Turkish stocks increased in 2022, but what is the main driver of the growth of the Turkish stock market?

The Impact of Negative Real Interest Rates on Turkish Stock Market Growth

The value of Turkish stocks increased dramatically in 2022. The main goal is to understand what is the main driver of the growth of the Turkish stock market.

In the first chapter, we will show that a negative real interest rate is a catalyst for stock market growth.

In the second section, we will show that the largest companies in Turkey have grown dramatically in the conditions of a real negative interest rate.

In the third section, we will show that the negative interest rate affects the trade balance of Turkey.

1. Negative Interest Rates Caused the Stock Market and Earnings Per Share Increase

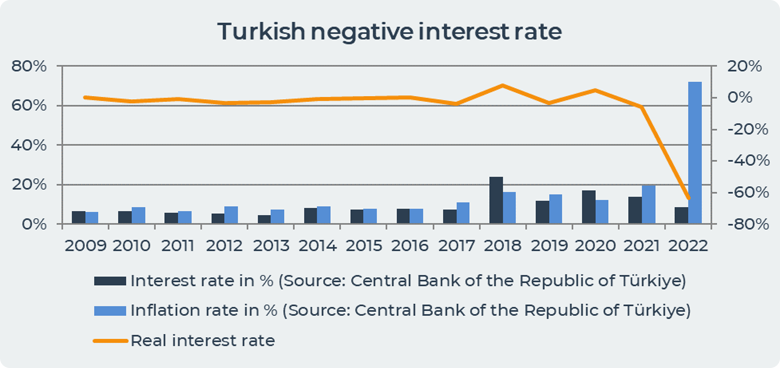

A negative real interest rate occurs when inflation exceeds the central bank's interest rate. The graph below shows that in Turkey this situation occurred in 2012-2013, 2017, 2019 and 2022. The low interest rates of the central bank of Turkey are caused by the influence of the President of Turkey and his unorthodox view on the monetary policy of interest rates.

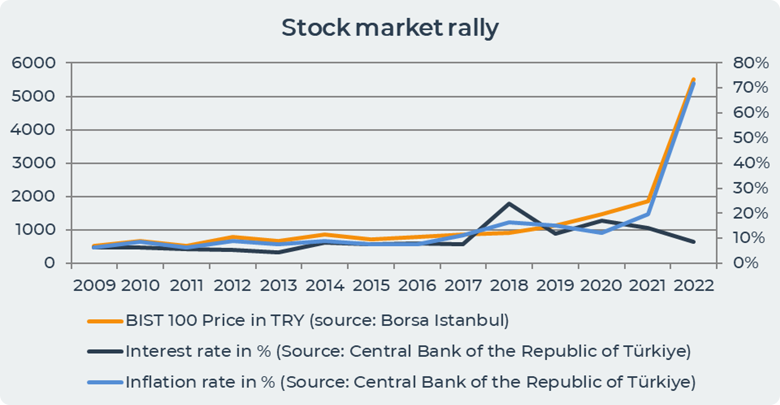

The graph below shows that in periods when there is a negative real interest rate, there is a stock market rally of the BIST100 indicator, which is the main stock indicator in Turkey.

In 2012-2013, the value of the BIST 100 soared by 35%, while the real interest rate was negative -3%, which led to an increase in the main stock index of the Istanbul Stock Exchange.

In 2017 and 2019, there is a boom in the stock market in Turkey again, while the real negative interest rate is -4% and -3%. During this period, there is a sharp increase in the prices of BIST 100 by 30%.

In 2022 is the largest negative indicator of the real negative rate and is -63% due to inflation of 72%. In 2022, the value of shares increases by 400% when inflation rises sharply to 80%.

Inflation and negative interest rates are direct drivers of the stock market in Turkey. Whenever real interest rates were more negative, the stock market rose more. As an example, in 2022, when inflation was 80% and the real interest rate was -63%, the stock market grew by 400%.

1a. Earnings Per Share Increase

Earnings per share is the portion of a company's income available to shareholders and allocated to each common share outstanding. Earnings per share is equal to the difference between net income and preferred dividends divided by the average number of common shares outstanding. Earnings per share shows the stability of earnings as well as the trend of earnings compared over different quarters or years.

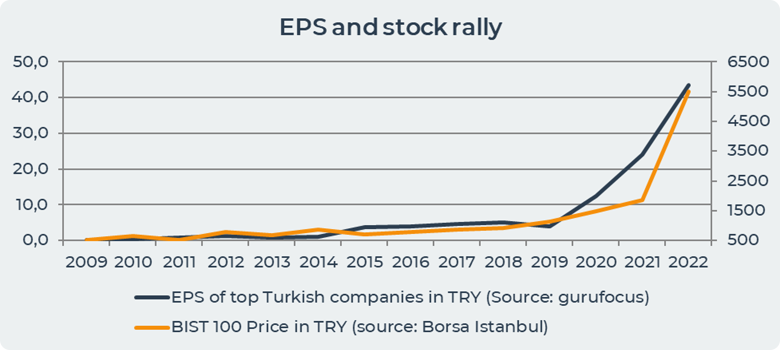

The chart below shows earnings per share is highly correlated with the stock market at 95%. Negative interest rates and high inflation are also reasons for increasing earnings per share.

