Why Reputed Investors Say There Is a Small Gold Mining Capacity?

Introduction

Renown investors around the world such as Jim Rogers say that there are little gold mining capacities, although the level of gold production is at the highest in history. The main idea of the article is to understand the reasons why they say that there is little mining capacity.

In the first chapter, we define what mining capacity is and we will study how much capacity there was in the history of gold.

In the second section, we will show that there are only a few unexplored high-quality gold reserves.

In the third chapter, we will show 5 main reasons for the decrease in mining capacity.

1. Definition of Mining Capacity and its History

Many well-known investors talk about a significant decrease in gold mining capacity in the world. One of the most famous investors, Jim Rogers, said in an interview last year “…so far we don’t have huge amounts of new capacity coming on stream, so the bull market can continue. [But] so far there are not massive amounts of new supply that have come on stream.” He meant mining production and new mines put in production. Because the question was about the quantity of commodities on the market.

Worldwide mining capacity is a global network of the totality of the world's gold production capabilities. Different amounts of production capacity are used in different periods. Production capacity is the maximum possible annual output of products. In other words, it is the potential for gross gold output. When forming the production capacity, the influence of such factors as the nomenclature, the quality of products, the park of the main technological equipment, the average age of the equipment and the effective annual fund of its working time under the established mode, the size of the production areas, etc. are taken into account.

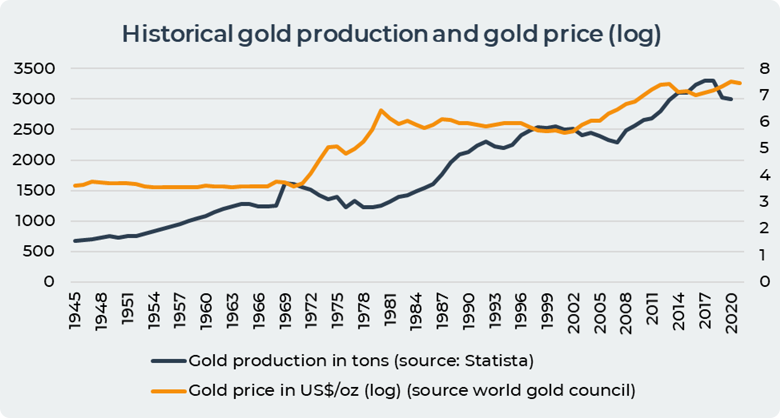

The graph above shows that gold production is at its peak. In 2015, gold production exceeded 3000 tons per year and has not decreased since then. Throughout history, mankind has mined 205238 tons of gold according to the World Gold Council.

1.1. There are 4 Periods in Gold Mining Capacities History.

1) 1850-1930 - geological research made it possible to increase gold production from 150 tons in 1850 to 500 tons;

2) 1930-1945 - the years of the Great Depression when people went to mine gold to live. The depreciation of the US dollar against gold from US$ 20.67 to US$ 35 per ounce due to the 'Gold Reserve Act' of President Roosevelt on January 31, 1934 stimulated production;

3) 1945-1980 - an increase in new research after the abolition of the gold standard by Nixon, a sharp increase in gold production in South Africa. New technological breakthroughs, like the carbon-in-pulp cyanidation process;

4) 1980 - today - expansion of the geography of gold mining. If previously the main producers were South Africa, Australia, the USA and Canada, now Russia and China have joined. Decrease in mining research.

