To begin year 2020, here's a reminder to buy investment gold efficiently and wisely. 8 tips to buy gold the best way.

In order to start the New Year on the best note investment-wise, here are some a reminders to make your purchase as effective as possible.

These tips apply even if you only start with a small amount, let’s say USD 5000 (around 100g of gold at current price).

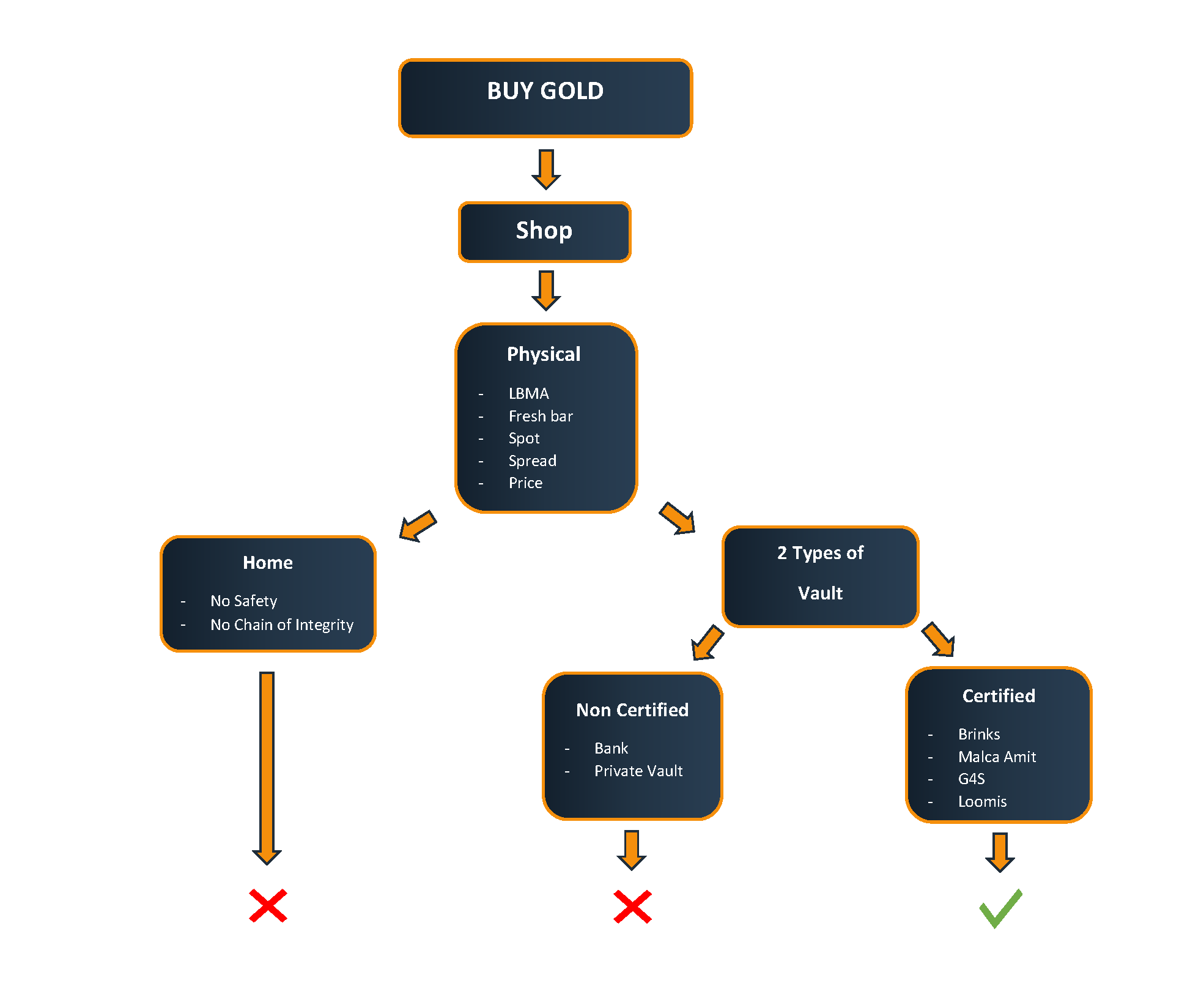

For gold purchase in physical shop

1. Try to Buy LBMA Gold Bars

The world leading authority in regulating the precious metals market is the London Bullion Market Association (LBMA). This organization certifies the most serious and diligent gold refineries in the world. Buying bars from LBMA-certified refineries mainly ensures the quality, purity and fungibility of the gold bars. Thus, you will be able to sell the bars on the international market easier than ones purchased from a non-certified refinery.

2. Try to Buy Fresh Gold Bars

Fresh bars are new and come directly from the refinery to you the customer. They are not pre-owned. Often, bullion dealers/banks buy bullion from non-certified sellers (e.g. individuals, traders.) and re-sell these bars to new clients without conducting a proper purity test (e.g. smelting). You should avoid buying such gold bars as the risk of counterfeit is higher. Although it is difficult to determine the freshness of gold bars, you can clarify with the bullion dealer if the bar has undergone the chain of integrity process.

3. Try to Check the Spot Price

Sometimes the price you see in the shop is not the real one. The real price called spot price is the current live market price for a product. Each has its specific name: XAUUSD for Gold, XAGUSD for Silver and XPTUSD for Platinum.Here are some websites that provide close spot prices for precious metals: - Oanda

- INTERACTIVE Brokers

- XE.com

4. Try to Ask for the Spread

The spread is the gap between the price that your bullion dealer will buy (back) the gold from you and the price he is selling the gold to you. It can give you an idea of the real margin made by your bullion dealer and give you a better negotiation leverage.5. Try NOT to Buy at More than 0.7%

If you are investing more than USD 5000 (around 100g of gold at current merket price), do not pay more than 0.7% of the price. So, check the market price of your bar and if the bullion dealer is selling it with a margin above 0.7%, you should look for another bullion dealer.For physical gold purchase in online shop