Earnings per share grew sharply during a period of negative real interest rates. In 2019-2020, earnings per share tripled from 4 to 12, and the stock market grew by 23% from 1147 lira to 1477 lira in 2020. In 2021, when inflation increased to 20% and the real interest rate was negative -6% earnings per share rose another 100% and the stock market rose 20%. In 2022, when the real negative interest rate became very negative -63%, earnings per share increased sharply by 180% and the stock market increased by 400%.

However, in 2012-2013 and 2017-2018, earnings per share did not have such a clear connection with negative interest rates, although it is absolutely clear that the stock market grew in national currency.

2. Turkish Companies Stocks Rally

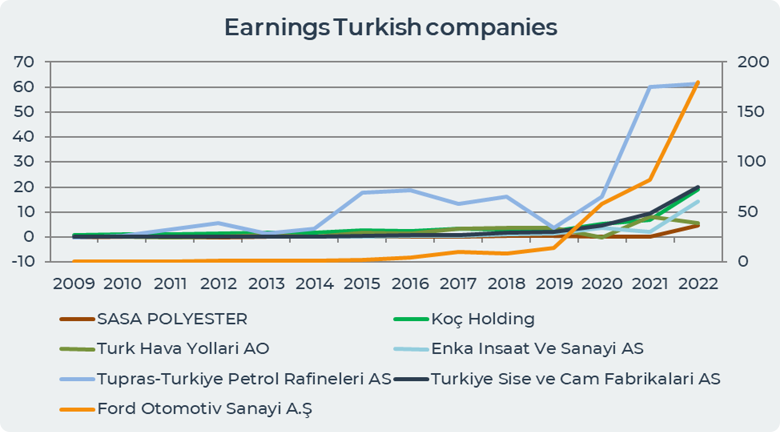

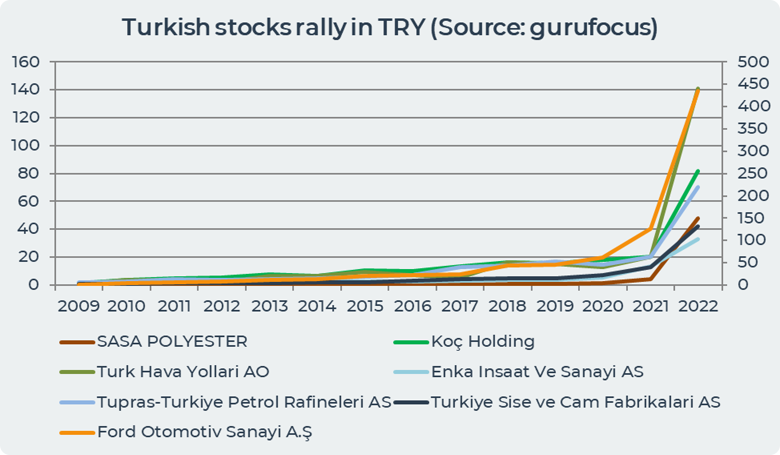

We took 7 of the largest Turkish companies by market capitalization to track their performance in the context of high inflation and negative real interest rates.

The graph below shows that the earnings per share in 2022 increased in almost all companies except Turk Hava Yollari AO, in its annual report the company explained the decline due to “bonus interest”. In Turkey, companies can increase their share capital through a proportional distribution of shares ("bonus interest") existing shareholders from retained earnings.

In other companies, there was a sharp increase in earnings per share. For example, in Enka Insaat Ve Sanayi AS, profit per share increased by 623%, and in SASA POLYESTER by 15 times.

Despite the decrease in earnings per share, the value of shares of the largest Turkish companies increased sharply in 2022 by an average of 500%.

The biggest growth was shown by SASA POLYESTER whose shares increased in value by 1160% and Turk Hava Yollari AO whose shares increased by 700% in 2022.

