While the cost of gold is increasing in value, the mining production of the main gold companies is decreasing sharply, recording a 15% decrease.

Despite rising costs, Main Gold Mining producers decrease their Production by 15%

The main gold producers are decreasing their production.While gold costs and prices continue to rise, production from the world's three largest gold mines fell in the first half of 2018 compared to the same period last year. The increase in these costs is due to lower production, higher energy prices and finally the free cash flow of the main gold producers, according to SRSRoccoreport.

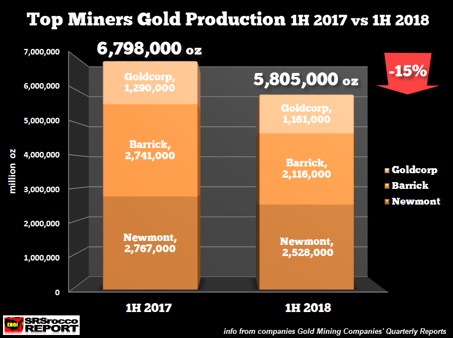

Barrick is the company that suffered the biggest loss, production having dropped by more than 20%, from 2.7 million oz the previous year to 2.1 million ounces in the first half of 2018. Newmont's production decreased by nearly 9%, while Goldcorp's production fell by 10%.

In summary, the production of the three major gold mining companies fell by 15%, or about 1 million oz, in the first half of 2018 compared to 2017.

According to an analyst, Goldcorp sold $431 million of the $1,639 million in total revenues in silver, zinc and miscellaneous metals and recorded, a loss of net income of $64 million in the first half of 2018. The company posted a low price of $850 per ounce of AISC.

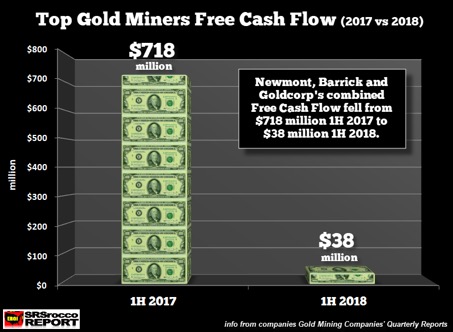

Recent company figures have shown that of the total positive free cash flow was $718 million, Newmont was $530 million, Barrick provided $204 million, and Goldcorp posted a negative balance of $16 million. However, free cash flow in all three cases decreased significantly in the first half of 2018 to only $38 million. Profit margins were much higher in the first half of 2017, even with a lower gold price.

Based on an average gold price of $1,243, the approximate break-even point was $1,126 per ounce. As a result, the profit margin on gold was nearly 10% last year. However, the current result amounts to $1230 in the first half of 2018. As a result, the profit margin fell to 5.6%.

While the cost of production of the gold industry is higher than market prices, or cash flows have been relatively low, the major gold producers have not made much money in this first half of 2018.

Posted by: GOLD&SILVER

Source: srsroccoreport.com