2. There Are Few Undeveloped High-Quality Gold Deposits.

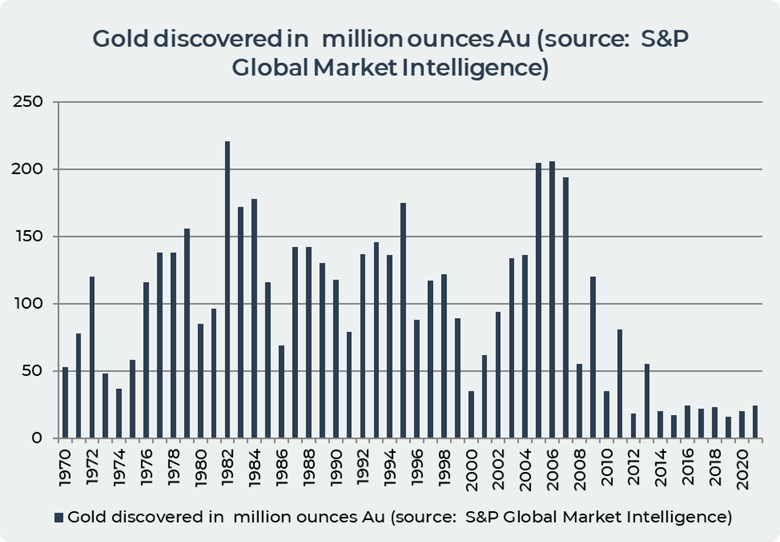

According to S&P Global Market Intelligence - 2020, 278 large gold deposits were discovered in the period 1990-2019. However, only 25 discoveries have been made in the last decade. In the period 2017-2019, there was no discovery.

The lack of new discoveries is explained by the fact that companies are focusing their activities on expanding existing mines. Which is inherently less risky. The lack of new discoveries also means that there are few unexplored high-grade gold mines left to replace the current large gold deposits over the next 25 years.

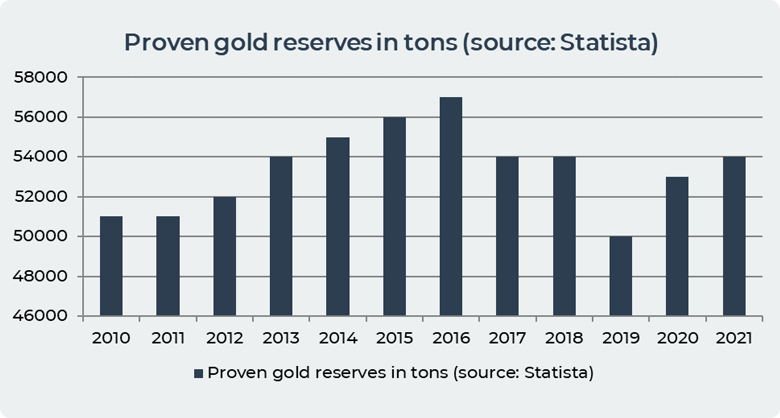

The graph above shows that today's gold reserves are approximately 54,000 tons of gold. In addition to these reserves, there are still 183,240 tons of gold contained in resources. About 70% of all reserves are located in active mines. This part will most likely be mined in the near future.

The remaining 30% relate to development projects and are less likely to contribute to production. Some of the gold in this material will be insignificant for mining, and companies will often want to direct resources to the discovery and development of more profitable deposits.

3. Five Main Reasons For the Gold Mining Decrease.

We identify 5 main reasons for the decline in gold production capacity.

