Brazil's stock market has grown recently, but what are the reasons?

Analyzing the Growth of Brazil's Stock Market: Factors and Influences

Brazil is the largest economy in Latin America and its stock market has grown in recent years. The main goal of the article is to understand why the stock market grew.

In the first section, we will show that the Brazilian stock market depends on the trade balance.

In the second section, we will show the policy of the central bank regarding interest rates.

In the third section, we will show that the performance indicators of the largest Brazilian companies depend on the interest rate.

1. The Stock Market Grows When the Trade Balance is Positive

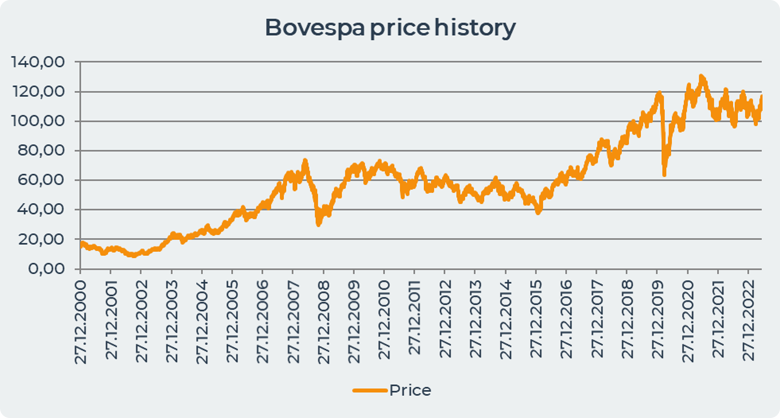

The main stock exchange index in Brazil is Bovespa. Bovespa includes the most active shares on the stock exchange, covering about 80% of transactions.

The chart below shows that between 2001 and 2006, the stock market grew by 400%.

Between 2007 and 2016, the Brazilian stock market did not move and was flat.

From 2016 to 2021, the stock market began to rise and showed a growth of 150% during the period.

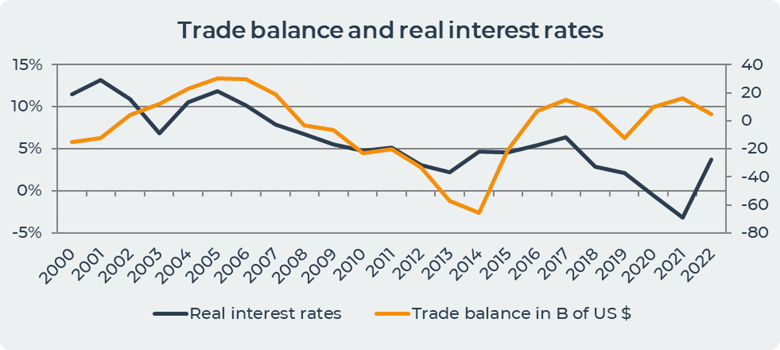

The real interest rate is the difference between the central bank interest rate and inflation. In Brazil, the real interest rate is positive, which means that the central bank keeps its interest rate above the inflation rate. Between 2001 and 2006, the real interest rate was positive while the trade balance was very positive, causing the stock market in Brazil to grow by 400%.

In the period from 2006 to 2016, the trade balance entered the negative zone, which means that Brazil imported more than it exported, although during this period real interest rates continued to remain positive. However, the Brazilian stock market did not show any sharp fluctuations and remained flat.

Since 2016, Brazil's trade balance has turned positive and the stock market has started to rise, while real interest rates have started to approach a negative value of -1% in 2020 and -3% in 2021. Brazil's stock market grew by 150% in 2016-2021.

So we see that the trade balance in Brazil has a greater influence on the growth of the stock market. The rise of the stock market is not due to a loosing interest rate policy.

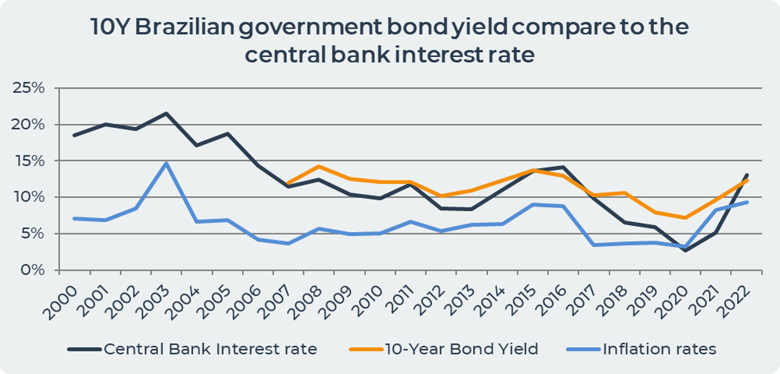

2. Interest Rates in Brazil

The graph below shows that 10Y interest rates have always been higher than the inflation rate. Banco Central do Brasil began raising interest rates in 2014 after the country entered a recession that began in 2014 amid falling commodity and oil prices and political turmoil. Brazil plunged into a deeper recession as its economy shrank 3.8%, the biggest drop since 1996, according to the Brazilian Census Bureau. In 2016, the country's economy continued to record negative growth of 3.6% in 2016 before recovering to positive growth of 1% in 2017.