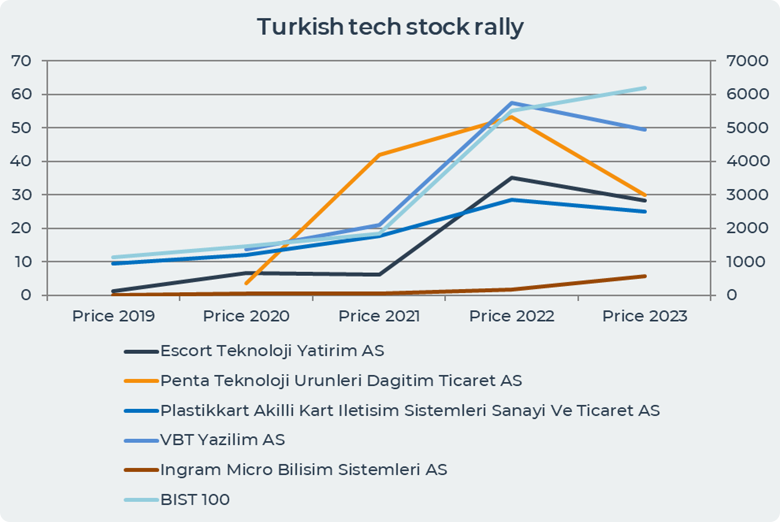

The chart above shows that even some small-cap tech companies less than 1 US$ Billions billion have seen a sharp rise in their stock value.

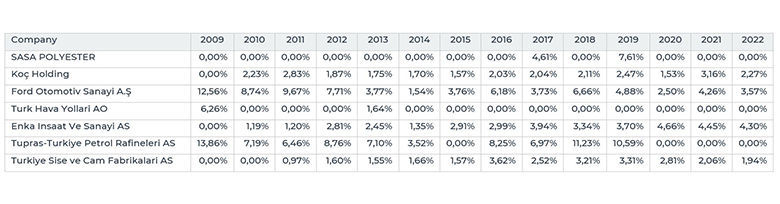

The table above shows the dividends of the largest Turkish companies. We see that despite the sharp increase in the value of company shares and earnings per share, dividends have not increased. It may seem strange, but it is explained by the fact that the profit follows the devaluation of the national currency. In 2022, the Turkish lira depreciated against the US dollar by 40%. Therefore, there is no need to pay a dividend on top of it.

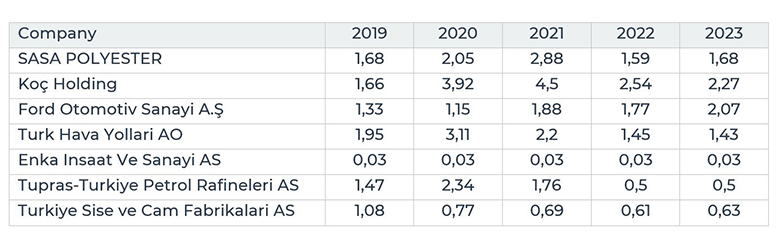

The table above shows that the 4 largest Turkish companies are highly indebted. Although high debt did not prevent them from growing in share value in 2022. It seems that in Turkey during the period of rising inflation, the more debt a company has, the more it will grow.

Among the 7 largest Turkish companies, Enka Insaat Ve Sanayi AS had the least debt. The company's share price increased the least in 2022, but its earnings per share were one of the highest.

The companies with the best price gains were those with a high debt-to-equity ratio of around 1.5.

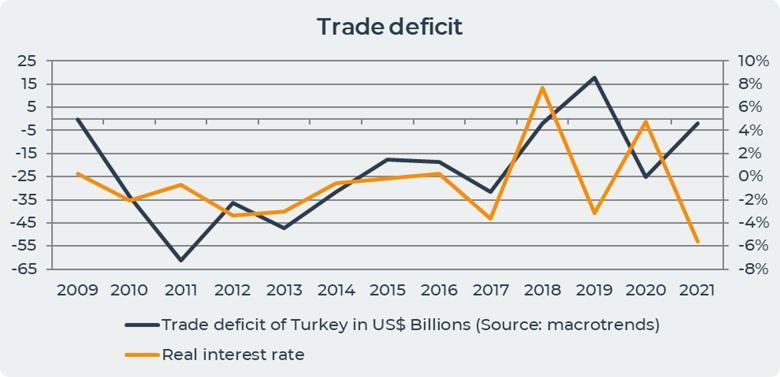

3. The Trade Deficit is Under the Influence of a Negative Interest Rate.

A trade deficit occurs when a country's imports exceed its exports during a given time period. The chart below shows that in the years when the real interest rate was negative in 2019 and 2021, Turkey's trade balance was positive.

In 2018, Turkish President Erdogan exerted enormous political pressure on Turkey's central bank to lower interest rates in order to keep the market functioning. Then Turkey entered a negative real interest rate. However, the trade balance began to improve and was positive, as was the stock market. In 2021, when the interest rate was -6%, the trade balance again showed growth.

Conclusion

A negative real interest rate has a large impact on the Turkish stock market. When there is a negative interest rate, the stock market rises sharply. Identical growth occurs in earnings per share. The results of Turkish companies show that in the conditions of inflation, one of the reasons for the boom in the value of shares is high indebtedness. All the largest Turkish companies showed a significant increase in the value of their shares, although not all of them saw an increase in earnings per share. A negative interest rate also has an impact on the trade balance, making it positive.

Date= 04th August 2023, Gold price – 1968.20$, Silver price – 23.93$, Platinum price – 940.20$, Oil price – 81.81$