In this report, we will examine gold in relation to real estate from a historical perspective since 1970. We'll then study the 2 assets in a structural way.

Comparison of Historical Performance

Gold outperforms real estate when the economy deflates, and governments create debt (period 1 below). Gold underperforms real estate when the economy is better and there is a growth (period 2 below). When deflation is such that governments print too much paper money, gold soars totally without comparison with real estate (period 3 below)

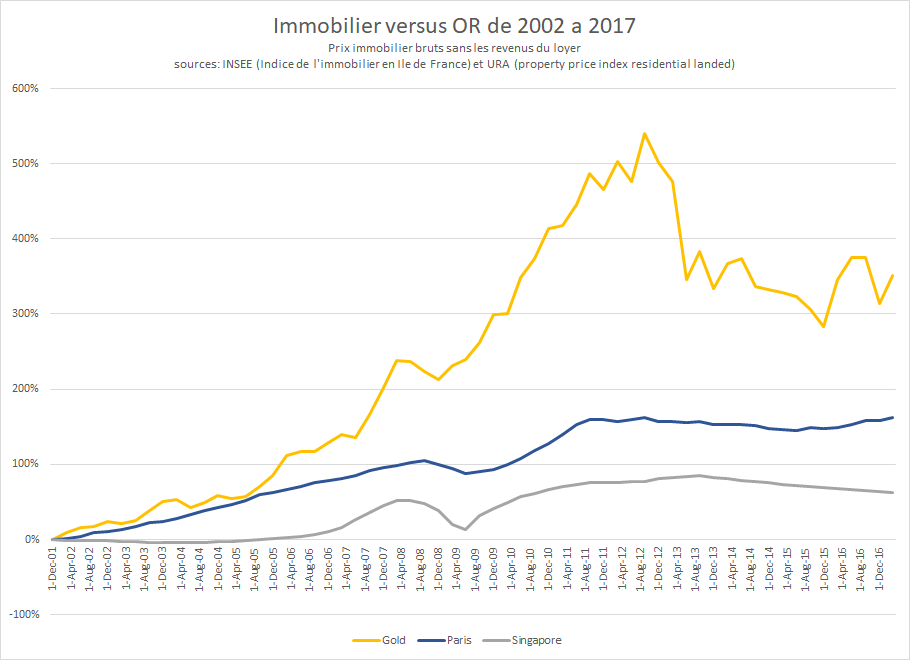

1st period: From 2002 to 2017

The environment is deflationary (production overcapacity). After the crisis in emerging countries in 1998 and the bursting of the dot-com bubble in 2000, the economy has been suffering since 2002. The financial system then begins to print money in bulk. This is the beginning of the subprimes that will break down in 2007.

After 2007, the financial system continued to print money massively through leverage, credit, and fractional reserve. States also take over by printing on their side.

For example, in 2014, the 5 largest American banks, JP Morgan, Citibank, Goldman Sacks, Bank of America, and Morgan Stanley have 300 trillion dollars of derivatives for 9 trillion dollars of real assets in their vaults. These derivatives are used to purchase various financial products, as well as real estate and have no real currency counterparts. This is a form of massive money printing.

We can see that the price of gold has risen by 300% while the price of real estate has risen by 150% in Paris and 65% in Singapore.

To this, it is necessary to add 50% to the real estate thanks to the rents collected.

Indeed, if we add a rent gain net of taxes and maintenance costs of the apartment of 2.5% per year; if we deduct the cost of gold storage and insurance of 0.30% per year; we obtain a differential of 2.80% per year in favour of real estate, which is a differential of:

Rent differential - storage costs = (1+2.80%)^(2017-2002)-1 = 50%

Hence, the comparison for the 2002-2017 deflation period in which we are currently is:

