In this report, we study the cost of production of Gold.

Introduction

As a commodity, the gold price should always be above its cost of production. The objective of this article is to study the cost of production of gold.

In the first section, we will show that gold price is heavily correlated to oil, and thus to the cost of energy.

In the second section, we will show that the AISC (all-in sustainable cost) is heavily correlated to oil, plus an intrinsic inflation rate of 7%.

In the third section, we will show that the marginal cost of production of gold is 1855 US$/oz.

In the fourth section, we will recompute the AISC of the major miners from their earnings results, and show that the average AISC should be 1,017 US$/oz.

Gold and Oil prices are correlated

1. Gold and Oil Prices are Correlated at 88%: Buying Gold is Equivalent to Buying Oil

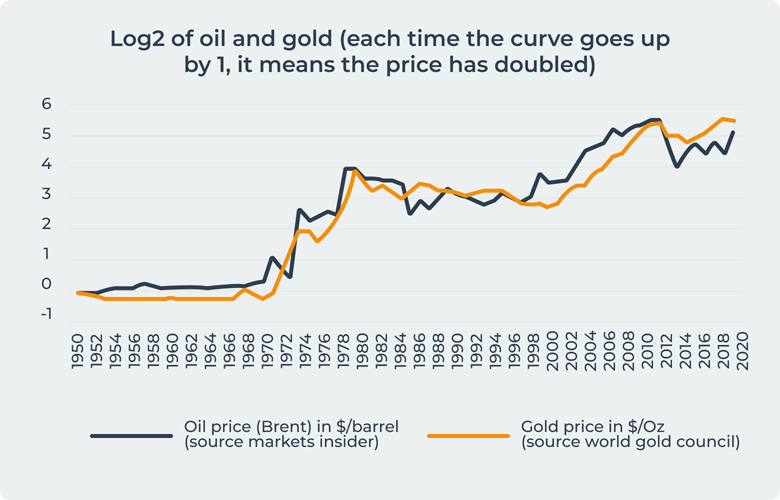

The chart below shows the long-term evolution of the prices of gold and the prices of oil, and shows how oil and gold prices are extremely correlated. The average 365-days correlation between Oil and gold price over 70 years is 88%.

The first significant jump occurred when the prices of gold and energy were multiplied tenfold in the 1970s (see chart below) during the global oil shock of 1973 when the members of OPEC declared an oil embargo. By the end of the embargo in March 1974 the price of oil had risen nearly 300%. In 1979 the second global oil shock was due to a fall in oil production and the war in Iran.

The second significant increase happened from 2000 to 2012, following the soaring demand from China, and the money printing everywhere in the world (see chart below).

The conclusion is that buying gold is equivalent to buying oil in the long run. Because the cost of storage of oil is 6% and the cost of storage of gold is only 0.35%, it is much more efficient to buy gold than oil as a hedge against energy inflation.

The AISC and Oil prices are correlated

2. AISC has an Intrinsic Inflation Rate of 7% Annualized

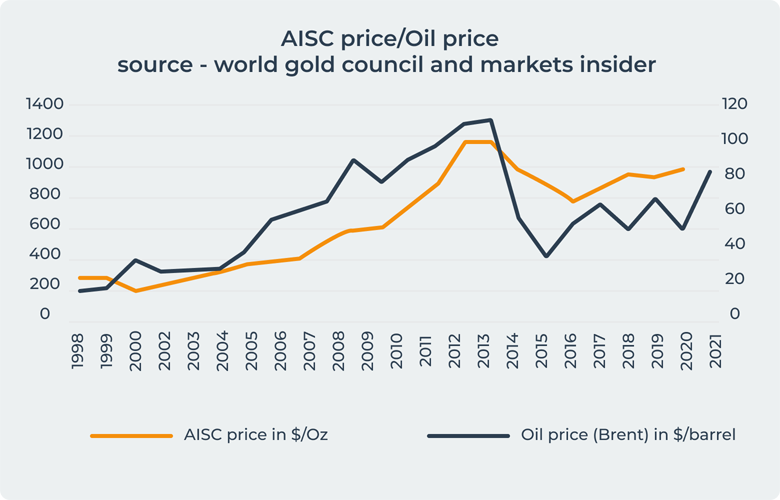

According to the World Gold Council, the All-In Sustaining Cost (AISC) is an advanced metric used by mining companies to report their cost of gold mining. AISC is an extension of current “cash cost” metrics which includes sustainable production costs too.

The AISC peaked in 2010, and then fell due to the fall of oil prices. But we can see on the chart that the AISC did not fall as sharply as the oil price. This is because there is an intrinsic inflation of the gold price of 7%.