In 2017, Banco Central do Brasil began to lower its interest rates in its statement indicating that The Committee believes that its inflation baseline has largely reversed, as expected.

In March 2018, Banco Central do Brasil lowered the Selic rate to 6.5% from 6.75% in February, which was the lowest nominal rate since 1999 when the bank started inflation targeting systems.

The bank maintained a rate of 6.5% throughout the year and began lowering it to 3.75% in July 2019. In 2020, the covid19 pandemic began, which significantly slowed the development of Brazil's economy, limiting the export of its main commodities and reducing commodity prices, in particular iron ore and oil. From July 2020 to August 2020, Banco Central do Brasil lowered the interest rate three more times to 3% and kept the rate at 3% until March 2021. In 2021, Banco Central do Brasil began raising interest rates, explaining that the environment became less favorable.. Level inflation at the end of 2021 amounted to 10.75%, which significantly exceeded the target, therefore the central bank increased the interest rate to 9.25%. From that moment, the central bank announced a tightening of monetary policy to curb runaway inflation and raised the interest rate to 13.75%.

3. The Performance of Brazilian Companies Stocks Depends on the Interest Rate of the Central Bank.

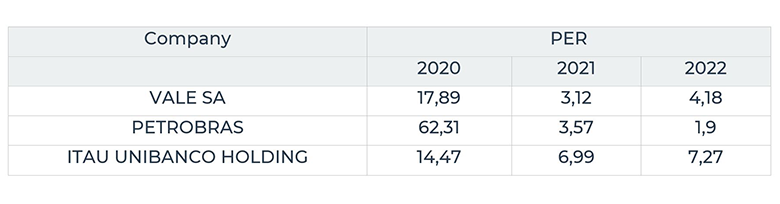

The main Brazilian companies are involved in Raw materials, Banks and industry. The table below shows that the P/E ratio for the largest Brazilian companies by capitalization is low, which may mean that the company's data is undervalued.

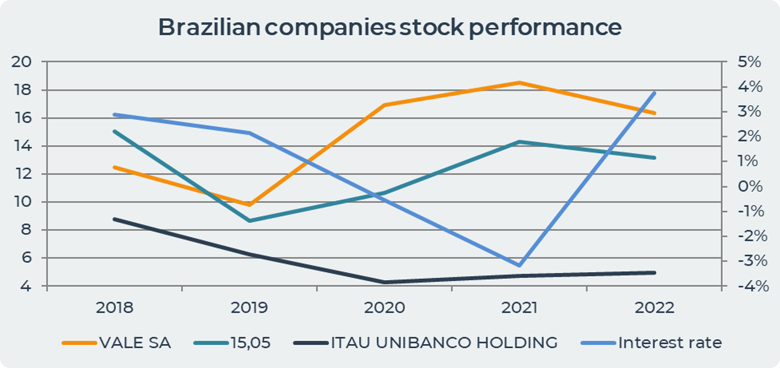

The graph below shows that when the real interest rate decreases, the share price also decreases, as for example in 2019 when companies lost about 30% of their share value, and also the value of bank shares decreases.

In the period 2019-2021, the share price of the two largest Brazilian companies has almost doubled. Although they started to decrease in 2022.The value of the bank began to gradually increase from 2020.

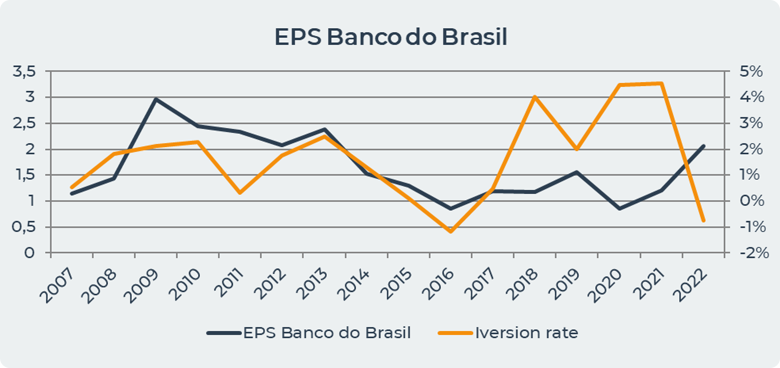

An important point in the value of earnings per share of Banco do Brazil is that the earnings per share depends on the slope of the rate curve. The chart below shows that, in 2016, when the rate curve inverted, earnings per share decreased even though the share price continued to rise.

Conclusion

Brazil is the largest market in South America. The biggest influence on the Brazilian stock market is the trade balance. When the trade balance of Brazil is positive then the stock market starts to rise sharply while when the trade balance is negative the stock market is flat. Brazil keeps its interest rate higher than the level of inflation, although in the period 2020-2021 the real interest rate entered the negative zone, which contributed to the decline in the share price of the largest Brazilian companies.

Date= 04th August 2023, Gold price – 1968.20$, Silver price – 23.93$, Platinum price – 940.20$, Oil price – 81.81$

Source: https://bunker-group.com/en/blog/driving-factors-of-turkish-stock-market-growth