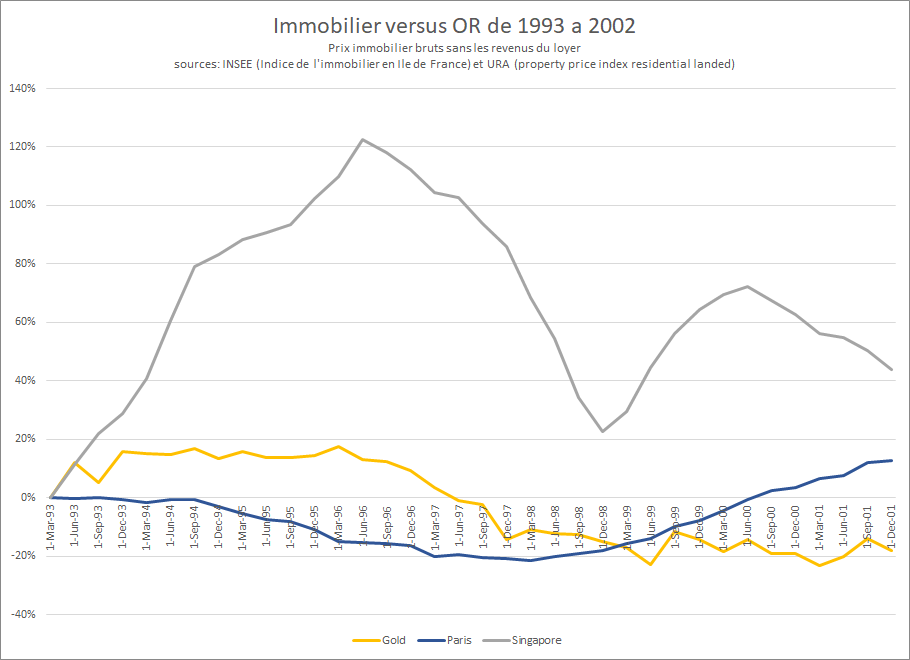

2nd period: From 1993 to 2002

The environment is inflationary (production undercapacity). The Internet revolution is coming with its productivity gains, the world is emerging from the post-1987 crisis and a deflationary cycle.

Gold has a gross return of -20%, real estate in Singapore has a return of 40%, and in Paris of 15%.

Likewise, a gain of 2.75% per year is added in favour of real estate to materialize the rents received and the cost of storing gold. We reach a differential of 67%.

We obtain the following comparison:

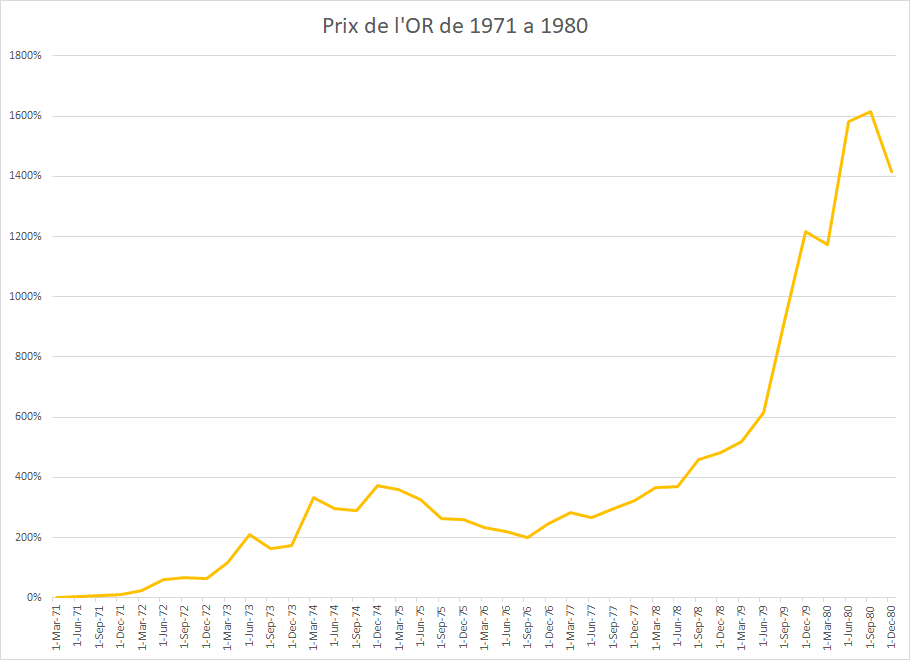

3rd period: From 1971 to 1980

The environment is deflationary. The world is going through the 1973 oil crisis. The United States had a gold exchange standard dollar/gold system that it had to give up in 1971 because of the huge costs generated by the Vietnam War.

From 1973 to 1976, deflation took place in the same way as the period from 2007 to 2017. The American government is unable to reduce its debt. The dollar is threatened and gold soars up to 1980, the second oil crisis, the beginning of the Iran-Iraq war.

The United States is implementing the petrodollar, which requires all countries in the world to have the American dollar as a reserve. They outsource their debt and save their monetary system from the paper dollar by a narrow margin.

Gold has risen by 1600% At the meantime, real estate in the United States is up by 43%. Source= United States Census Bureau ). The differential due to the rent is 27%. Thus, to summarize this period:

REAL ESTATE STRUCTURAL COMPARISON / OR

Liquid market / Illiquid market

One factor that is often undervalued by those who invest in stone themselves is the lack of liquidity in the real estate market. It is structural and due to the fact that each apartment is unique. The square metre of an apartment is not worth the same value as the square metre of another. In contrast to gold, 1 Oz of gold has exactly the same value as 1 Oz of gold from another bar. So to sell gold bars, it can be done in one click at your bullion dealer . For a flat, it takes several months, hoping that the market will not be bearish.

Fungibility

Gold is fungible. A gold bar at one side of the planet is worth the same gold bar as at the other side. We can switch them. This is called fungibility.

Real estate is not fungible. An expert must be appointed each time to assess the property. It is therefore impossible to give a unit price to real estate. It is on a case-by-case basis. This makes the market very opaque and impacts liquidity.

Spread bid/ask

The bid/ask spread is the difference between the purchase price and the sale price. Either way, everyone pays for this gap. The further away the purchase price is from the sale price, the greater the friction and costs will be during transactions.

Gold has a bid/ask spread of about 1%

Real estate has a bid/ask spread of 11%: taxes are at 7% in France and agency fees at 4%

Delay necessary to sell

This is crucial for the liquidity of a market. The longer it takes to sell the property, the more opaque the market becomes. In addition, the seller may be placed in a difficult position of having to wait months before getting cash.

