Historically, what pushed the FED to lower its key rates?

What Is Causing The FED To Cut Its Rate?

The Federal Reserve of the US has increased dramatically its key interest rate. The question now is what event will trigger them to lower the rates back to zero? The goal of the article is to study in the History, what made the FED lower its key rate.

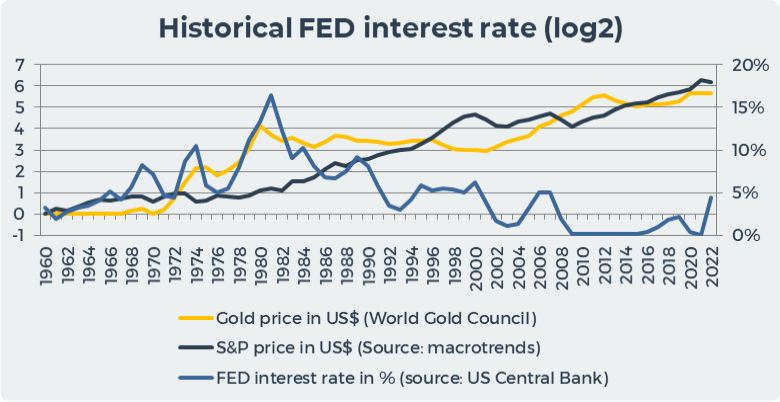

In the first chapter, we will show that there is an uncertain relationship between Fed rates and the value of gold and S&P 500.

In the second chapter, we will show the periods when the Fed lowered its rates.

In the third chapter, we will show that stock market isn’t the main reason for decreasing interest rate. Fed is historically more influenced by the credit liquidity conditions and by the housing market.

1. The Impact of Key FED Rates on the Gold Market and the Stock Market is Uncertain

According to the Federal Reserve System, the key rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The graph above shows that there is a vague relationship between Federal Reserve rates and the gold market and the stock market. The Fed rate shows a negative correlation of -50% to gold and -55% to the stock market. But there is a high correlation between the price of gold and the S&P 500 by 86%, which means that when the stock price falls, investors start investing in gold and vice versa.

There is an opinion that higher interest rates lead to a fall in gold due to increased competition from high-yielding investments. However, we can see that there is no clear connection. For example, during the 1970s, Fed rates rose along with gold prices. In the 1980s there was a decrease in interest rates and a bear market in gold.

This influence is due to the fact that trading in the gold market is carried out globally and there are forces influencing the gold market beyond the reach of the Federal Reserve System, such as gold demand and supply in long term prospects.

2. Periods of FED Interest Rate Cuts

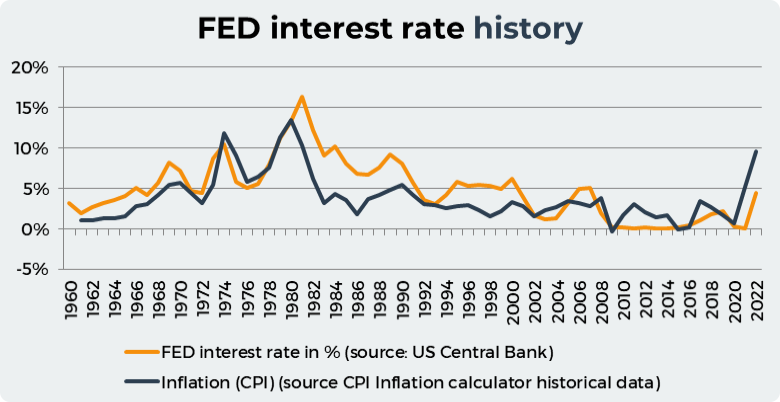

The graph below shows several periods when the Federal Reserve sharply lowered its rates.

The first period of sharp rate cuts occurred in 1974-1976 when Nixon tried to control inflation without raising the unemployment rate. These controls only temporarily slowed price growth, while exacerbating shortages, especially for food and energy. After the Ford administration declared inflation "enemy number one", the president in 1974 introduced the Whip Inflation Now (WIN) program, which consisted of voluntary measures to encourage greater thrift. Interest rates decreased from 11% to 5%.

In 1981, the economy entered a recession that lasted until November 1982. Unemployment reached 11%, but inflation continued to decline and fell below 5%. Unemployment subsequently declined and the economy entered a period of sustained growth and stability. Interest rates decreased from 16% to 9%.

