What would be the worst case scenario of the impact of the carbon tax on the price of precious metals?

The worst-case scenario of the impact of the carbon tax on Gold, Silver & Platinum prices

Introduction

The European Union has implemented a carbon tax to reduce carbon emissions and achieve the goal of climate neutrality by 2050. This article aims at assessing the worst-case scenario of the impact of the carbon tax on the price of precious metals.

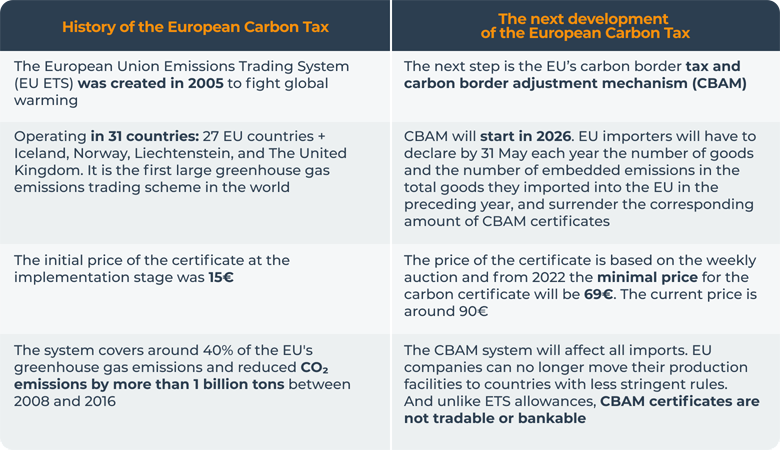

In the first chapter, we will show that the EU carbon tax is the first and the biggest greenhouse gas emissions control system launched in the world and we will talk about the carbon border adjustment mechanism (CBAM).

The second chapter will show that the worst-case scenario impact on gold prices is 3.2%.

The third chapter will show that the worst-case scenario impact on silver prices is 1.5%.

The fourth chapter will show that the worst-case scenario impact on platinum prices is 7.6%.

1. The history and the development of the European carbon tax

The Emissions Trading System (EU ETS) is currently operating in the European Union. Under this scheme, a company pays carbon tax when importing if the conditions of carbon emissions permit from the country of origin are lower than those in force in the EU. Since only the EU is enforcing such permits, it concerns only the EU imports.

The EU is now implementing a new mechanism (CBAM), which is more expensive and stricter.

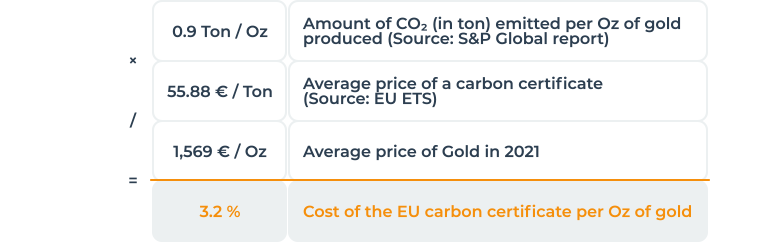

2. The impact of the carbon tax on gold importers should average 3.2% per ounce

If the rules of carbon emissions do not have restrictions or restrictions are weaker than those proposed in the EU, then companies must purchase a carbon certificate, and pay for each ton of carbon dioxide (CO2) emitted during the extraction of the precious metal.

We detail the final cost below for one Oz of gold:

In conclusion, the impact of the carbon tax on gold importers will theoretically be 3.2%.

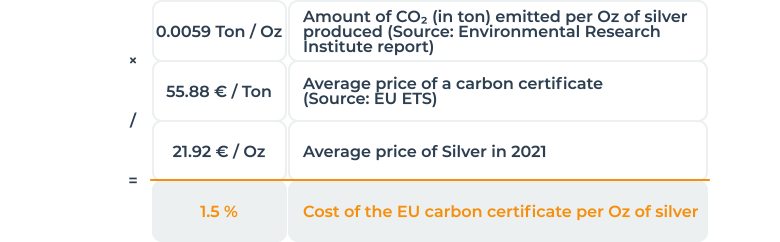

3. The impact of the carbon tax on silver importers should average 1.5% per ounce.

Silver, which is considered an industrial metal unlike gold, follows the same calculation.

In conclusion, the impact of the carbon tax on silver importers will theoretically be 1.5%.

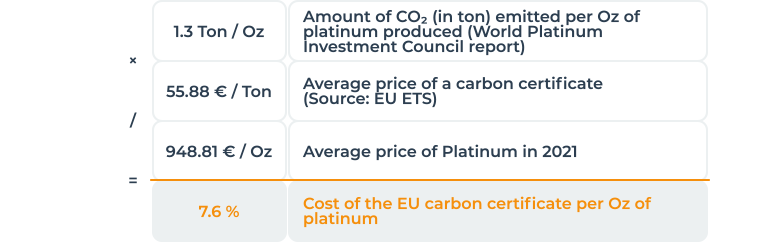

4. The impact of the carbon tax on platinum importers should average 7.6% per ounce.

Platinum has the heaviest impact on the environment.

In conclusion, the impact of the carbon tax on platinum importers will theoretically be 7.6%.

Conclusion

The carbon tax for imports of precious metals into Europe is quite big for refiners because their margins are around a few percent at maximum. However, it is not prohibitive, it will be passed on to the final customer, and we should expect the final prices (premium over spot) to increase by only a fraction of it since the carbon tax is paid only once.

In addition, there are a lot of uncertainties about how the EU system will work as there are many legal loopholes. For example, companies could avoid paying the carbon tax or get significant benefits if they invest in the “green” sector. Another option for companies is a free permit to import metals that the company can get based on the country's emissions in previous years’ historical carbon emissions and comparative technical characteristics and depending on the number of permits purchased at auctions. A company will get a deduction from the carbon tax during the import if a producer in a non-EU country can show that he has already paid the equivalent price for the CO2 emissions.

In conclusion, with the current EU plan, the worst-case scenario is still reasonable, and the carbon tax should not significantly impact the precious metal industry.

Date of the article: 21 March 2022, gold price: 1938 $/Oz, silver price: 25.5 $/Oz, platinum price: 1063 $/Oz