The United States and Turkey are both experiencing high inflation without the economy collapsing.

How is the USA similar to Turkey?

Recently, the USA has high inflation, but the economy is not collapsing. A similar situation exists in Turkey. The main idea of the article is to find out whether the USA is similar to Turkey.

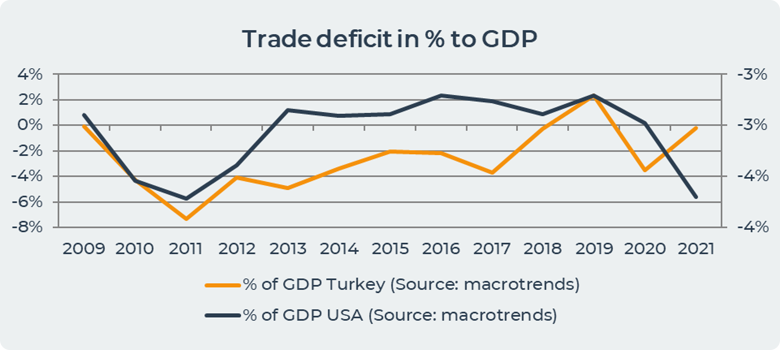

In the first chapter, we will show that Turkey has better dynamics of trade balance than the USA, but in terms of percentage of GDP, the countries are similar.

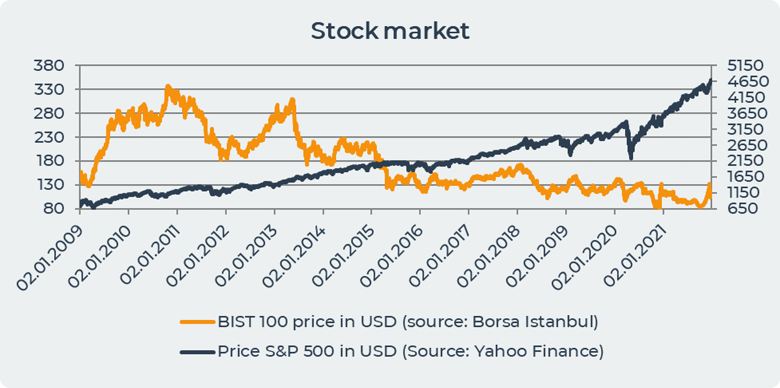

In the second chapter, we will show that the stock market of Turkey does not collapse against the background of high inflation.

In the third chapter, we will show that when the Turkish Central Bank did pivot and decreased rates, then the inflation went ballistic to the upside.

1. Turkey has Better Dynamic in Trade Balance than USA.

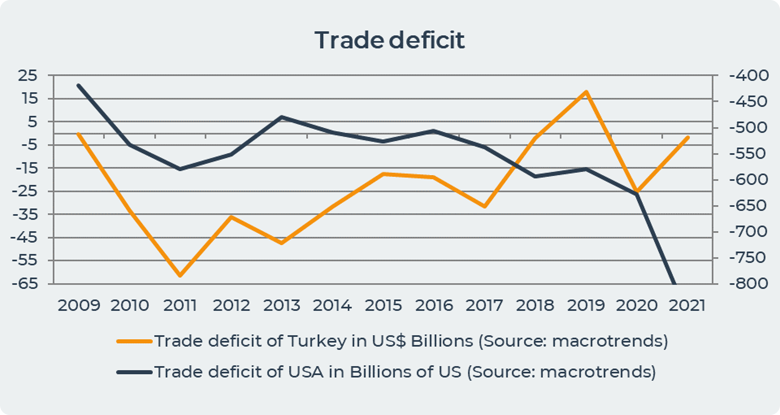

Trade balance is the difference between exports and imports in the country. A trade deficit occurs when a country imports more goods than it sells. This is a negative indicator. The graph below shows that Turkey has a much more positive trade balance dynamics than the USA.

Since 2011, Turkey's trade balance has improved steadily. For example, in 2010 the trade deficit was -33 US$ billion dollars, while in 2021 the trade deficit is only -2 US$ billion dollars. In 2021, President Tayyip Erdogan presented a new plan, authorities are working to turn Turkey's chronic current account deficit to a surplus, which the central bank says will help establish price stability. According to the Turkish Statistical Institute (TurkStat), the deficit narrowed to 1.87 US$ billion for all of 2021, down from an estimated 24.14 US$ billion in 2020. In 2021, exports jumped 32.8% to 225.3 US$ billion, while imports rose 23.6% to 271.4 US$ billion. Among the main reason that the deficit still remains, TurkStat named the sharp increase in the cost of energy carriers.

On the contrary, the USA show a trade deficit deepening every year to an absolute record in 2021.In the period 2009-2021, the US trade deficit increased by 205% from -419 billion US dollars to -862 billion US dollars in 2021. A trade deficit in the US means that the country consumes more than it produces. The Washington International Trade Association calls the low level of domestic savings of households, firms and the government in the US relative to its investment needs among the main reasons for the growth of the negative trade balance. Therefore, Americans borrow in other countries with excess savings, for example in China. The role of the dollar is also an important factor in maintaining the US trade deficit. As the de facto global reserve currency, the US dollar contributes to trade deficits by increasing the availability of dollars and dollar-denominated assets. Foreign investors look to dollar-denominated assets as safe havens, especially during economic downturns. As long as foreigners are willing to lend the United States money to finance the lack of savings in the U.S. economy, such as by buying U.S. Treasury securities, trade deficits can persist, according to the Washington International Trade Association.