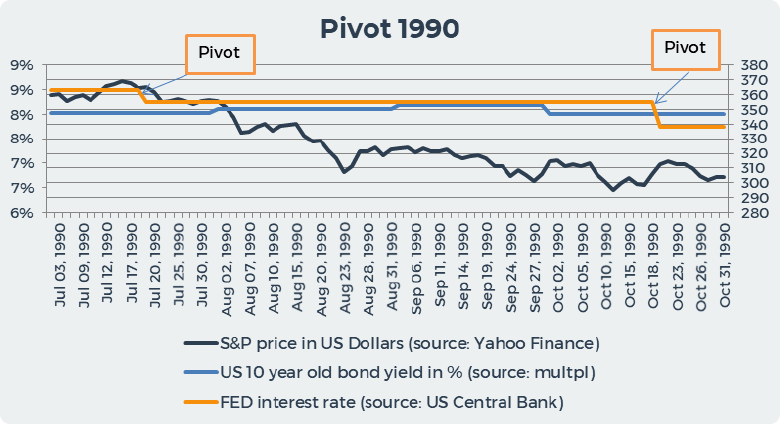

In 1990, the US entered a recession that lasted for 8 months until March 1991. The post-Gulf War recession lasted from July 1990 to March 1991, but it took some time for households to recover. The unemployment rate jumped to 7.8% in 1992. Interest rates decreased from 9% to 4%.

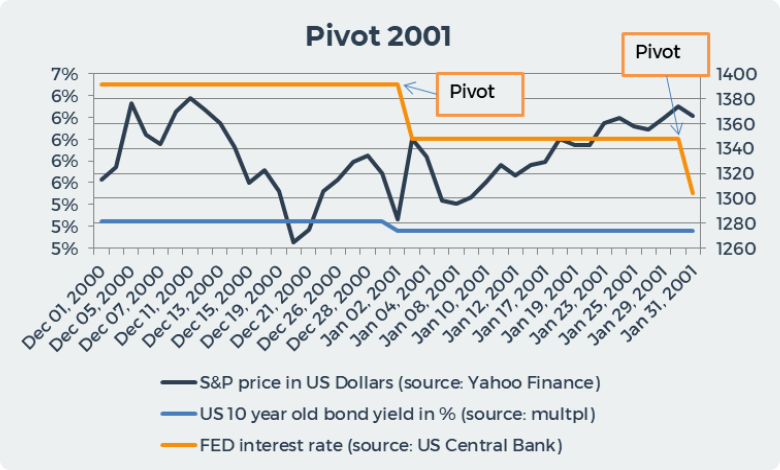

In the period 2001-2003, rates decreased from 4% to 1%. The Dot-Com Bust and 9/11. Huge sums of money poured into increasingly less viable dot-com investments, leading to the inevitable stock market crash. The stock market crash had an impact on the real economy, causing GDP to decline and unemployment to rise, as well as an eight-month recession. The terrorist attacks of September 11 only exacerbated the problems in the economy.

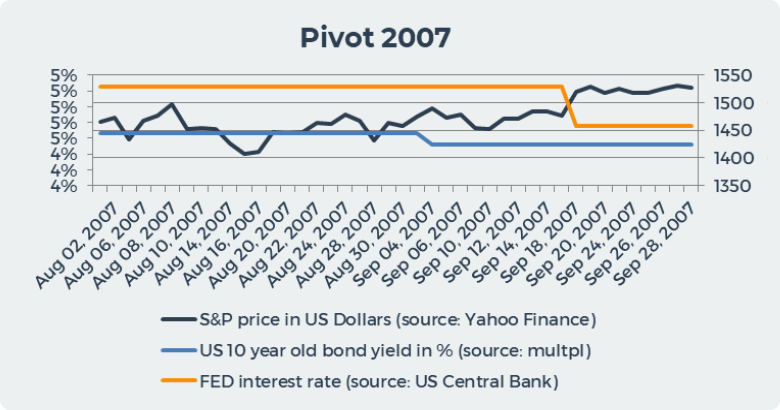

Period 2007-2009. The Housing Market Crash and The Great Recession. In early 2007, the real estate bubble burst and the unemployment rate began to rise from 5% in December 2007 to 10% by October 2009. The Fed began to cut rates due to the worsening economy. The Great Recession officially began in December 2007 and lasted until June 2009. But the Fed suspended rate cuts between April 2008 and October 2008 as the global financial crisis deepened. Therefore, the Fed began to implement a new type of monetary policy known as “Effectively zero”. A zero interest rate policy is when a central bank sets its target short-term interest rate at or close to 0%. Unable to cut rates any further, the Fed began buying trillions of dollars in bonds to stimulate the economy and put Americans back to work.

