You may have heard that Turkey is in a bad financial position. Indeed, the US president threatened to block the importations of Turkish products.

You may have heard the news. Turkey is in a bad financial position. As per their habit, the US president threatened to block the importations of Turkish products. They threatened to freeze the US banking accounts that the wealthiest Turkish officials may have on US soil. As a retaliation, the Turkish president threatened to block US importations into Turkey and to freeze any account US officials may have in Turkey. Erdogan has a sense of humour. He even claimed “They have the US dollar, but we have Allah!”. But enough of the stupidity of the presidents of the countries of the world. What is it about the real economic situation in Turkey? How bad is it, and what is happening there?

In short, companies in Turkey have been borrowing in EUROs and USD to benefit from low interest rates. But the Turkish Lira has dropped significantly this year. They need to repay their loan in the foreign currency, which is much higher in nominal than what they borrowed. This put them bankrupt since their income is in Turkish Lira.

What happened is frighteningly simple and naïve, and shows how the financial world is not sophisticated at all. Let’s detail more and give the sources and proof of our statement:

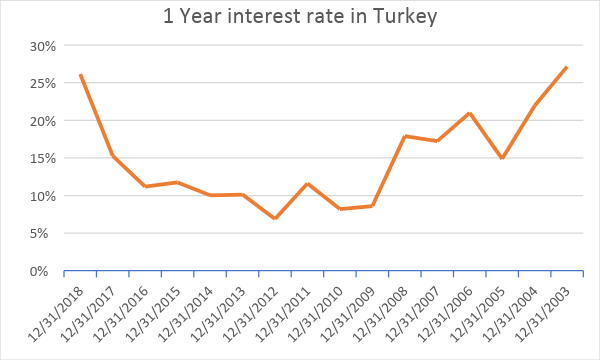

The interest rate in Turkey has historically always been very high. It has been between 10% and 14% in the past 5 years. How can an economy survive an interest rate of even 12%? This would mean that your money must make that much every year, so that you just keep your purchasing power. This would mean that the companies borrow their money at 12%, and therefore must provide a return of at least 12%. Turkey still goes on by having a constant high inflation on the prices all over the country. You can see on the chart below that this is not a new situation for Turkey.

The interest rate recently surged to 26%. So, what is the big deal, would you think? Looking at the chart below, it is not the first time, it was the common interest rate between 2003 and 2006. Yet Turkey survived, and nobody at that time was alerting about the situation of the country.

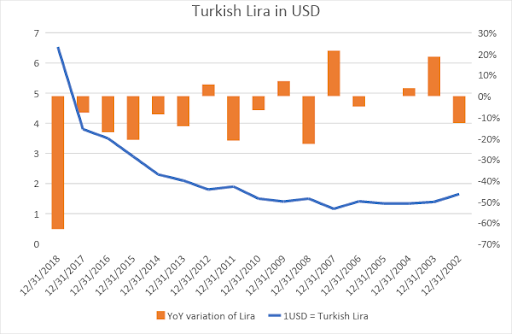

The difference is that now the Turkish Lira is going down sharply. This year it lost 42% in August 2018, this is a 63% annualized loss.

What happened is that all the companies in Turkey felt smart enough to borrow in EUROs at zero interest rate, and to repay their loan in EUROs. Since the inflation was at 12% in the country, companies were increasing their prices at a rate of 12%, but they were reimbursing their debt at 0%. They were making easy money.

At the same time, some smart investors were doing a carry trade. They would sell EUROs, USD or Japanese Yen, and buy Turkish Lira. This way, they would enjoy a 12% interest rate, assuming the currency exchange rate would not vary that much. Japanese are well known to be the experts in this game since their interest rate is negative. Europeans have joined the club, thanks to the zero-rate policy of the European Central Bank.

It was a good trade in 2017. Interest rates were at 12%, the Turkish Lira fell only 8%. The net gain was 4%.

This worked well until the moment the US put pressure on the emerging markets by raising interest rates and by so the price of the USD. Exportations became more difficult. The Turkish Lira began to fall due to a difficult situation for emerging markets. At the same time, the carry trade USD-Turkish Lira became less attractive, driving capital away.

Then, the nightmare situation happened. The game was so crowded by both the carry trade players and the Turkish companies borrowing in foreign currencies, that the Turkish Lira entered a falling spiral. This means that Turkish companies had to repay their loans in a strong foreign currency whereas their income is still in Turkish Lira. At the time of the article, the Lira has fallen at an annualized rate of 63% since the beginning of the year. This means that the companies will be losing 63% when they aimed at saving 12% on the cost of their loans. It is easy to understand how this whole system is going bankrupt.

The falling currency is the new data that is changing the whole situation compared to the period 2003-2006.

Then, what is the impact of Turkey going down, would you say?

Turkey is not like Greece, or Argentina. It is a much bigger country. The population of Turkey counts 80 million people. Its GDP is 900 billion USD, which makes it the 17th country in the world. Greece in comparison was the 53rd country in the world with 200 billion USD of GDP.

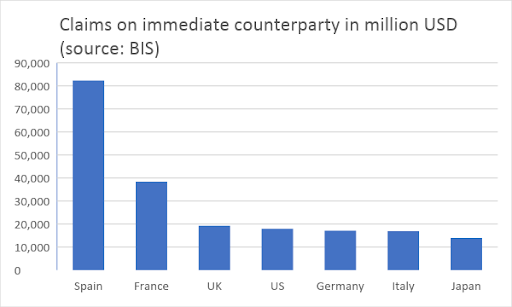

Talking about the exposure of foreign banks to Turkey, the bank of international settlement published the known exposure to Turkey. The total amount is 265 billion USD. This is likely to be the tip of the iceberg. Remember that when Greece went down, the official number at that time was 8 billion USD. And we all know how far it went when banks started to dig in.

The exposure to Turkey is very concentrated to Europe. The amount is already very big. This means that the whole system cannot let Turkey go bankrupt. Otherwise the whole system goes away. This means that the other countries will have to bail out Turkey, by extending the loans, or by writing off some debt, or any other shadow mean they are so good at finding out.

Source:GOLD&SILVER