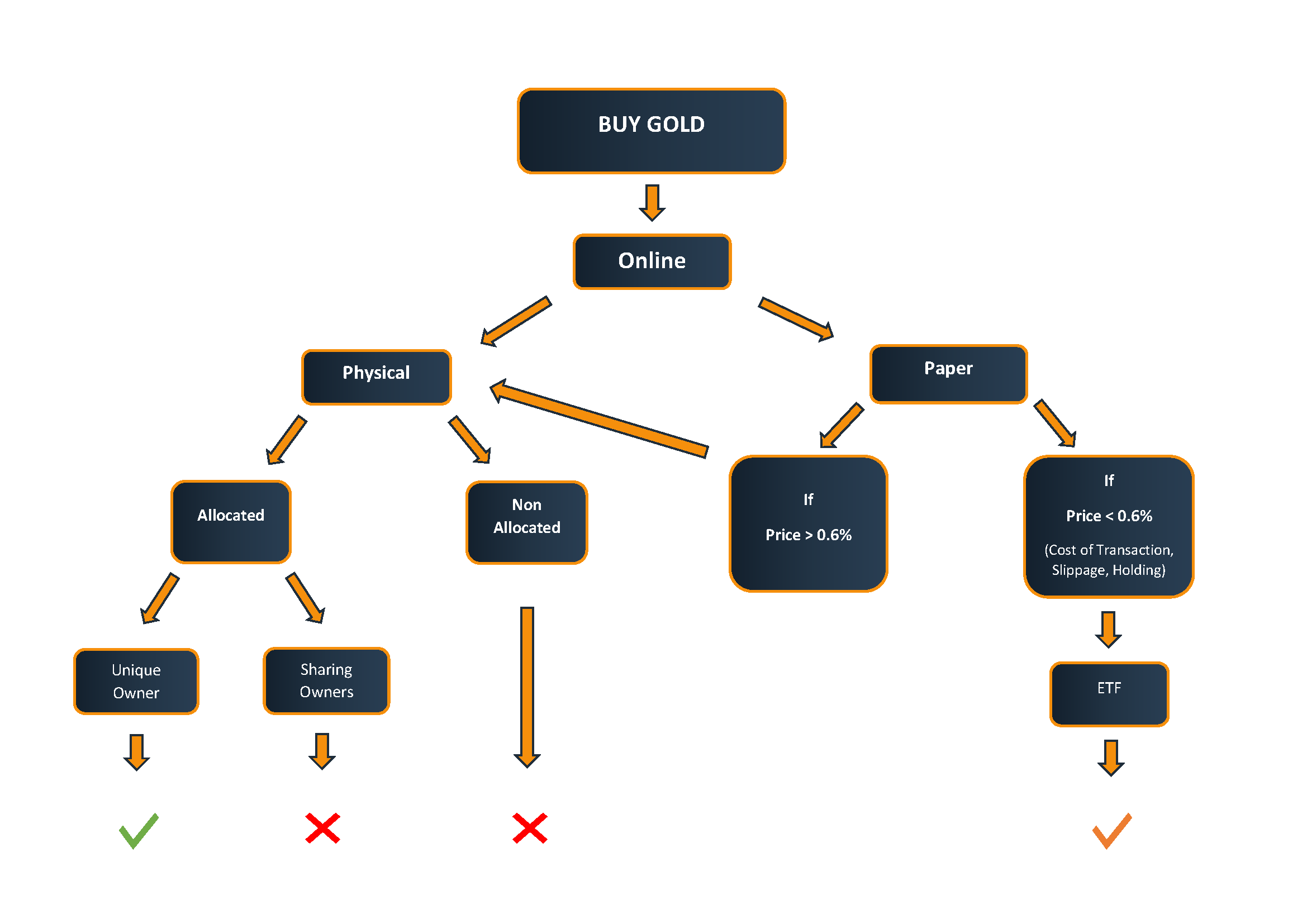

If you go to an online shop, the tips for a physical purchase still apply, in addition to the following points:

If you go to an online shop, the tips for a physical purchase still apply, in addition to the following points:

6. Try to Choose Allocated Bars

Allocated bars render you full ownership of the bars bought, whereas an investment in unallocated bars serves as a credit for the bullion dealer backed by its gold reserve. But the gold bar itself does not directly belong to you.7. Try to Choose Full Bar Ownership

Sometimes you can possess direct ownership of allocated bars, but you are not the sole owner. For example, a 12kg bar can have 12 customers owning each kilogram of the bar. So, the gold bar is allocated but you may not physically collect the bullion as you are not the sole owner of the bar.8. Try to Choose LBMA Certified Vault

Outside of the banking system, there are four LBMA-certified vault companies in the world: Malca-Amit, Loomis, G4S and Brinks. Check if your bullion dealer is working with one of them to store your physical gold. Also:For those buying ETF or other Paper Gold…

If you invest in gold through an ETF (see orange tick in the diagram above), you don’t actually own the precious metal. You have no claim on the gold within the fund. This means that you cannot take delivery of the metal if the need arises.

Nowadays, you can buy allocated physical gold, including storage cost, at the same conditions as ETF (e.g. total price, liquidity) with a redeemable ingot as collateral. So, if you think about buying an ETF, buy physical gold instead: you have the same advantages as the ETF plus the real asset.

Here is the expense ratio or cost of holding for some major precious metals ETF (These fees do not include the transactional fee and general commission of the broker) :

- SDR gold: +0.4%- Ishares silver: 0.50%

- Aberdeen Platinum: 0.6%

More details about the cost of holding :

ETF Cost of Holding

However you can face some problems like the failure to get your gold bullion:

Deutsche Bank Refuses Delivery of Physical Gold Upon Demand

For those who want to store in a Financial Institution:

Sometimes you might think of banks to buy/store your precious metals. However, here are some reasons why you should avoid it:

1- The Gold Ingot Disappear and the Bank is Not Responsible

2- The Banks do Not Want to Give the Gold

Source: Bunker Gold&Silver