The chart above shows that in Turkey in the period 2009-2011 there is a negative increase in the trade deficit as a percentage of GDP from 0% to -7%. However, there is a gradual improvement from -7% to -2% in 2016. In 2018-2019 there are positive indicators to GDP and in 2021 the trade deficit as a percentage of Turkey's GDP was only -0.23%. In the USA, the trade deficit as a percentage of GDP is identically increasing in the period 2009-2011 from -2.9% to -3.72%. We see a further reduction of the trade deficit to GDP in 2016 to -2.71%. After 2016, the trade deficit to the US GDP started to grow and in 2021 was -3.7%.

2. Stock Market in USA and Turkey don’t Collapse when Inflation is High.

The only stock exchange in Turkey is Borsa İstanbul A. Ş. Its main index is BIST 100. The median of the Price to Earning ratio of share is 7. The percentage of industrial companies in the BIST 100 index is about 35%.

Over the past few years, the interest of foreign investors in Turkey has been growing. Investments in Turkey have grown significantly both in terms of transaction volume and deal size. Turkish capital markets have also grown, with the largest IPOs in Turkish history occurring in 2010-2014. In 2018, the Capital Markets Board of Turkey (CMB) launched an IPO initiative to encourage Turkish and international companies to list on Borsa İstanbul A. Ş.

As of January 1, 2022, the shares of 541 companies with a total market capitalization of 1.8 trillion Turkish Liras (approximately 135.14 US$ billion) were listed and traded on the stock market, according to the Borsa İstanbul A. Ş.. Since 2009, the number of companies listed on the stock market has ranged from 322 to 541. Since 2009, the total market capitalization has increased from 351 billion Turkish Liras to 1.8 trillion Turkish Liras (approximately 26.28 US$ billion to 135.14 US$ billion) .

The stock market does not specialize in any particular type of company and does not encourage listing. On the contrary, it encourages any company that meets the listing requirements to list on Borsa Istanbul.

The main stock exchange in the USA is the New York Stock Exchange. The main index is S&P 500. The median of the Price to Earning ratio of share is 15. The percentage of industrial companies in the S&P 500 index is about 12%.

The chart above shows that the stock market of Turkey went down in USD terms. But it has more or less stabilized since the trade deficit of Turkey is nearing the zero value.

If the USA shall follow the path of Turkey now that they entered a high inflation environment, their stock market should become suppressed.

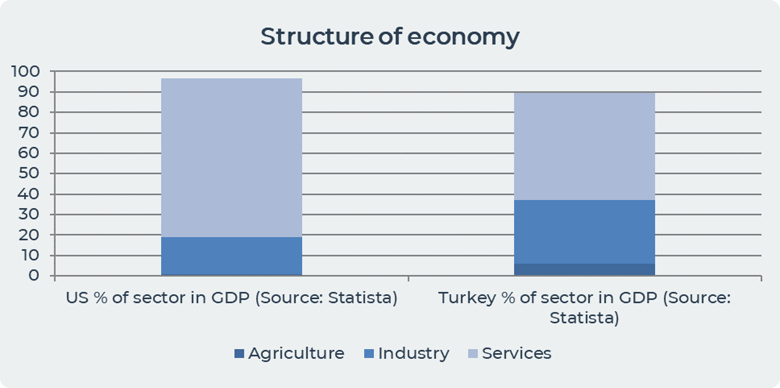

2b.The Economy Structure of Turkey and USA.

The chart above shows that when the central bank makes a pivot, inflation starts to rise. For example, in 2016-2017, the interest rate was reduced by 0.5%, but inflation increased from 8% in 2016 to 11% in 2017. The situation is identical in the period 2020-2022. The Central Bank of Turkey reduced the interest rate from 17% to 8.5%, but inflation increased from 12% to 72%. In the period from 2016 to 2022, the Turkish lira devalued by 535%.

Such a sharp devaluation of the Turkish lira is explained by the "unorthodox" understanding of the monetary policy of President Recep Tayyip Erdogan. In Turkey, the central bank is not independent. Turkey's economy has developed recently, which has led to rising prices as demand exceeds supply. In this case, central banks often use interest rate hikes to cool the economy. They do this by increasing the cost of borrowing money, which reduces economic activity. However, in Turkey, the central bank kept interest rates very low, causing the economy to spiral out of control. As a result, confidence in the economy nearly collapsed, and foreign and local investors pulled their money out of Turkey due to the free fall of the lira. In a 2016 interview with Reuters, Erdoğan said, “If my people say to continue this way in the elections, I say that I will emerge victorious in the fight against this curse of interest rates. Because I believe that interest rates are the mother and father of all evil."

At the same time, in the US, we see the opposite work from the Fed. For example, in 2017-2019, the Fed raised its interest rates in order to reduce the level of inflation in the United States. The Fed raised the interest rate from 0% in 2016 to 2% in 2019, which led to a decrease in inflation from 3.4% to 1.6%. The rate cut in 2020-2021 led to an increase in inflation in the US to 5.2%.

Conclusion

Turkey in general has much more positive dynamics in the trade balance than the USA. The structure of the countries' economies is different, and in Turkey the role of real industry is much greater than in the USA. In Turkey, when the central bank makes a pivot, the inflation rate starts to rise and the stock market does not collapse.

The USA should have a worse reaction to inflation than Turkey since their trade deficit is abyssal. When the Fed will pivot, the inflation should go to the roof, but with a lag (as it did for Turkey). It is not sure that the US stock market will rise, since the trade deficit is huge for the USA, and since that what drives stock prices are the earnings.

Date= 07th April 2023, Gold price – 2023.00$, Silver price – 25.32$, Platinum price – 1027.90$, Oil price – 80.43$