Following the discovery of Gold Bars stamped with counterfeit major refinery logos in JP Morgan Chase vaults last August, how to trust in Banks now?

A bank with fake gold… Doesn’t it sound like a bank with…fake money!?! Unbelievable, isn’t it? Who can we trust if the bank itself issues fake money!

However, this is the last revelation that is shaking the financial sector this September. And if we use the word “shaking” it’s not for the importance of the fraud (some central banks in Africa already tried to sell fake gold bars to their clients) but because this fraud comes from a top world-class leading bank: JP Morgan

Besides some market manipulation in the precious metal trading or the fact that usually the same single gold bar can be sold to dozens of clients at the same time (certificates..), now banks have also the nerve to sell fake gold to customers!..

Fake gold does not only refer to gold bars with tungsten or other cheaper metal blocks plated with gold. Fake bars refer also to bars with 99.99% pure gold but from unknown origin (drugs, prostitution, warlords….) and labeled with a counterfeits well-known refinery brand.

But where is the problem. Some might think: “It’s a fake brand, but the gold is real, and gold is gold”.

Despite the ethical consideration since this gold may come from prostitution or drug activities there is another issue impacting directly the investor return.

Indeed, the official precious metal market is mainly regulated by the LBMA institutions which include the most reputable refineries. The ingots produced by these refineries are certified for the international market. Thus, if your bars are identified as fake branded, you would not be able to access the market in order to sell them back. So, as an investor (individual or institutions) you may face a considerable loss in your investment.

Lack of Control

Then the next question is how banks could end up with counterfeit gold…? One of the answers are the number of intermediaries and the non-respect of the so important “chain of integrity”.

Basically, banks or other financial institutions can buy gold from different intermediaries ( brokers, second hand gold market…) based on the well-known brands but without being sure of the origin and purity of the gold bars.

This is why the world gold authority, LBMA, has implemented a process to track gold bullion life from its origin. Most of the banks and bullion dealers do not fully respect this process and many fake bullions can enter in their inventories to be sold to clients.

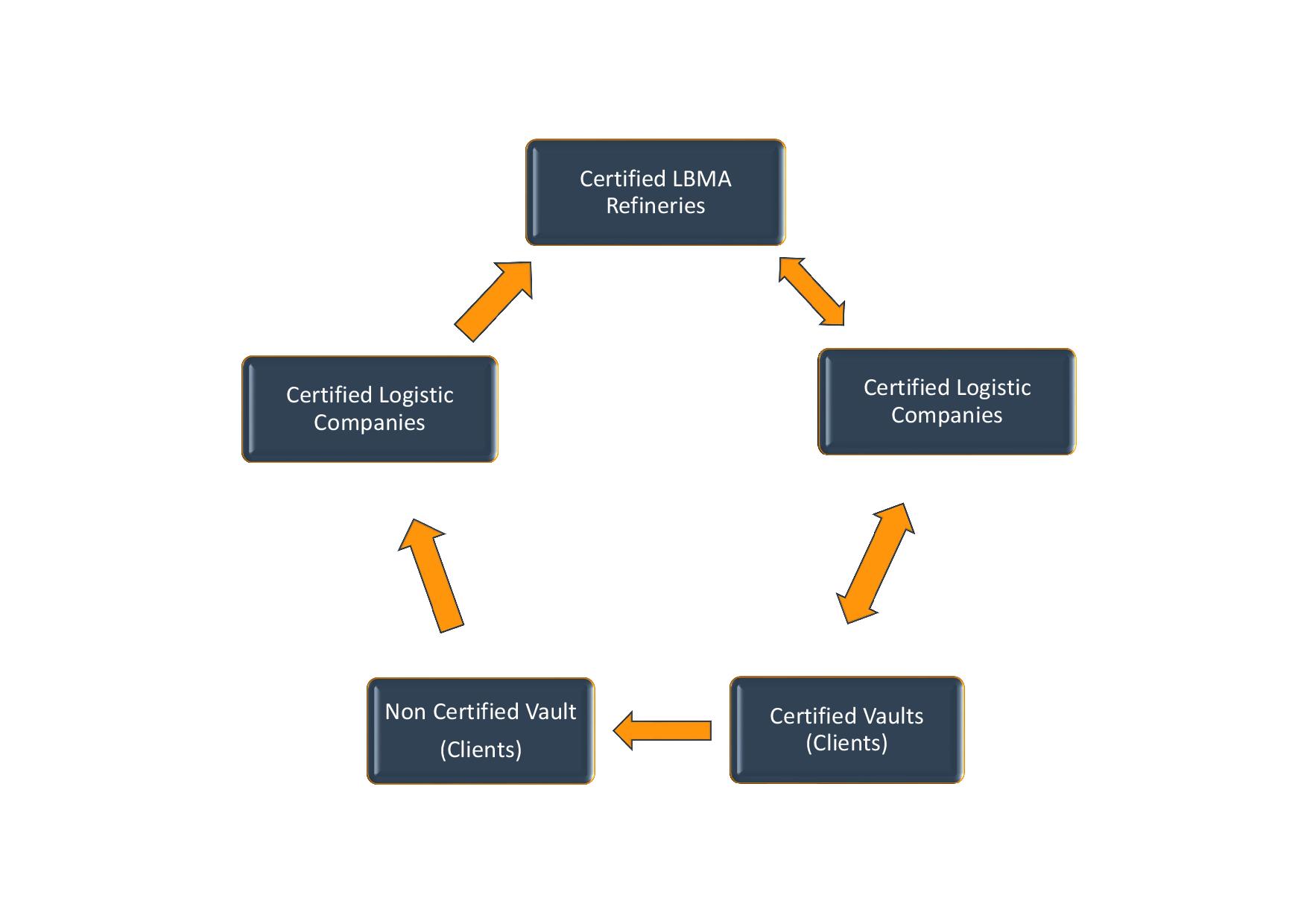

Respecting Schema of Chain of Integrity Process

The bullion are not leaving the certified vault. The clients store and keep allocated ownership directly in the vault with direct access to its ingots.