The gold market is almost immediate. We're talking about a few days before we receive our liquidity.

The real estate market is much less liquid. We talk about several months before we can sell our property

Taxes

Taxes on Purchase

Gold is not taxed on purchases in France or Singapore

For real estate, the costs are 7% at the time of purchase in France

Taxes on capital gains

For gold, the person is taxed on the capital gain at the time of sale according to the law of the country where he or she is a tax resident. In France, this is the standard capital gains tax. In Singapore, this is 0%.

For real estate, there is no tax if it is the main residence. But if we talk about real estate as a financial asset, then there is the same tax

COMPARISON IN THE CURRENT CONFIGURATION

Cost of Production

The production cost of gold is about 1200 USD/Oz. The current price of gold is 1200 USD/Oz, it is close to the cost of production. Many mining companies are currently going bankrupt because gold prices are not high enough.

The production cost of a house is 2000 euros/m2 (10 sq ft). The selling price is much higher in big cities, it is at this level in the provinces.

One of the characteristics of deflation (production overcapacity) is to have selling prices that are closely linked to production costs, leaving producers with zero or even negative profits.

The current period is undoubtedly a period of severe deflation.

Nature of the Asset

Gold is not a financial asset because it does not generate interest. Gold is currency. It is used to preserve the cumulative value and to transport it over time.

Real estate, on the other hand, is a financial asset because it generates a rental income. Like any financial asset, real estate can be valued as the sum of its present value of future cash flows.

Real Estate Yield

Currently the price per “m²”(sqm) in Paris is 8.796 euros and the rental price is 26 euros (source: meilleurs agents)

The gross return on assets is therefore:

Real estate yield in Paris = 26 * 12 / 8,796 = 3.5% / year

Management fees, repair costs, months of non-lease, and miscellaneous taxes are considered to cost half of the rent.

The net return drops to 1.77% per year for real estate in Paris

To assess the quality of the financial asset, one considers how many years of rent it takes to buy it back. This is called PER.

Real estate PER in France= 1 / 1.77% = 56 years

It takes 56 years of rent to buy back your apartment. It's very high. Well-managed financial assets have 6-year PERs. From 20-25 years, the PER is considered to be becoming very high. Thus, 56 years is exorbitant. These are generally start-up PERs for which growth other than current income is expected.

Factors that boost real estate

Currently all the factors that might increase real estate are already at their maximum and can no longer trigger a rise in real estate

- Rents : If rents rise, real estate is more profitable and therefore also rises. In France, more and more laws require that the rent price not be increased. In addition, in Paris, the average salary is 2.256 euros/month (source: salaire moyen) and the average rent is 26 euros per “m2” (source: meilleurs agents). For a 50m2 (538 sq ft), this is 1300 euros, or 60% of the pre-tax salary. The burden of rent on households is already very high and cannot increase much more. Rents seem to have reached a ceiling, and will not be able to generate an increase in property prices

- Growth : If the economy is doing well, people are wealthier, prices are increasing and rents are rising too. The economy is stuck in deflation, unemployment rates are at their highest historically.

- Interest Rates: If rates fall, more people can borrow, so more buyers, and real estate prices rise. The interest rates are negative in Europe, we cannot lower them any further. There are no new buyers to expect there.

- The age pyramid: An asset will rise if there are people to buy it later. If there is a sharp increase in demographics (immigration or natural), then real estate prices will naturally be supported. However, France is in the middle of a aging population, so there are more potential sellers than potential buyers

- If households have a margin for debt: But borrowing terms are now very long. They are currently between 30 and 50 years old.

Leverage

Leverage is the most important concept to understand of our current financial system because it is the one that generates all the bubbles and serious crises.

Currently, all assets are hyper-leveraged. This means that they were purchased with borrowed money that does not exist. When you borrow money from the bank, the bank gives you non-existing money and records it in its books. This has been perfectly legal since the financial deregulation of the 1980s. As a result, the 5 largest American banks have 300 trillion derivatives compared to 9 trillion assets alone.

Real estate is no exception to this rule. Except for individuals who are heavily indebted to buy their apartments; companies, banks, groups buy real estate by benefiting from loans and hence leverage.

This means that if prices were to fall, there could be a real estate chain reaction, and prices could collapse by much more than a few dozen percent. The mechanism is very simple. Groups that have bought real estate by borrowing huge sums of money end up with a negative balance sheet if real estate prices fall, their financial situation deteriorates, banks no longer want to lend them, these groups no longer have the funds to cover their operating costs, and they collapse into bankruptcy. They then sell their real estate by force, causing prices to plunge even further, and causing the bankruptcy of other groups.

This was the case during the 2008 subprime crisis in the United States. This crisis has been stifled and delayed. None of the problems have been solved, it is reasonable to expect that real estate will be strongly impacted during the next crisis.

Unlike real estate, physical gold is absolutely not leveraged. No one can take out a loan to buy physical bars. No company or financial institution offers loans to buy gold. Each purchase of physical gold represents an amount of real money.