We computed the 7% intrinsic inflation rate of gold as the increase between AISC 2017 and AISC 2005, because oil had the same price in 2017 and 2005:

The conclusion is that gold price in the past 20 years has had an inflation rate of 7% on top of energy inflation rates. This is mainly due to the decrease in mine output: the amount of gold for each ton mined has decreased sharply. In 2000 the average output for gold was 19 g/t and in 2020 it was 6.5 g/t. One needs mine 3 to 4 times more mineral in order to extract the same quantity of gold today as compared to 20 years ago.

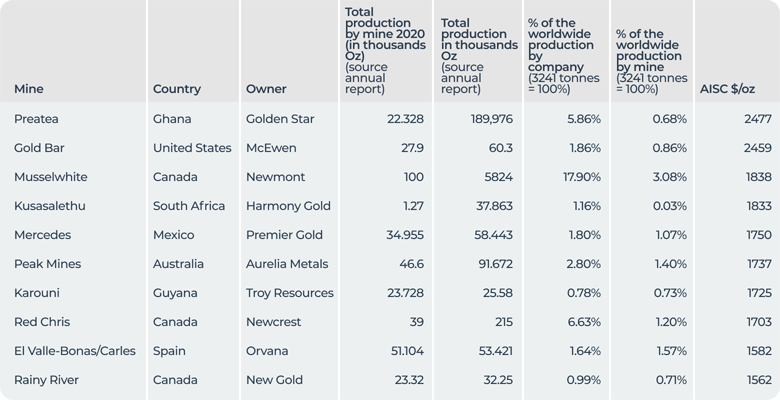

3. The Marginal Cost of Production of Gold is 1855 $/Toz

The real cost of production of gold is the cost of production of the most expensive mines. Indeed, if the production amounts have to be maintained at current levels, then even the most expensive mines must be profitable, as gold price should always be higher than its cost of production.

The AISC of the 10% most expensive mines in the world is 1855 US$/oz.

Any buyer of a commodity should watch carefully the cost of production. Have a price under the cost of production is not sustainable for any commodity or, the production is bound to fall, either the price of the commodity will rise.

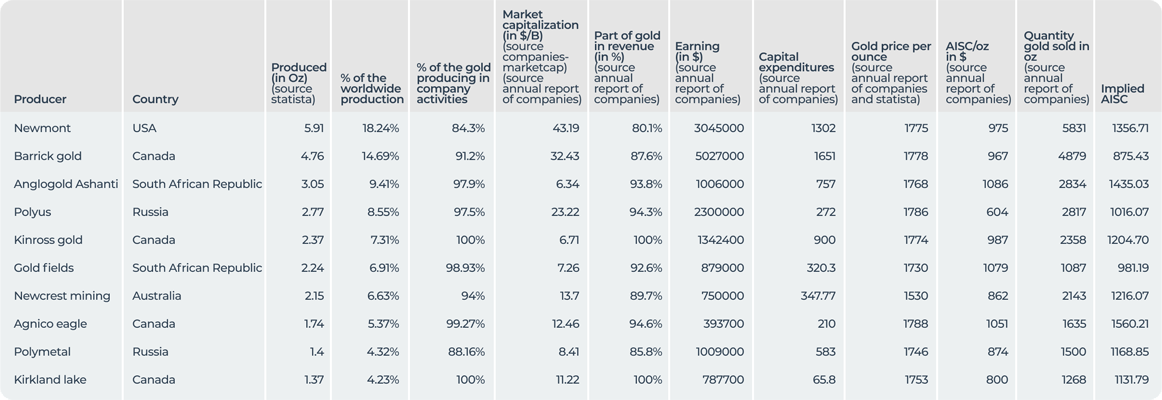

4. Credibility of the AISC

In the table below, we recomputed the implied AISC of the most expensive mines for 2020 (should it not be the biggest gold producers instead of the most expensive mines?). We obtain an average of 1,017 US$/oz. The logic is simpl: we take the earnings of the company and we divide that by the amount of gold produced. Obviously, we need companies which produce only gold.

The value we find by doing so is 3% above the value given by the officials in section 2. It is not too far off, so it does validate the data. But it also shows that not all costs are taken into account in the AISC, and that we should inflate it by a good 3%.

5. Conclusion

Gold is a perfect hedge against energy inflation, since it has the same performance during periods of large spikes, yet its storage cost is minimal (0.35%) and it does not suffer from depletion.

Gold itself gets harder to produce, and has an additional inflation rate of 7% on top of the energy inflation rate, which provides additional protection.

The current price of gold is around its marginal AISC of 1855 $/Oz. This means the commodity is not expensive at current levels.