state company in Zimbabwe to mine the platinum there. All three miners are representative of South Africa and Zimbabwe.

We will focus only on those three miners, who count for 74% of the world production. Understanding those 3 miners is understand the mining world of platinum.

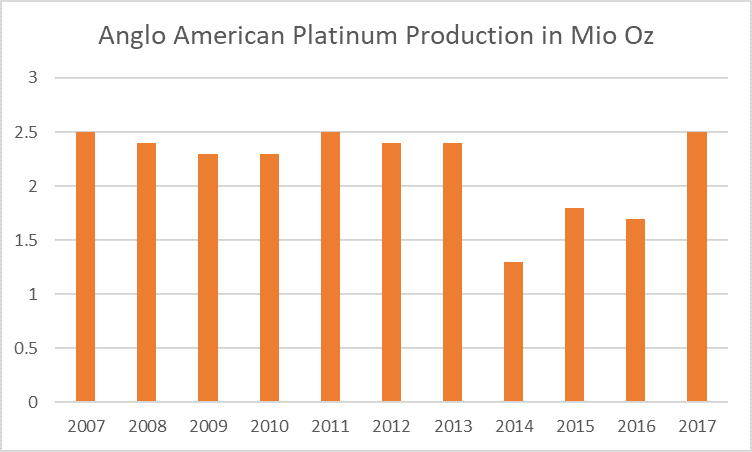

We notice that Anglo American Platinum is the only one to have increased its production in 2017. If we look at it more closely, we realize that this increase is only a recover to the time before the big strikes of 2014. It is not due to new projects.

The financial situation of the miners

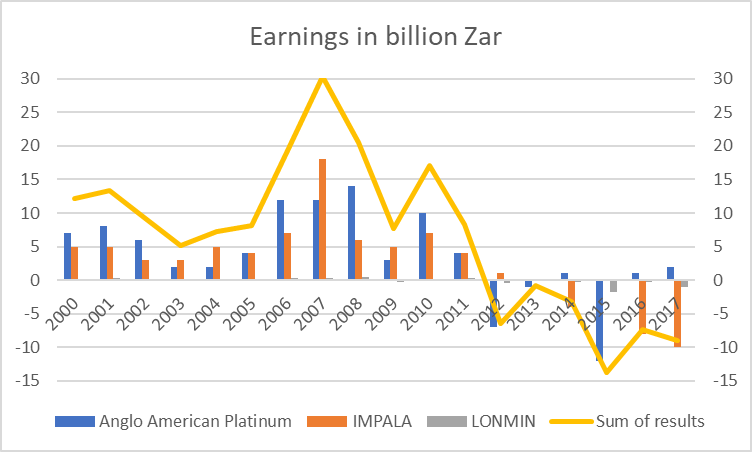

In the chart below, we can see the result in billion Zar (the currency of South Africa) of the three miners. In 2017, Anglo American is earning 2 billion Zar, Impala is losing 10 bn Zar, and Lonmin is losing 1 bn Zar.

We should note that Anglo American Platinum is less exposed to platinum than the two others. It has a large production of palladium. Considering that palladium trades at ~1080 $/oz, 25% above platinum, this metal is a large part of the profit of the company. Unfortunately, we cannot allocate the profit to either metal, since mines are producing both.

On the other hand, Lonmin and especially Impala are specialized in platinum production.

It is also very interesting to note that

the sum of the profit of all three companies has been negative for 6 years now since 2012. Even if one or the other is making money on a specific year, the total of the three companies is losing money consistently. It has been six years that the sector destroys capital. How long more can it last? It is already longer than the usual cycle. Because miners don’t want to close operations, they tend to support losses, waiting for the good days to come back. But in the past, this lasted three years maximum before either a rise of the commodity, or a bankruptcy of the miner. We are now at six years, and the losses are consistent every year, as shown in the chart below:

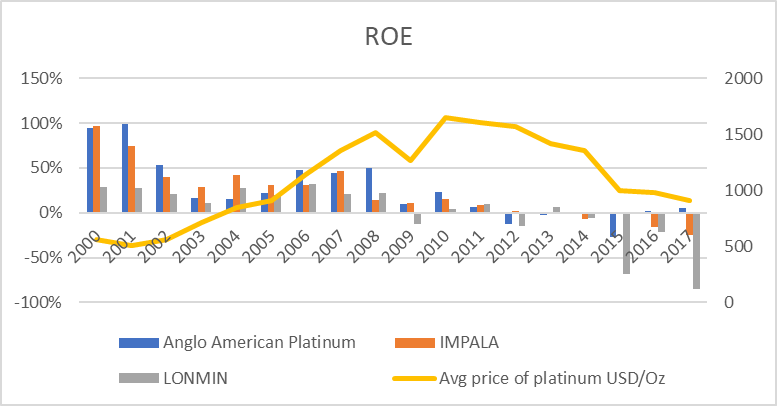

The return on equity (ROE) of those companies is also impressive. In 2017, Lonmin had a ROE of -85%!

This means that in 2017 alone, Lonmin destroyed 85% of the capital of the shareholders.

Impala had a ROE of -25%, which is also astronomically bad for shareholder.

Only Anglo American Platinum had a ROE of +5%. But remember that this company is not producing only platinum.

It is fair to state that the platinum mining sector is on the verge of collapse and is only supported by shareholders losing money or by governments printing money to keep fuelling the loss so they don’t have a big unemployment problem and civil riots.

Conclusion

The price of platinum is at its lowest ever in 30 years. It is under production cost significantly, and many miners lose money.

The metal has discouraged many investors, if not all. This is an option to have the price rise sharply if investors would come back.

Miners have been losing money for six years now as a whole. They are destroying shareholder value every year.

The supply/demand balance is so thin that if the production would fall, or if investors would come back, the price of platinum would certainly go up.

Additionally, with rising cost of production of 15% yearly, we hardly see how platinum could go any lower.

Posted by: GOLD&SILVER