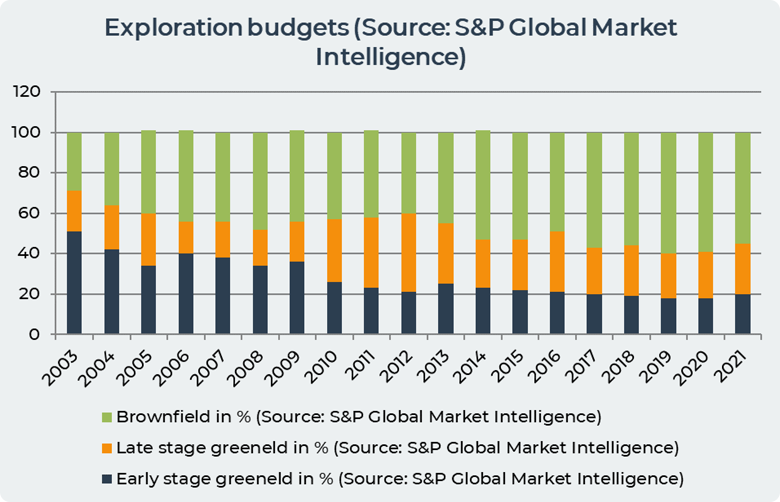

Freezing of capital expenditures for the opening of new mines. The top 20 gold companies have significantly reduced their capital expenditures since 2012. The capital expenditures of the twenty whitest companies decreased from 30US$ billion in 2012 to 12US$ billion in 2021. The reduction occurred due to an attempt to raise debt to invest in new projects. Similarly, budgets for intelligence and intelligence programs have been drastically reduced. In the period 2012-2021, the intelligence capital fell from 106US$ billion in 2012 to 58US$ billion in 2021.

The graph above shows that gold companies have started to focus more on brownfield development. Brownfield exploration is the search for additional gold deposits at already known or operating mines. Exploration budgets have shifted from high-risk projects that can potentially make new discoveries to low-risk projects whose primary function is to extend mine life. Between 2011 and 2021, the top 20 gold companies spent 12.7US$ billion on exploration, with more than 75% allocated to late-stage development and areas around existing deposits. The consequences of this cost cutting and limited scale meant that gold mining companies converted nearby resources into reserves.

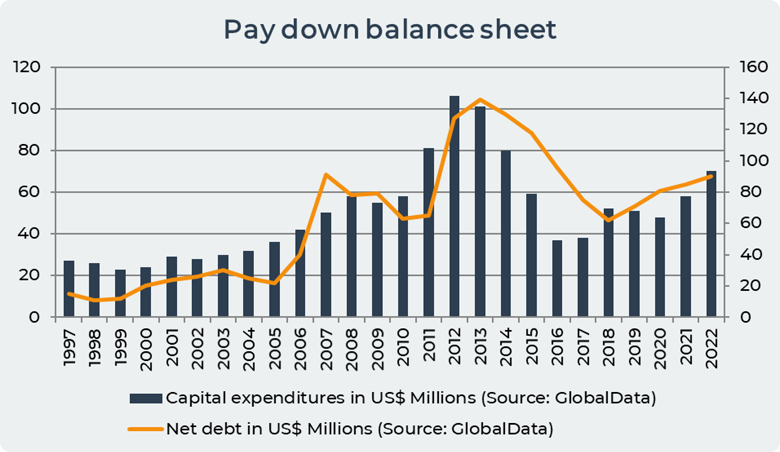

Pay down balance sheet. The gold industry has taken steps to reduce debt through a combination of asset write-downs, divestments and closures.

The chart above shows that net debt and capital expenditures are correlated by 84%. Which means that as companies increased their capital expenditures, their debt increased. For example, in the period 2008-2012, when capital expenditures increased by 82% from 58US$ billion to 106US$ billion, the net debt increased by 63%. While in the period 2013-2019, when capital expenditure decreased by 98%, which caused a decrease in net debt by 95%.

For example, in 2015 Barrick sold a 50% interest in the Zaldivar copper mine in Chile, sold a 70% interest in the Spring Valley project and sold the Ruby Hill mine. Newmont closed the Midas mine in Nevada, the Jundee mine in Australia, and the La Herradura joint venture in Mexico.