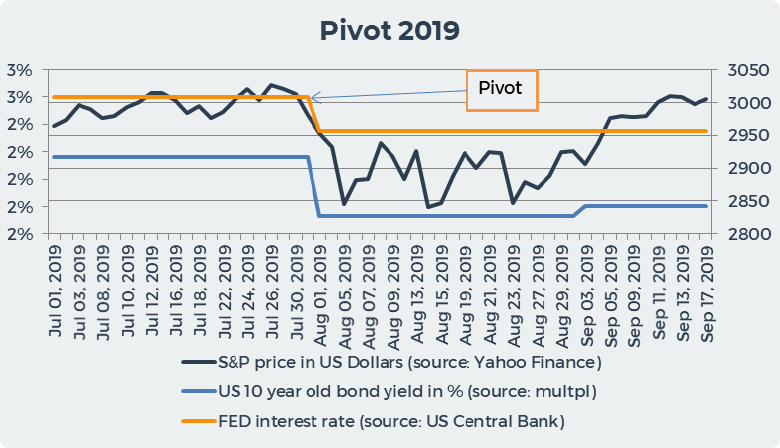

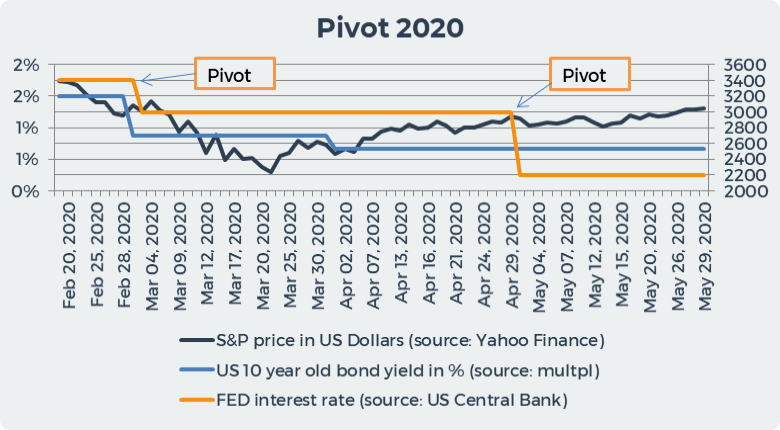

The Fed last cut rates in 2019-2020 from 2% to 0%. Powell called a “mid-cycle adjustment.” The Fed has cut rates in the middle of a typical business cycle from expansion to recession. In 2019, there was a conflict between the US and China over trade, and the Fed feared that the conflict would hurt the economy and push up the unemployment rate. In 2020, there was a fight against Covid-19. Which caused a sharp increase in unemployment to 14%. The Fed cut rates by 0.25% and the economy began to grow, although the effects are still being felt.

3. FED Pivots. The Stock Market isn't the Main Reason of Falling Interest Rates. Credit and Housing are.

FED pivots is when the Federal Reserve begins to cut rates.

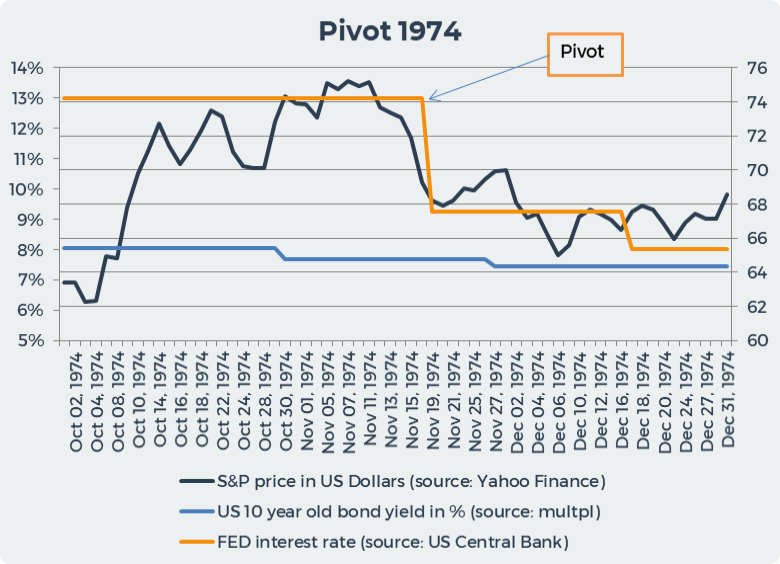

On November 19, 1974, the Fed sharply lowered its interest rate from 13% to 9.25%. The main reason for the decline was slow in credit. In a brief statement, the Federal Reserve Board said: “The action was taken in view of recent slackening in demand for credit and in recognition of the lower level of interest rates that has developed since last summer.” Unemployment has reached 6.5 per cent of the labor forte, its highest level in 13 years, and that the stock market sank to its lowest point since October, 1962. The Federal Reserve has begun to loosen its monetary controls to increase the nation's money supply a little faster than before, according to its Open Market Committee.