When the bars are leaving the chain of integrity they are sold back to LBMA refineries to approve the origin, test the purity and smelt new bars to sell to clients.

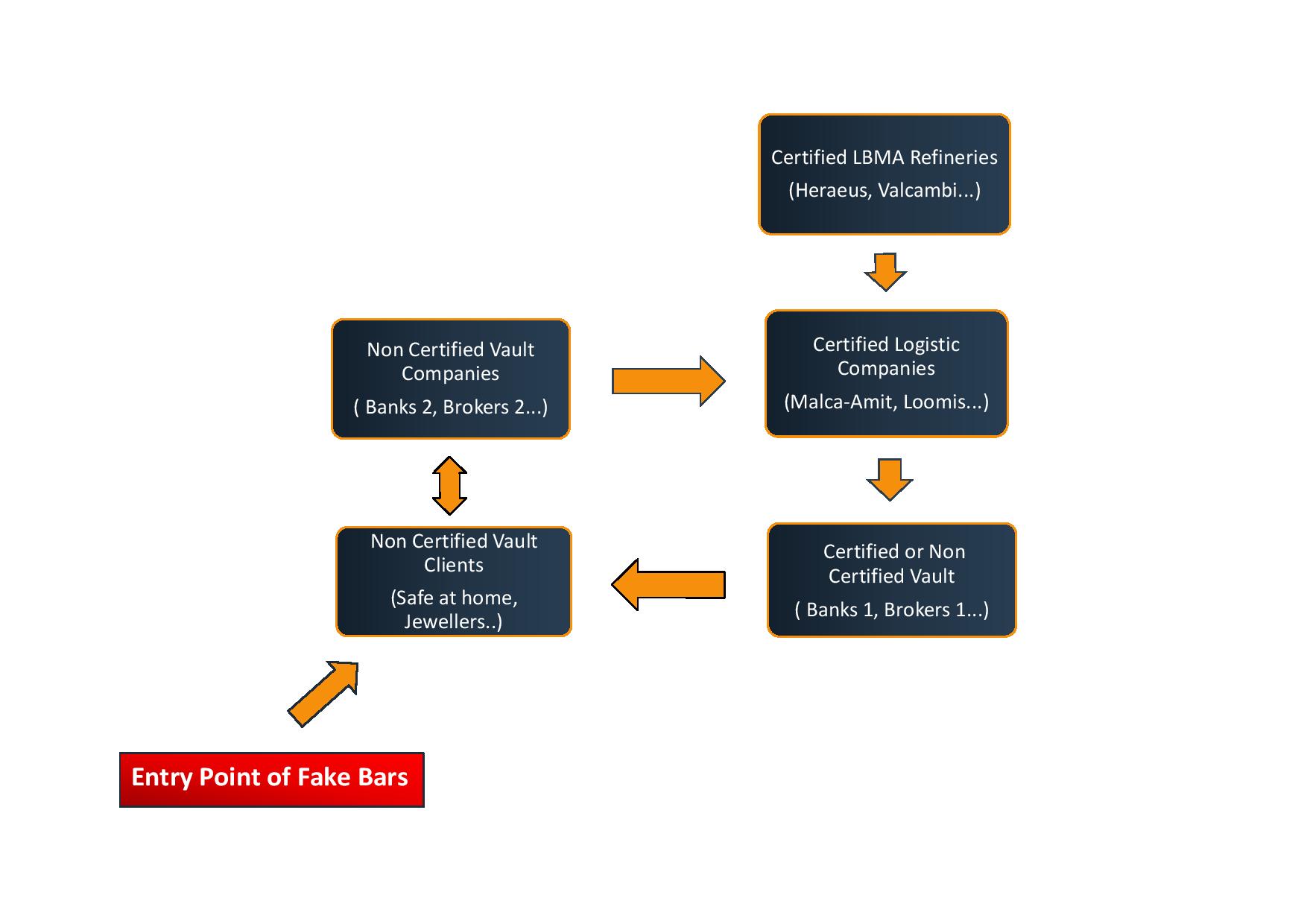

Usual Schema of Gold

The bars are leaving the chain of integrity when it is sold to clients (individual, jewelers...).

The bars are leaving the chain of integrity and a proper check is not always done when a financial institution or brokers are buying back client gold bars. So fake bullion may enter in the market.

Bunker Gold&Silver Solution

In order to avoid this problem of fake bars, Bunker Gold&Silver, set up an investment platform respecting the chain of integrity procedure. So, the customer can buy/sell allocated physical gold bars that is sourced directly from the LBMA refineries. The gold ingots are directly delivered by one of the fourth-world certified logistics companies, from the refinery to clients ownership, without any intermediaries between them.

Clients can decide to stock the bars at home.

So when they sell it back to Bunker Gold&Silver, the latter will send back the bars to the refinery in order to test the purity and make new bars. Then, Bunker Gold&Silver will take the new bars. In that way, the Bunker can be sure that only fresh bars are sold to clients with a 99.99% purity.

In summary, respecting the chain of integrity process is today the only key to ensure the origin, integrity, international fungibility and competitiveness of the physical gold bar.

Source: Bunker Gold&Silver