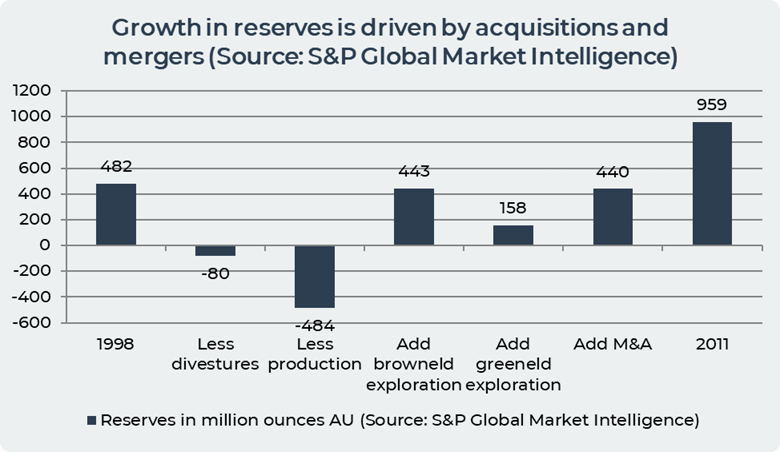

The increase in reserves is caused by the merger of companies. Major gold mining companies have historically consisted of mergers and acquisitions. Between 1998 and 2011, mergers and acquisitions of gold mining companies were the second largest source of reserves for large companies, slightly behind brownfield exploration. Mergers and acquisitions accounted for 42% of the growth in gold reserves between 1998 and 2011.

In recent years, large companies have increasingly relied on the acquisition of young gold mining companies. In the 1980s, junior gold companies accounted for up to 30% of all gold discoveries. In the 2000s, the share of junior companies was 65-75% of all gold exploration. For now, however, junior gold companies face a lack of capital as investors try to avoid high-risk gold exploration companies that traditionally rely on small public offerings and placements to fund drilling programs. If large companies do not open, acquire or build new mines, they will face the problem of depleting reserves.

Lack in discoveries and more time to implement new mines. In the 1970s, 1980s, and 1990s, a large number of large gold mines were discovered, developed, and mined. During this period, gold mining companies have discovered at least one deposit with reserves of 50+ MoZ and ten deposits with reserves of 30+ MoZ and very few deposits with reserves of 15+ MoZ. Over the past decade, the total cost of exploration for new mines has exceeded 50 billion, which is twice the total cost of the previous 20 years. However, the desired result was not achieved. Only 216 MoZ were found in the last 10 years in 41 discoveries. One reason is that the new mines are located in high geopolitical risk areas in Central Africa, Central Asia, Eastern Russia, Ecuador, Mongolia and China. Another reason is that the time to implement new mines has increased from 12-15 years in the 1990s to 20 years on average in the 2010s.

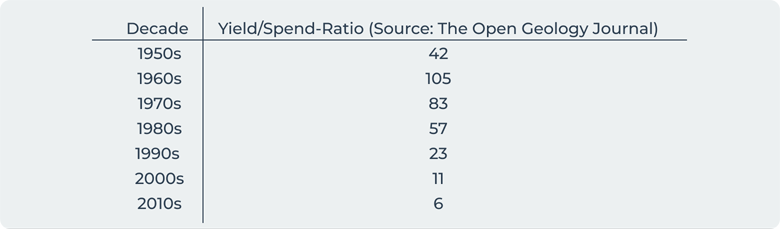

Decrease of exploration success. The quality of gold exploration reduction: in 1950 the average gold grade of discoveries was 8 g/t. This value has dropped to 0-5 g/t today. A decrease in the Yield/Spend-Ratio - Ratio of Discovered US$ in the Ground Per US$ Exploration Expenditure. In the 1950s the cost per discovered ounce was 6.80 US$, which rose to 10 US$/oz in 1980 and to 52 US$/oz in 2010.

Many companies have begun targeting high-grade deposits due to falling gold prices and cost pressures. High grading is mining the highest grade ore for short-term profit with the hope that the rest of the ore will be mined later when gold prices rise. However, the effect in the short term does not give results in the long term because current stocks and reserves become uneconomical.

Conclusion

Despite the highest gold production in history, the production capacity of gold mining companies is small. In recent years, huge sums have been spent on gold exploration. However, the result was disappointing. Companies were unable to add large amounts of gold to reserves. There are few unexplored high-quality gold mines in the world that are located in unstable regions or in autocratic states where investors do not want to invest. Spending on research does not give the desired success in research due to the drop in gold grade. Therefore, companies reoriented their capital expenditures on brownfield development. Gold companies are also faced with the need to reduce their debt and a shortage of junior mining companies. If gold mining companies continue to deplete reserves at such rates as today, they will soon face the problem of a lack of resources if they do not open, acquire or build new mines.

Date= 7th September 2022, Gold price – 1727.20$, Silver price – 18.64$, Platinum price – 883.10$, Oil price – 81.65$