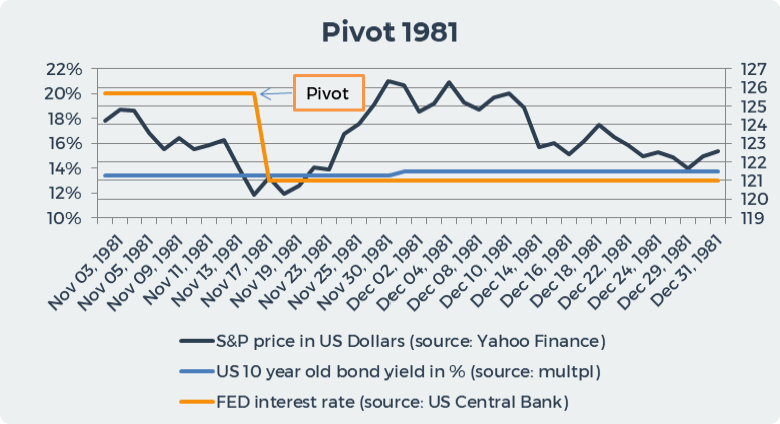

On November 17, 1981, the Federal Reserve lowered its interest rate from 20% to 13%. In its explanation, the Federal Reserve System stated that almost no bank borrows often enough to pay additional fees. The surcharge, which applied to banks with deposits of $500 million or more, was added to the discount rate when banks either borrowed for two consecutive weeks or more, or when banks borrowed more than four times in any 13-week period. The Fed has signaled a tightening of its restrictions on the money supply. However, the Fed canceled the surcharge, explaining that "the board believes the surcharge is unnecessary under the current circumstances in light of the level of short-term interest rates in the market and the reduced level of borrowing adjustments" from the Fed.

On July 13 and October 29, 1990, the Fed lowered the interest rate twice by 0.25% and 0.5% to 7.5%. The main reason for the decline was a slow in credit. Banks have become too cautious in lending money and Alan Greenspan has said that interest rates will have to be lowered to keep the economy moving forward. The data indicated that commercial bank lending rates and collateral requirements are becoming tighter in the context of an unchanged federal funds rate. That's why Alan Greenspan said, "If so, that could have undesirable effects on the economy that the Federal Reserve would have to consider offsetting with an ease in monetary policy."

In January 2001, the Fed lowered its rate twice from 6% to 5%. The main reason was the decline in real estate sales and the decline of the stock market. A series of sharp falls in housing markets over the past few weeks, fueled by growing concerns about revenue shortfalls, high energy prices and disappointing holiday season sales, apparently pushed the Fed to act earlier. On January 31 In a brief statement, the committee said a "rapid and forceful response" was needed to growing signs of weakness in the economy and signaled that it may slash rates again. "The committee continues to believe that against the background of its long-run goals of price stability and sustainable economic growth and of the information currently available, the risks are weighted mainly toward conditions that may generate economic weakness in the foreseeable future," the statement said.

On September 18, 2007, the Fed lowered the interest rate by 0.5%, citing this move as an attempt to protect the economy from falling home prices and rising stock markets. The Fed said in a statement that the move was a preemptive strike to neutralize the impact of market shocks on the economy. "Today's action is intended to help prevent some of the adverse effects on the economy as a whole that might otherwise arise from disruptions in financial markets and to help moderate growth over time," it said.

On August 1, 2019, the Fed lowered its rate by 0.25% amid political pressure from Donald Trump. Powell said that the US economy remains strong, but the decline was intended to "provide some insurance against ongoing risks."

In the spring of 2020, the Fed cut its rates to 0.25% to combat the impact of Covid-19 on the economy. "Coronavirus poses increasing risks to economic activity," the Fed said in a statement. At a news conference, Chairman Jerome Powell said the Fed took action after officials saw the coronavirus was having a significant impact on the economic outlook. The Fed also added that "The disruptions to economic activity here and abroad have significantly affected financial conditions and have impaired the flow of credit to the U.S. households and businesses.” On Twitter, Trump noted that this reduction is not enough, but the Fed said that it will not be in a hurry.

Conclusion

The Federal Reserve creates US monetary policy. During periods of declining interest rates, the Federal Reserve System is not always guided by the situation in the stock market as it is commonly believed. We have shown that there are other reasons for the start of lowering interest rates, such as the real estate market, bank loans or political pressure in the fight against the pandemic.

The Federal Reserve System has no direct influence on the value of gold in global markets because it cannot influence other factors, such as the demand and supply of gold in other countries, so we do not see a clear connection between gold prices and interest rates.

Date= 10th March 2023, Gold price – 1878.10$, Silver price – 20.80$, Platinum price – 978.50$, Oil price – 76.52$